Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

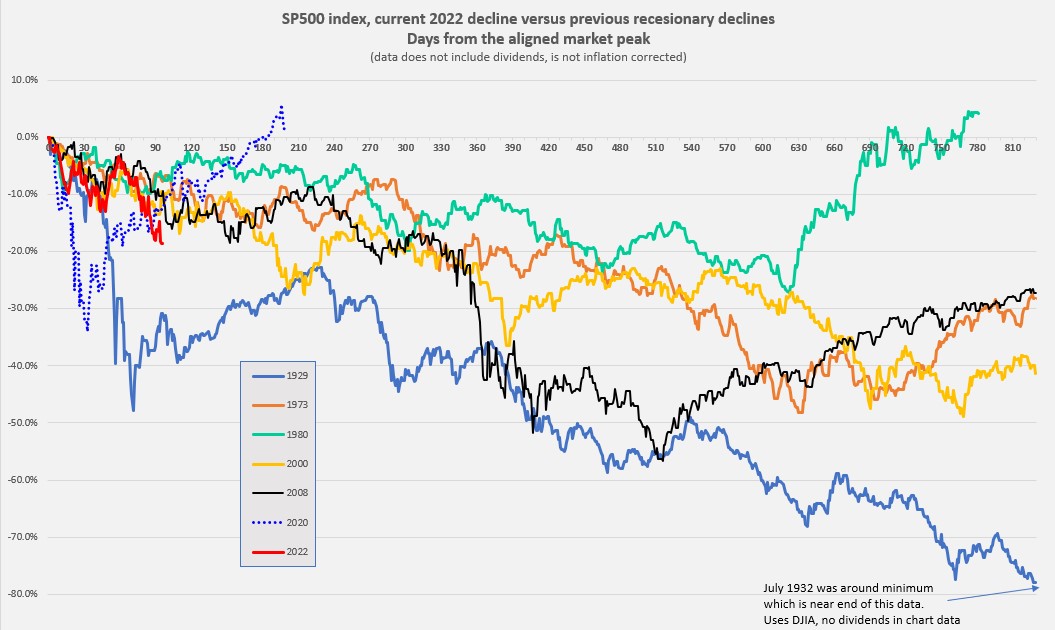

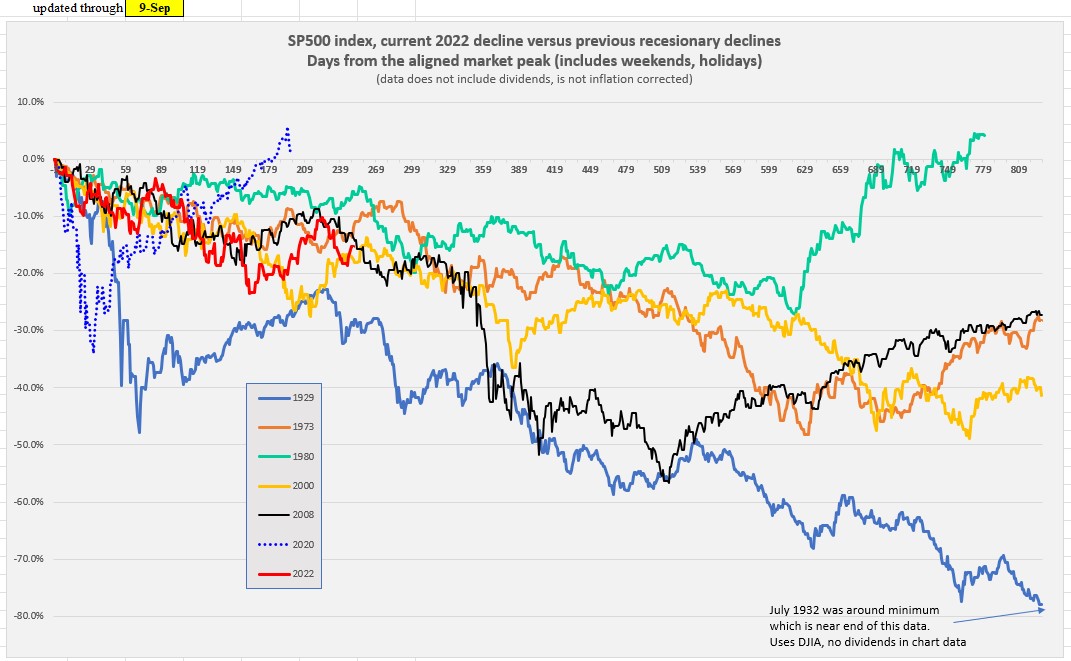

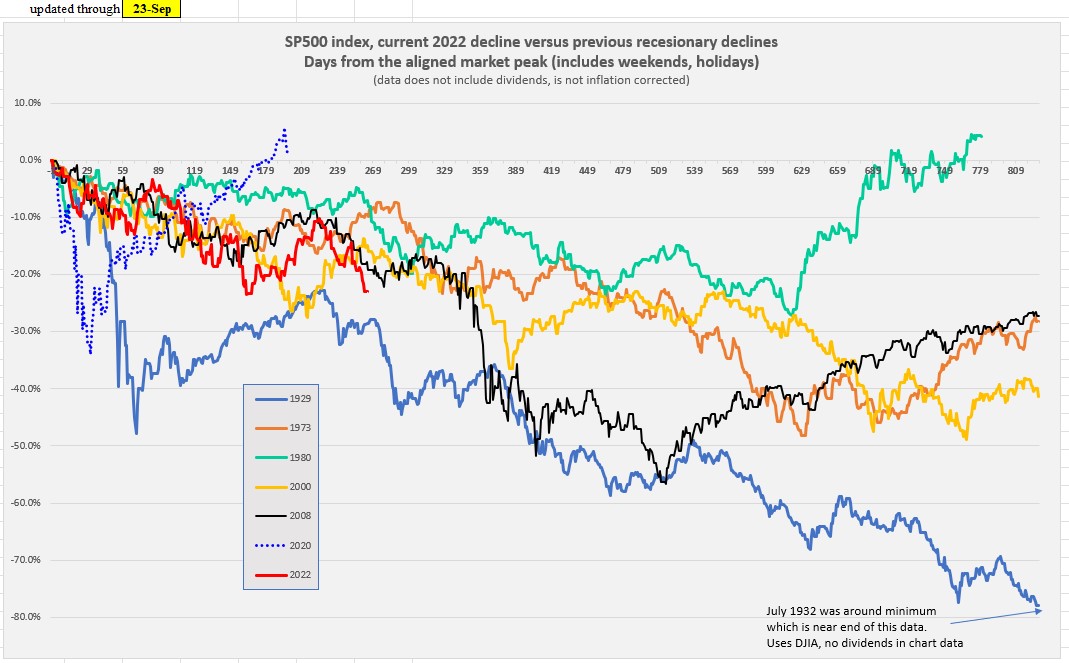

The worst market I have even been in was the one that started in 1974. The depth and length of that dive was breath taking. IIRC, it took the US stock market over a decade to recover in real terms. Business week ran its famous issue back then. See below.

This market is a cream puff compared to that one so far. Of course, this BEAR may or may not be heading back to its den for a long period of hibernation. We don't know.

Yeah, the 74 on recession/oil shock/stagflation/etc. was a lot worse than now - so far. We never know where things are heading and there are a lot of new players on the scene that can affect the situation. I have kind of an uneasy feeling about things - not that there is much I can do about it. I'm revisiting my back-ups to be certain they are still viable but hope I don't need to exercise any of them. YMMV