- Joined

- Oct 13, 2010

- Messages

- 10,763

Has anyone added a UHC/AARP Medicare supplemental policy after their spouse already had such a policy?

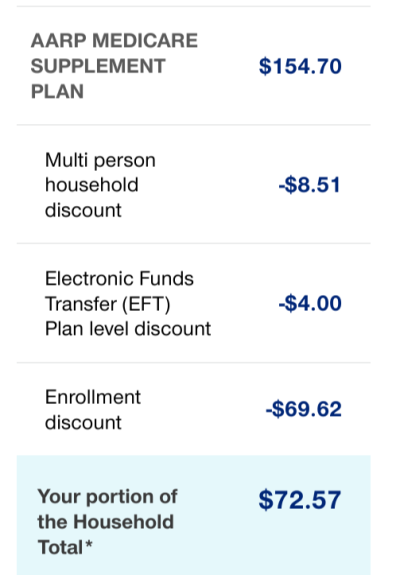

The reason I ask is because if you have two AARP members in the household, you get 10% off, but if you have two policy holders in the household, you get 15% off.

Right now, the existing policy is getting 10% off. But when we get the second policy established, both policies should get 15% off.

I just wondered if we need to call, or if it will happen automatically.

The reason I ask is because if you have two AARP members in the household, you get 10% off, but if you have two policy holders in the household, you get 15% off.

Right now, the existing policy is getting 10% off. But when we get the second policy established, both policies should get 15% off.

I just wondered if we need to call, or if it will happen automatically.