Most understood “transitory” to mean “short lived”. I interpreted it to mean “it will fall back to more typical levels without needing much help from Fed monetary policy”. Inflation doesn’t usually remain at high levels unless wages stay there as well, and for the past 2-3 decades high wage growth has always been short lived. Containing wage growth has not been a challenge.

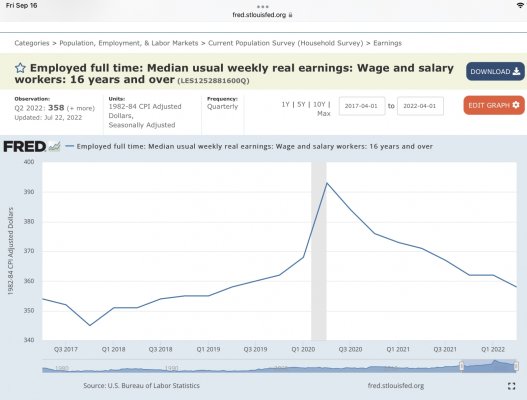

Until a month ago, the news was exactly that. Real wages rose, peaked, and then began to fall, and annualized, are back pretty much to pre-pandemic levels. See the St Lois Fed chart

here

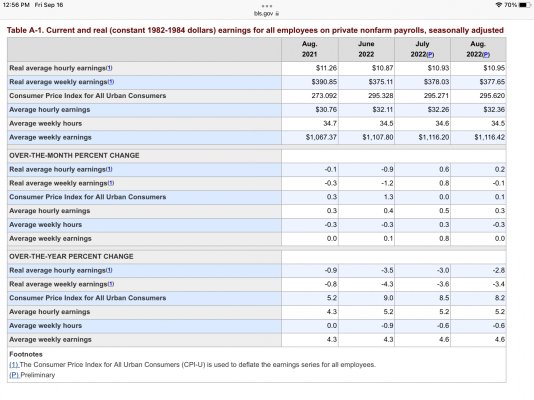

The August release of BLS monthly data (

here) showed a sharp increase in real wages month to month (0.6%), and the Sept release

showed another, smaller rise (0.2%). A clear challenge to the “wage growth containment” trend. I would say this is one of the most worrisome datapoints and one of the reasons the Fed has come out so strongly, and the Fed will stay aggressive until real wage growth stabilizes.