Every thread about Medicare blasts Mutual of Omaha. I did a little research and found pros and cons about every plan G offered. Do states matter? If you took MoO in FL as opposed to IL, is there a difference in premium increases or "closing the book" on certain policies? Is MoO a bad decision overall?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Medicare-MoO, any positive experiences?

- Thread starter Rianne

- Start date

If you live in a state that does not let you switch insurance companies annually, it would be very foolish to choose MoO based on their track record.

Thanks for pointing that out. I just found this and am grateful we live in IL.

https://www.senior65.com/medicare/a...linois, Idaho,with no medical questions asked.

folivier

Thinks s/he gets paid by the post

- Joined

- Oct 8, 2009

- Messages

- 2,053

I've had MoO for 3 years now and have been pleased with the coverage. This is in Louisiana.

Thanks for pointing that out. I just found this and am grateful we live in IL.

https://www.senior65.com/medicare/article/switching-medigap-plans#:~:text=Some%20States%20Allow%20Switching%20Without%20Medical%20Questions&text=California%20%2C%20Oregon%2C%20Illinois%2C%20Idaho,with%20no%20medical%20questions%20asked.

That link is missing some key data points!

Here is a link to the legislation summary:

https://www.ilga.gov/legislation/publicacts/fulltext.asp?Name=102-0142

Most other links I have found summarize it more accurately. That one you posted did not. Try a new search and read a few more links.

The key difference is that we Illini are limited to plans with the SAME carrier you currently have that have the same or lesser benefits under the new Birthday rule legislation It is not an open season to switch companies.

JW

Last edited:

Got it! As long as I stay with MoO, I can switch to plan N with no underwriting.

https://www.medigap.com/faqs/medicare-birthday-rule/

https://www.medigap.com/faqs/medicare-birthday-rule/

harllee

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My DH is stuck with a closed book Mutual of Omaha policy. We live in NC so he cannot switch to another company because he cannot pass underwriting due to to a preexisting condition. His Mutual of Omaha premium has been going up about 30% per year. DH and I are the same age . I have a AARP UHC G policy and DH has the MofO G policy and he is paying about 3 times the premium that I am. Avoid Mutual of Omaha if you are in a state where they can close the book and where you cannot change companies without underwriting. Go with a company that is not known for playing the closed book game like AARP UHC.

Last edited:

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We’ve had our Plan G supplement through MoO since May 2019 with zero issues. Reasonable premiums and I’ve paid next to nothing after Medicare and MoO. Their website provides all the info I need as well.

troutnut1

Recycles dryer sheets

I am under the impression that Plan G is exactly the same coverage no matter who provides it. While the premiums charged for this coverage differs between companies based in part on the claims they experience. Am I missing something or is there some other problem with MoO?

harllee

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I am under the impression that Plan G is exactly the same coverage no matter who provides it. While the premiums charged for this coverage differs between companies based in part on the claims they experience. Am I missing something or is there some other problem with MoO?

Mutual of Omaha is known for "closing the book" on older policy holders. MofO stops selling new policies under one company name in a state and substantially increase premiums for the policy holders under that closed company name. Then they open a new company under a different name in the state for younger policy holders with lower premiums. As a consequence older policy holders will see substantial increase in premiums and often will not be able to move to another company because they cannot pass underwriting. While not illegal, this is a very questionable business and unethical practice in my opinion. Most companies (like United Health Care and Blue Cross) do not engage in this practice.

CRLLS

Thinks s/he gets paid by the post

^ +1

This is why it is so important to research the insurer you plan on using and see how their track record is on their business practices as well as their entering prices. I did and MoO was quickly discarded from my list. They had a history of Bait and switch. Not one of not so much of covering per their agreement. Others may have differing ideas about that, and that is Okay.

This is why it is so important to research the insurer you plan on using and see how their track record is on their business practices as well as their entering prices. I did and MoO was quickly discarded from my list. They had a history of Bait and switch. Not one of not so much of covering per their agreement. Others may have differing ideas about that, and that is Okay.

Z3Dreamer

Thinks s/he gets paid by the post

DW has had a G MoO plan for 3 years. No problems. In western NC. I think it is about $110 per month.

Telly

Thinks s/he gets paid by the post

- Joined

- Feb 22, 2003

- Messages

- 2,395

Yup! harlee knows what she is talking about!Mutual of Omaha is known for "closing the book" on older policy holders. MofO stops selling new policies under one company name in a state and substantially increase premiums for the policy holders under that closed company name. Then they open a new company under a different name in the state for younger policy holders with lower premiums. As a consequence older policy holders will see substantial increase in premiums and often will not be able to move to another company because they cannot pass underwriting. While not illegal, this is a very questionable business and unethical practice in my opinion. Most companies (like United Health Care and Blue Cross) do not engage in this practice.

And as an example, using Medigap plans in Indiana:

MoO opening a new book in Indiana (oh it's so exciting!) under the name Mutual of Omaha Insurance Company. Low rates! Sign those Medicare Newbies up, now!

Oh but those poor souls in Indiana that are in the book that closed, named Omaha Insurance Company, they get increases of 15% in Plans G, N, High F.

But this doesn't bother a well-known internet broker frequently mentioned here, that likes to push the many faces of MoO, no, that broker will just "shop you around" to find a cheaper Medigap Plan company for you. No problem, they will do it for free whenever you get an increase. Just call them, they really will!

But remember to stay real healthy and not be diagnosed with any of those pesky multitudes of conditions that are so common for aging people, that disqualifies one from getting picked up by a different company's Medigap plan. And if you already had that condition when you entered Medicare (the guaranteed admission at age 65 route), well just suck it up and don't complain, you should have thought of that before you acquired it! You're stuck

But, in fairness, this insurance company has nice incentives for brokers above and beyond the usual $. It used to be 3-figure dollar amounts for a small number of signups in a couple months. Now they have added Amazon gift cards, airline travel trips, all the bling to energize brokers behind the scenes. We're all just cattle, going MoO MoO. I was able to bail, and did. Buyer beware.

troutnut1

Recycles dryer sheets

Thanks for the clarification. I had no idea about closed books and MoO. Sleazy stuff.

- Joined

- Oct 13, 2010

- Messages

- 10,777

If anyone wants to "help you" get a medigap plan and doesn't lead with the basics on pricing (Attained-Age vs. Issue-Age vs. Community-Rated Medigap Plans) as well as a mention of the business practice of closing the book, they haven't placed your interests ahead of other interests, or is incompetent.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Telly knows what they are talking about. I was helped a great deal by Telley’s posts on the topic.Yup! harlee knows what she is talking about!

And as an example, using Medigap plans in Indiana:

MoO opening a new book in Indiana (oh it's so exciting!) under the name Mutual of Omaha Insurance Company. Low rates! Sign those Medicare Newbies up, now!

Oh but those poor souls in Indiana that are in the book that closed, named Omaha Insurance Company, they get increases of 15% in Plans G, N, High F.

But this doesn't bother a well-known internet broker frequently mentioned here, that likes to push the many faces of MoO, no, that broker will just "shop you around" to find a cheaper Medigap Plan company for you. No problem, they will do it for free whenever you get an increase. Just call them, they really will!

But remember to stay real healthy and not be diagnosed with any of those pesky multitudes of conditions that are so common for aging people, that disqualifies one from getting picked up by a different company's Medigap plan. And if you already had that condition when you entered Medicare (the guaranteed admission at age 65 route), well just suck it up and don't complain, you should have thought of that before you acquired it! You're stuck

But, in fairness, this insurance company has nice incentives for brokers above and beyond the usual $. It used to be 3-figure dollar amounts for a small number of signups in a couple months. Now they have added Amazon gift cards, airline travel trips, all the bling to energize brokers behind the scenes. We're all just cattle, going MoO MoO. I was able to bail, and did. Buyer beware.

https://www.early-retirement.org/fo...-attained-age-pricing-101199.html#post2339007

Telly was also caught by the MoO closed book trick early but was able to switch over to another Medigap provider.

I didn’t find Telly’s original thread where they discussed their “adventure”. That thread was timely and very helpful to me.

Last edited:

zinger1457

Thinks s/he gets paid by the post

- Joined

- Jul 22, 2007

- Messages

- 3,230

Luckily I got a heads up from this forum about BB pushing MoO, sure enough after a short discussion with the BB rep they recommended MoO, that was my last conversation with them.

I called my local SHIP office and my broker. I think rather than focus on MoO, I'd like to understand how other insurance companies work. I understand the age vs community issue part, but does that mean your premiums won't go up in a community-based issue?

It's all relative on a big scale. And state laws. Would I rather my premium go up because I'm older or because the community-based pricing has lots of cases of cancer or heart conditions? We will grow older, but will we stay healthy? Should I research the community they are basing their pricing on? Is it a community that has lots of cancer? I'd like to hear from those who've had bad experiences with other insurance companies too. My bold and edits. What are "other factors"?

Costs of Medigap policies

Each insurance company decides how it will set the price, or premium, for its Medigap policies. It’s important to ask how an insurance company prices its policies. The way they set the price affects how much you pay now and in the future.

Medigap policies can be priced or "rated" in 3 ways:

Community-rated (also called “no age-rated”)

How it’s priced

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age.

What this pricing may mean for you

Your premium isn’t based on your age. Premiums may go up because of inflation and "other factors", but not because of your age.

Example

Mr. Smith is 65. He buys a Medigap policy and pays a $165 monthly premium.

Mrs. Perez is 72. She buys the same Medigap policy as Mr. Smith. She also pays a $165 monthly premium because, with this type of Medigap policy, everyone pays the same price regardless of age.

Issue-age-rated (also called “entry age-rated”)

How it’s priced

The premium is based on the age you are when you buy (when you're "issued") the Medigap policy.

What this pricing may mean for you

Premiums are lower for people who buy at a younger age and won’t change as you get older. Premiums may go up because of inflation and "other factors", but not because of your age.

Example

Mr. Han is 65. He buys a Medigap policy and pays a $145 monthly premium.

Mrs. Wright is 72. She buys the same Medigap policy as Mr. Han. Since she’s older when she buys it, her monthly premium is $175.

Attained-age-rated

How it’s priced

The premium is based on your current age (the age you have "attained"), so your premium goes up as you get older.

What this pricing may mean for you

Premiums are low for younger buyers, but go up as you get older. They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

Example

Mrs. Anderson is 65. She buys a Medigap policy and pays a $120 monthly premium. Her premium will go up each year.

At 66, her premium goes up to $126.

At 67, her premium goes up to $132.

At 72, her premium goes up to $165.

Mr. Dodd is 72. He buys the same Medigap policy as Mrs. Anderson. He pays a $165 monthly premium. His premium is higher than Mrs. Anderson’s because it’s based on his current age. Mr. Dodd’s premium will go up every year.

At 73, his premium goes up to $171.

At 74, his premium goes up to $177.

It's all relative on a big scale. And state laws. Would I rather my premium go up because I'm older or because the community-based pricing has lots of cases of cancer or heart conditions? We will grow older, but will we stay healthy? Should I research the community they are basing their pricing on? Is it a community that has lots of cancer? I'd like to hear from those who've had bad experiences with other insurance companies too. My bold and edits. What are "other factors"?

Costs of Medigap policies

Each insurance company decides how it will set the price, or premium, for its Medigap policies. It’s important to ask how an insurance company prices its policies. The way they set the price affects how much you pay now and in the future.

Medigap policies can be priced or "rated" in 3 ways:

Community-rated (also called “no age-rated”)

How it’s priced

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age.

What this pricing may mean for you

Your premium isn’t based on your age. Premiums may go up because of inflation and "other factors", but not because of your age.

Example

Mr. Smith is 65. He buys a Medigap policy and pays a $165 monthly premium.

Mrs. Perez is 72. She buys the same Medigap policy as Mr. Smith. She also pays a $165 monthly premium because, with this type of Medigap policy, everyone pays the same price regardless of age.

Issue-age-rated (also called “entry age-rated”)

How it’s priced

The premium is based on the age you are when you buy (when you're "issued") the Medigap policy.

What this pricing may mean for you

Premiums are lower for people who buy at a younger age and won’t change as you get older. Premiums may go up because of inflation and "other factors", but not because of your age.

Example

Mr. Han is 65. He buys a Medigap policy and pays a $145 monthly premium.

Mrs. Wright is 72. She buys the same Medigap policy as Mr. Han. Since she’s older when she buys it, her monthly premium is $175.

Attained-age-rated

How it’s priced

The premium is based on your current age (the age you have "attained"), so your premium goes up as you get older.

What this pricing may mean for you

Premiums are low for younger buyers, but go up as you get older. They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

Example

Mrs. Anderson is 65. She buys a Medigap policy and pays a $120 monthly premium. Her premium will go up each year.

At 66, her premium goes up to $126.

At 67, her premium goes up to $132.

At 72, her premium goes up to $165.

Mr. Dodd is 72. He buys the same Medigap policy as Mrs. Anderson. He pays a $165 monthly premium. His premium is higher than Mrs. Anderson’s because it’s based on his current age. Mr. Dodd’s premium will go up every year.

At 73, his premium goes up to $171.

At 74, his premium goes up to $177.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Luckily I got a heads up from this forum about BB pushing MoO, sure enough after a short discussion with the BB rep they recommended MoO, that was my last conversation with them.

When we called we had already decided UHC/AARP. They tried to talk us around to the somewhat cheaper plans like MoO but we told them straight out why we wouldn’t use MoO. They signed us up for what we wanted including the Part D plan.

harllee

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It is really a crap shoot picking a Medicare supplement, you do your research and do the best you can and you may find out a few years later you picked the wrong plan. And then you may have a health problem and not be able to switch due to underwriting. People who live in states that do not require underwriting to change supplement policies (like California, Oregon and Washington and a few others) are really at advantage when choosing supplements. It seems like more states would adopt rules that allow a person to change supplements once a year without underwriting, especially if the state wants to attract retirees. I think I will contact my state legislator about this.

Pluperfect

Recycles dryer sheets

- Joined

- Dec 12, 2018

- Messages

- 96

Are you sure you understand it? Because despite the specific example of Mr. Smith and Mrs. Perez that you quoted, which shows a 65-year-old and a 72-year old each paying the same premium for a community-rated plan, that's not my experience.I understand the age vs community issue part, but does that mean your premiums won't go up in a community-based issue?

With my AARP United Healthcare supplement in Texas, which is community-rated, there IS one premium for everyone, but everyone gets a discount based on their age, up to a certain age, after which the discount goes to zero.

In Texas, the discount is 39% for ages 65-69, starts rising at age 70, and goes to zero at age 81.

https://www.aarpsupplementalhealth....t/StatePlanVariations/SA25873TX_SA25731TX.pdf

There appears to be a similar scheme in Illinois. According to this document, the discount is 45% for ages 65-67, starts rising at age 68, and goes to zero at 86.

https://www.aarpsupplementalhealth....nt/StatePlanVariations/SA25908IL_M10091IL.pdf

And when you get quotes, that "discount" is already baked into the premium. That sure doesn't look like "everybody in the community pays the same premium" to me. In fact, it looks a lot like an attained-age plan, where one's age each year has an upward effect on the premium.

Maybe there are "community-rated" plans under which everyone, regardless of age, really does have the same amount of money taken from their account each month, but it's definitely not the AARP United Healthcare ones I've looked at.

And really, calling any of them that provide "discounts" like this "community-rated" is a disservice, because I assume all companies use the community's "experience" in setting their rates, so what's the actual difference, other than a set amount of premium rise (in addition to "other factors") each year?

This actually kind of reminds me of the early days of Obamacare, where some plans on the exchange were designated "multi-state" plans, and people (and some agents) thought that meant they provided coverage in more than one's home state, but it meant nothing of the sort.

zinger1457

Thinks s/he gets paid by the post

- Joined

- Jul 22, 2007

- Messages

- 3,230

I was confused initially when I priced some of the AARP supplement plans, the discounts varied widely from one plan to the next, and there was no explanation if the discounts were temporary or permanent. I posted the question on another Medicare thread and don't recall anyone explaining how it worked. I did find later on a link on the quote page that brings up a pdf document similar to what Pluperfect shows above that explains it better, just think they should be more up front with it, I'm sure many miss it.

CRLLS

Thinks s/he gets paid by the post

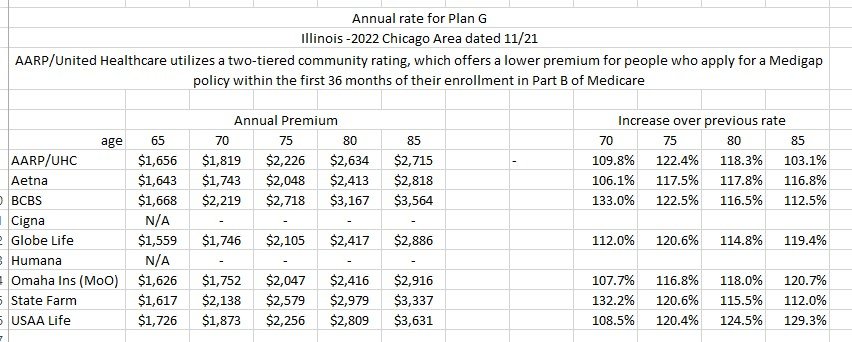

Here is an example of what several companies charge for a Plan G supplement in 2021 in the Chicago area based on age. This data comes from the Illinois SHIP website: Unfortunately, they stop at age 85. This is about where AARP premium discounts stop and do not increase and everyone else continues to increase. AARP plans are the only ones available for me that are community rating. It is clearly stated on the SHIP website.

What does not show is the 15% family discount or the $4 per month discount for auto pay. When we went thru this decision making, BCBS had no such discounts. Unless you dig deeper on each and every plan, comparing based on age 65 pricing clearly doesn't allow one to find the best financial solution.

FWIW, DW and I both have AARP and are 69 and 70. Our actual monthly cost is currently $248 combined. That is an average of $1,488 annually each. That is lower than the stated pricing for 65 people on the SHIP website. I have tried to reconcile our actual premium vs the SHIP price shown using the AARP website, the family and auto-pay discounts and have failed.

What does not show is the 15% family discount or the $4 per month discount for auto pay. When we went thru this decision making, BCBS had no such discounts. Unless you dig deeper on each and every plan, comparing based on age 65 pricing clearly doesn't allow one to find the best financial solution.

FWIW, DW and I both have AARP and are 69 and 70. Our actual monthly cost is currently $248 combined. That is an average of $1,488 annually each. That is lower than the stated pricing for 65 people on the SHIP website. I have tried to reconcile our actual premium vs the SHIP price shown using the AARP website, the family and auto-pay discounts and have failed.

Attachments

Similar threads

- Replies

- 8

- Views

- 552

- Replies

- 11

- Views

- 1K

- Replies

- 27

- Views

- 6K

- Replies

- 19

- Views

- 1K