Fair enough. I think we're probably talking about different things here.

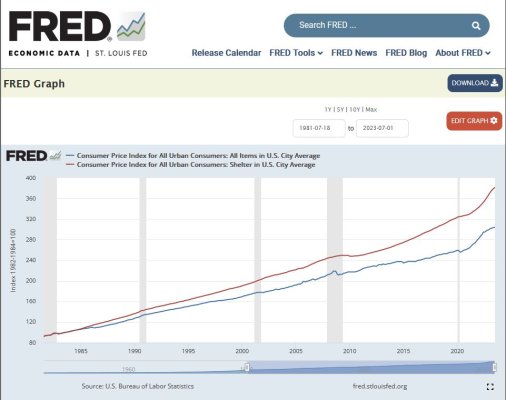

To me, "real" inflation is when the average of all prices, which average consumers pay, goes up.

I think what others may be talking about here ("gov't numbers") are those which analysts and statisticians watch. Presumably, they consider lots of factors which have no effect on the average consumer. I suppose corporations, the ultra-wealthy and the government all have expenses which heavily influence the "average" being used.

Clearly billionaires don't worry about groceries, fuel, housing, transportation, education, travel, etc. all ticking up 25-40%. To them, maybe it really does look like inflation matches the government figures. Politicians, investment bankers, corporate executives and their accountants and analysts have a very different outlook on what "inflation" means than the average consumer.

Obviously, there's a lot of supposition there. Maybe you can dispute it point by point.

What you won't do is convince me that the prices I'm paying today - across the board - are not between 25 and 40% higher than a year ago. Those are facts I do have, from first-hand experience.