I officially retired 1/1/2022 at the age of 49. I watched our professionally managed brokerage and IRA's drop 26% (including fees) and I survived

I must say that retiring at the peak of a bull and watching your portfolios drop 26% was rough... so much so that I fired our AUM financial advisors (thanks to this website and bogleheads) and we rained in our expenses a fair bit. We are lucky because we have substantial rental properties (they don't generate a ton of income but they are worth a lot of money if/when we needed to sell them) which is why our brokerage and IRA's are in 100% equities.

Curious to hear your perspective/thoughts especially if this was your first bear market... Hopefully nobody pulled out of the market because (fingers crossed) it's headed back up!

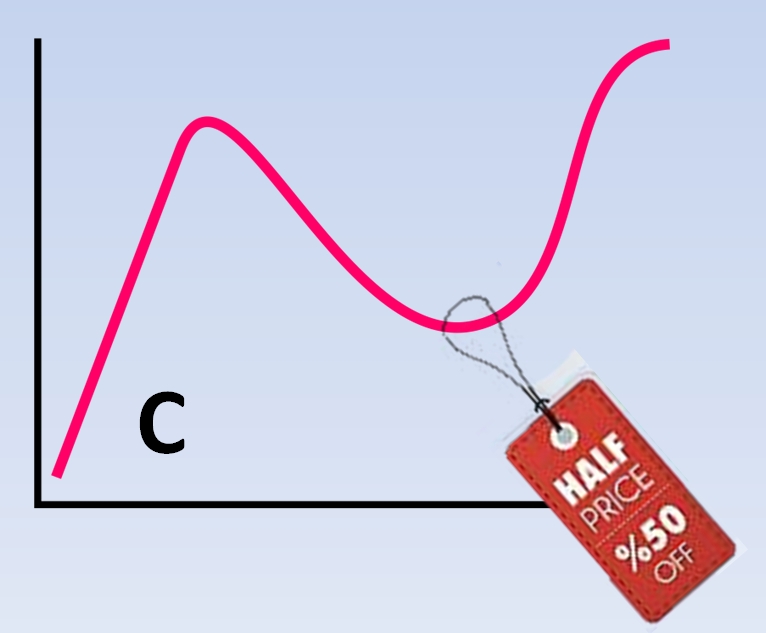

Yep, retired this year at 58, but set up a 10 year bond ladder to cover planned spend just to sleep well at night. Everything else is in equities. Since my spend is highly discretionary, I have other levers to pull if needed. That said, the current drop in the market is really messing up pretty graph showing my net worth growing by 5% a year!