ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't even think it is possible to be so low. Here's our annual numbers compared with the above categories:

HOA (does not include anything on the house): $6,024

Landscape: $1,440

Electricity and Gas: $6,500

Water and Sewer: $2,200

Internet and Streaming Subscription (No Netflix): $2,200

Umbrella and Home Insurance: $1,700

Cell phones and mobile devices: $3,000

Pest Control: $460

Property Tax: $4,350

Pool: $2,000 (not in yours)

Cleaners: $5,000 (not in yours)

Total: $32,674

Our HOA just covers the 24x7 guards and community landscaping and upkeep.

1st. It is OK to derail this thread to include this info if you so desire. The original has run its course.

Here is ours for 2022 with a little more granularity for you I maintain my own pool, DW is cleaner, we do not have any streaming services, we do not need them for content. I would say we are in a MCOL area, although it is getting more expensive every year.

HOA and Landscaping (HOA = $180pm Landscaping = $145pm) Includes 2 Guarded Gates.

Electricity, Water & Sewer & Gas (E=$130pm W=$53 G=$22pm) Includes: Electric Range and 2 AC Units, Water Heater is Tankless Gas)

Internet & Cable TV (We had cable in 2022 but not now) 1gb $104 per month

Umbrella, Flood & Home Insurance (Year - U=$241 F=$550 H=1294)

Telephone (2 Lines Unlimited Everything $60pm)

Pest Control (Year - $241pm for Termite Bond the rest is done by HOA)

Property Tax (Year $5,207)

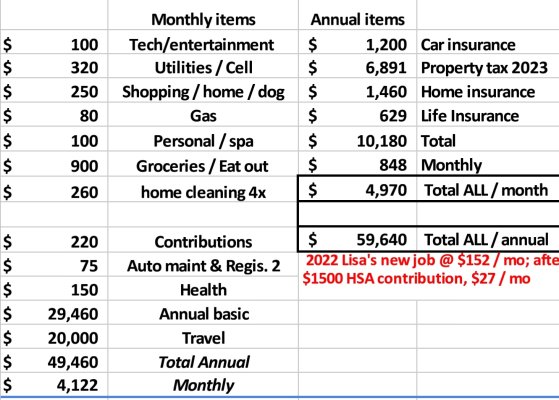

See attached section of my 2022 spreadsheet:

Attachments

Last edited: