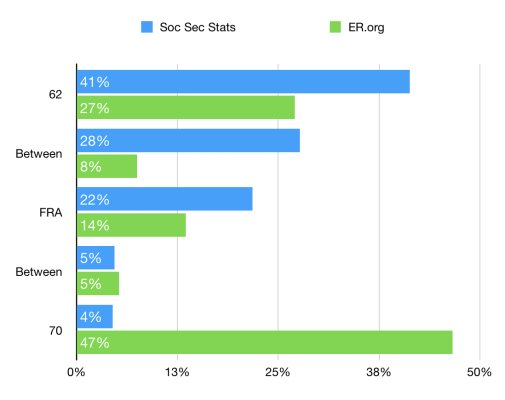

I took my SS as early as possible. My wife, a retired teacher, never participated in SS. She is not eligible to receive benefits. And, if I pass before her, she is not eligible for survivor benefits, on my record, due to her pension, and IRS WEP exclusion.

We decided to take my benefit, and funnel it into our portfolio. In this way she will get a greater benefit if I check out first. So far, this plan is working out very well.

My wife is also a retired teacher. Because she is not eligible for any SS spousal benefit when she retired we took the option of 100% of her pension with 0% survivor benefit to maximize the amount she would receive. I then delayed my SS benefits until 70 to maximize the amount of SS I would receive because I will not get any of her pension. I do not have any pension. We both come from a line of long lived relatives. If I die before her, she will receive some SS survivor benefit that is reduced because of GPO. We also have enough IRA and taxable savings to provide for the surviving spouse.