- Joined

- Oct 13, 2010

- Messages

- 10,766

Amazon has only pre-orders at the moment. I haven't gotten mail or email offers from H&R Block, but then again, I only buy the "Basic", so they don't like me, hehe!

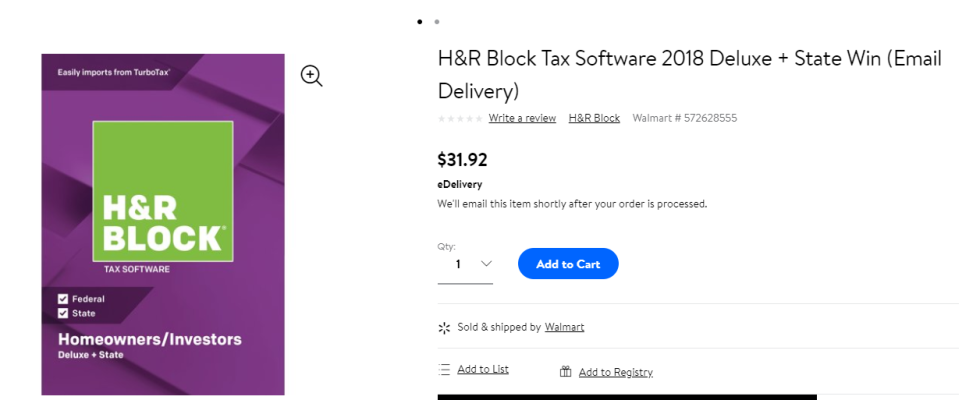

$45 - Deluxe Federal & State

$35 - Deluxe Federal

$20 - Basic

(same prices as the Block site, as far as I can tell)

$45 - Deluxe Federal & State

$35 - Deluxe Federal

$20 - Basic

(same prices as the Block site, as far as I can tell)

So bottom-line is that you got Deluxe Federal & State for $20? After you've used it, would you mind sharing the link? It might be a one-time thing, but might be worth a shot for others here.I just received an email offering a $25 discount on Delux download for Federal and State taxes.?

I'm not sure how to interpret this. $20 off of Deluxe Federal and State would mean you would pay $25 for Deluxe Federal & State? Or are you getting $20 off on Deluxe Federal for $15? Either way, that's nothing to sneeze at. Now, if they give you $20 off of an inflated price, or a higher priced version, that's not a deal.Hmmm.... I got offer, but it was only for $20 off ($34.95) on Deluxe. Guess I'm not as special as you

Last edited: