audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I’m planning some Europe travel this fall which will include two different tours spaced about a week apart, one of which is rather pricey, and of course the international air fare.

Our main concern is an elderly parent - whether they got suddenly seriously ill requiring our presence or worse. But of course if something happened to either of us that would for cancellation or needing to interrupt the trip and return back to the states early.

How doesn’t one do this piecemeal? - You are supposed to buy insurance within a few days of your initial deposit to get the most benefit. But we will be buying this in parts - one tour, and then the other, each with their own deposit schedule I assume, and then much later purchasing the nonrefundable airfare which we generally do just about two months before the trip. Do they just keep updating the quote or adding to it?

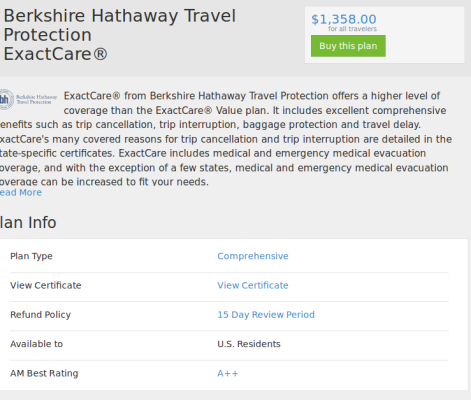

I’ve been reading some of the material at insuremytrip.com, but they don’t seem to discuss the actual mechanics of buying the insurance. Do you end up communicating with an individual and they walk you through various quotes? This doesn’t seem very cut and dried. I supposed it's easier if you are just going on one cruise with attendant air fare.

We’ve never bought insurance before as we only pre-pay the airfare (which can be used later) and usually do our own hotel booking, always cancelable. Also, the parent is much more frail now than in the past.

_______________

FWIW Here are some threads I recently collected from the past few years. Most discuss medical travel insurance.

http://www.early-retirement.org/forums/f46/trip-insurance-95893.html

http://www.early-retirement.org/forums/f46/trip-reimbursement-insurance-88310.html

http://www.early-retirement.org/forums/f46/trip-interrupted-how-does-trip-insurance-work-92297.html

http://www.early-retirement.org/forums/f46/blue-card-worldwide-travel-health-insurance-85552.html

http://www.early-retirement.org/forums/f46/travel-insurance-74082.html

http://www.early-retirement.org/forums/f46/travel-insurance-79192.html

http://www.early-retirement.org/for...chase-sapphire-reserve-credit-card-88382.html

http://www.early-retirement.org/forums/f46/travel-insurance-questions-91175.html

http://www.early-retirement.org/forums/f38/pre-medicare-insurance-travel-nearly-full-time-92091.html

http://www.early-retirement.org/forums/f46/travel-insurance-review-92608.html

http://www.early-retirement.org/for...insurance-as-a-periodic-supplement-88164.html

http://www.early-retirement.org/for...u-know-travel-insurance-exclusions-95273.html

Our main concern is an elderly parent - whether they got suddenly seriously ill requiring our presence or worse. But of course if something happened to either of us that would for cancellation or needing to interrupt the trip and return back to the states early.

How doesn’t one do this piecemeal? - You are supposed to buy insurance within a few days of your initial deposit to get the most benefit. But we will be buying this in parts - one tour, and then the other, each with their own deposit schedule I assume, and then much later purchasing the nonrefundable airfare which we generally do just about two months before the trip. Do they just keep updating the quote or adding to it?

I’ve been reading some of the material at insuremytrip.com, but they don’t seem to discuss the actual mechanics of buying the insurance. Do you end up communicating with an individual and they walk you through various quotes? This doesn’t seem very cut and dried. I supposed it's easier if you are just going on one cruise with attendant air fare.

We’ve never bought insurance before as we only pre-pay the airfare (which can be used later) and usually do our own hotel booking, always cancelable. Also, the parent is much more frail now than in the past.

_______________

FWIW Here are some threads I recently collected from the past few years. Most discuss medical travel insurance.

http://www.early-retirement.org/forums/f46/trip-insurance-95893.html

http://www.early-retirement.org/forums/f46/trip-reimbursement-insurance-88310.html

http://www.early-retirement.org/forums/f46/trip-interrupted-how-does-trip-insurance-work-92297.html

http://www.early-retirement.org/forums/f46/blue-card-worldwide-travel-health-insurance-85552.html

http://www.early-retirement.org/forums/f46/travel-insurance-74082.html

http://www.early-retirement.org/forums/f46/travel-insurance-79192.html

http://www.early-retirement.org/for...chase-sapphire-reserve-credit-card-88382.html

http://www.early-retirement.org/forums/f46/travel-insurance-questions-91175.html

http://www.early-retirement.org/forums/f38/pre-medicare-insurance-travel-nearly-full-time-92091.html

http://www.early-retirement.org/forums/f46/travel-insurance-review-92608.html

http://www.early-retirement.org/for...insurance-as-a-periodic-supplement-88164.html

http://www.early-retirement.org/for...u-know-travel-insurance-exclusions-95273.html