REWahoo

Give me a museum and I'll fill it. (Picasso) Give

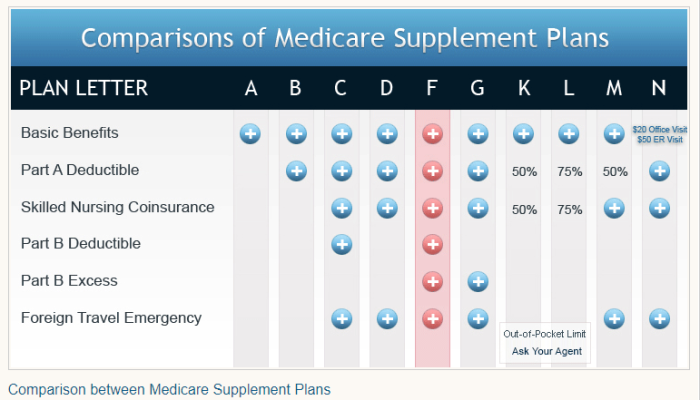

According to that https://www.bestmedicaresupplement.com/ website, Plan G provides no international medical coverage whereas Plan F does. I thought Plan G was simply Plan F with a small deductible, but apparently there are other potentially significant differences.

I think there is an error in whatever you saw there. I agree with your understanding of the two plans and every reliable source I've seen says the deductible is the only difference:

https://www.medicare.gov/supplement-other-insurance/compare-medigap/compare-medigap.html

Last edited: