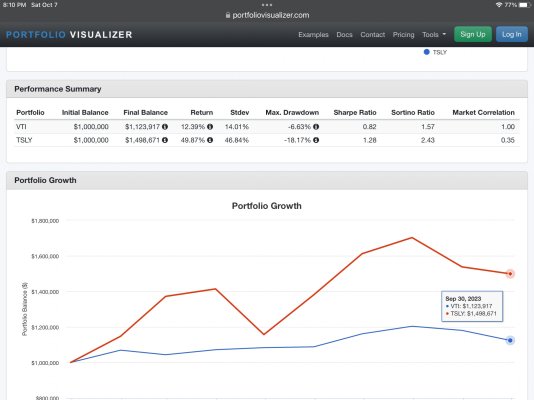

I am trying to help a person generate $1500-2000 a month off their $500k portfolio - mainly to cover rent.

I'm looking at these, mostly because I own them and it's what I'm familiar with.

DVY 4.01%

SCHD 3.70%

SWVXX 5.237% (Schwab cash)

More background...

This is the entire portfolio, about half is non-qualified, the rest is IRA money.

The person is 52.

Income is $20k a year (yes, this has to change).

I thought maybe a bond ladder?

Annuity? But then you're locked in, for better or worse.

Some sort of combination? Because of the persons age, growth is needed.

My thought is buy a condo with cash and get a better job, but at the moment, this person is stuck.

Any ideas?

I'm looking at these, mostly because I own them and it's what I'm familiar with.

DVY 4.01%

SCHD 3.70%

SWVXX 5.237% (Schwab cash)

More background...

This is the entire portfolio, about half is non-qualified, the rest is IRA money.

The person is 52.

Income is $20k a year (yes, this has to change).

I thought maybe a bond ladder?

Annuity? But then you're locked in, for better or worse.

Some sort of combination? Because of the persons age, growth is needed.

My thought is buy a condo with cash and get a better job, but at the moment, this person is stuck.

Any ideas?