FiveDriver

Full time employment: Posting here.

Plan N has an up to $20 copay for office visits, but not lab work, imaging and such.

Excess charges are rare and easy to avoid, but even if you get one, it’s usually only a few dollars. 96% of doctors don’t charge excess charges, and seven states, including PA where I live, don’t permit excess charges. All you have to do is ask if the doctor accepts Medicare assignment to avoid them completely.

This entire thread contains some valuable information....I'd almost say it's worthy of a sticky.

Yesterday in the US Mail, came a nice informative package from South Carolina Blue Cross. It has a decision tree in flow-chart form, asking questions like --

"Are you willing to pay a percentage of hospital bills for a lower premium?"

A Yes response leads to Plan G-HD, No Response leads down a different path.

"Would you be willing to pay $20 copay for lower premium?"

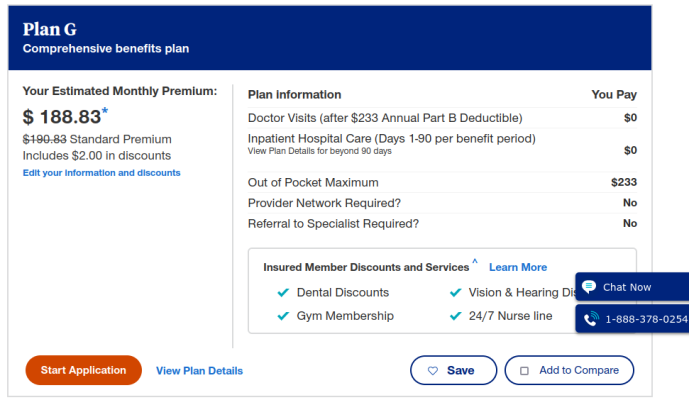

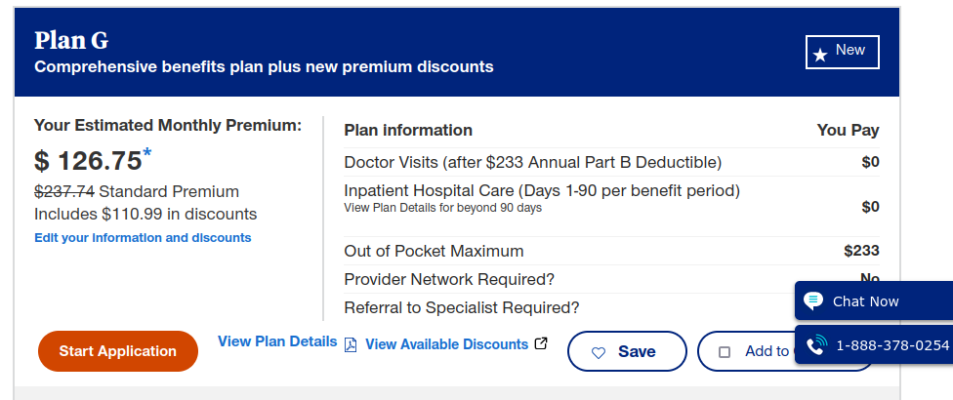

Yes Response leads to Plan N. No leads to Plan G.

Followed by a Table with what each Plan pays.

Not saying we'll sign-up with SC Blue Cross, but this flow chart is about as much info in one place that I've ever seen. The lowest cost provider based on my phone calls would be UHC/AARP. I will check out United American Co, on Monday for their quotes.

Still not sure about the actual savings on Monthly Premiums when using High Deductible Plans. Or if it's easy to switch out of HD at some point down the road.

Nor do I have a clear answer on what is the catch with a Medicare Advantage Plan. I've been on MA for 8 years with near Zero Dollar cost.