dixonge

Thinks s/he gets paid by the post

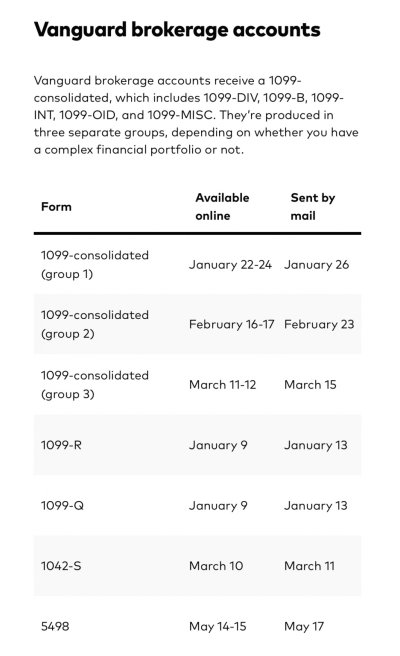

I thought that getting tax forms electronically would help me file early and get it over with, but it doesn't seem to work like that for retirees. The main source of delays seems to be brokerages. Specifically, Schwab. I don't do any exotic trading, Index funds only, but my best estimate is that I won't have all necessary forms available for filing until late February at the earliest.