Elizrogers

Recycles dryer sheets

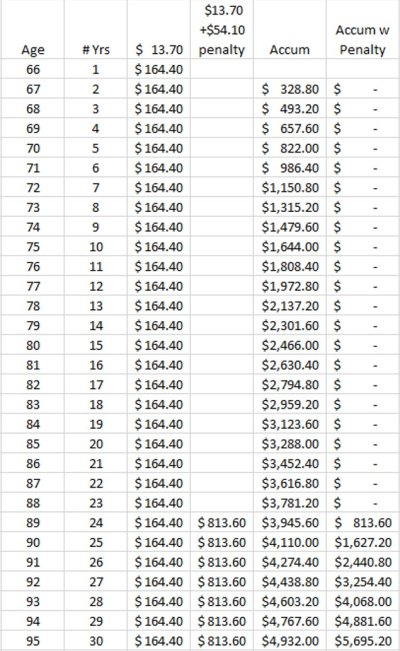

I did not take the Part D Rx plan when I first started Medicare, so I have 2, I found that the two I used to take are not covered by any plan, at any tier, so I would be paying the total cost. The one I take occasionally, with my Good RX discount card costs $11 for 90 pills. Under Rx plans it runs anywhere from $159-$256 depending on the plan. That is ridiculous. So, I have decided to save the $264 yr, which would be over $2,264 over the next 10 years. And the premiums will go up. If I save that money, I can pay for a lot of drugs.

I realize if you have something serious like MS, you may have some very pricey drugs to take, but the chances are low for something like that. I do expect cancer as it runs in my family and I have had a small one removed from a breast gland, but no chemo or radiation was required and it did not spread beyond the gland, which was removed. Of course, chemo and radiation are considered Treatments, not drugs, and covered under Part B, so if I ever do take them Part D won't help. I don't know how they are allowed to penalize you so heavily for not taking this coverage from day one, when you can't use it, effectively forcing people to pay for nothing, just because they fear the unknown future and so may pay someone thousands of dollars and never get a benefit.

If I don't start for 10 years, (assume in 10 years I need an expensive drug) it will still only cost about $50/mo for Part D at that time. If a drug is only a couple hundred dollars, I am still going to be ahead by saving that premium all those years and I can't imagine taking a drug that costs thousands of dollars, as I do not intend to go to extremes to prolong life, should I get something catastrophic anyway. Am I wrong or overlooking something? I'm 68 and have no health problems other than orthopedic, so consider the risks of needing ridiculously expensive drugs very slim, and I might not take them even if prescribed, just because I hate drugs. I had a blood clod about 5 years ago and they wanted me to take Xarelto for the rest of my life. I took it for 9 months, which was 3 more than they said I needed to in order to clear out all the pieces of the clot from my system, but then stopped. They could not show me any indications that I might ever have another one, except that I had had the one. It was a fluke, no history in my family, and no indications in my blood or other medical tests to say I'm at risk. Everyone seems to want me to waste money on this plan, "just in case", but I can't wrap my head around paying someone for something I don't expect to ever use and will probably cost me more than any drugs I may ever take.

Comments?