LeavingOhio

Recycles dryer sheets

First off, let me say that I'm not looking for ways to pay for college for my children...knowing where they are gradewise and scorewise and what our income is and what schools we're targeting for my oldest (who is a junior in HS now; and younger is in same boat academically), I have a good sense of what we will need to pay at various schools (and in our case, the better schools actually will cost much less than mediocre schools unless we go for full-ride academic scholarships at those mediocre schools...MOST top schools don't give merit scholarships...only need-based aid).

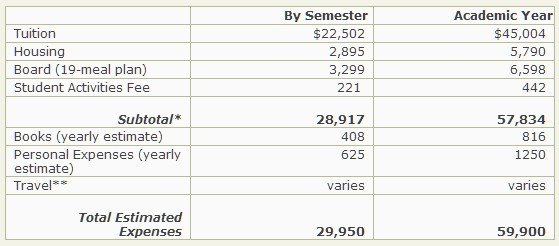

I'm more curious to see what all of you did. I often hear that people are afraid of the $45,000 tuition cost, and really from what I see, MOST people don't end up paying anywhere near that once financial aid and other scholarships are applied, and the ones who do pay that usually can easily afford to do so.

Then, of course, there are plenty of schools with a cheaper price tag, Community College is still an option for many as is working and attending part time.

So, what did you do?

I'm more curious to see what all of you did. I often hear that people are afraid of the $45,000 tuition cost, and really from what I see, MOST people don't end up paying anywhere near that once financial aid and other scholarships are applied, and the ones who do pay that usually can easily afford to do so.

Then, of course, there are plenty of schools with a cheaper price tag, Community College is still an option for many as is working and attending part time.

So, what did you do?