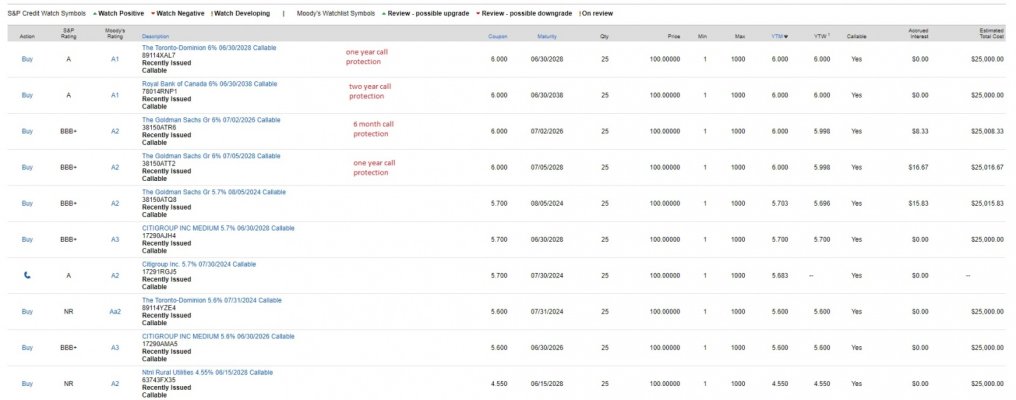

So almost 6% interest for at least 3 years and no risk as with equities? Yeah, I'll be getting some of that.

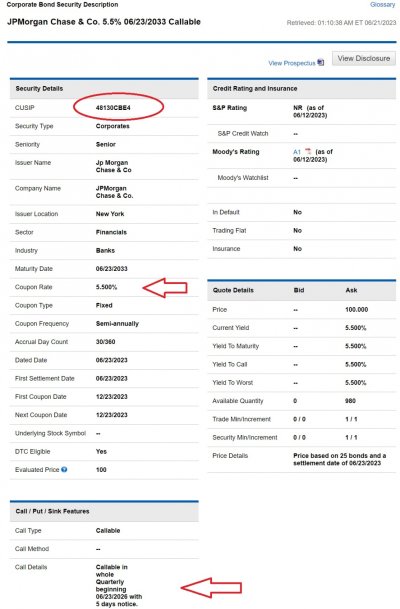

There is interest rate risk, since they have a call option. If rates rose substantially in the coming years, you would be stuck with a below-market rate interest rate vehicle, or would have to sell at a loss because the bond principal would drop. I still haven't figured out a way to mathematically evaluate a bond with a call option vs bonds without.

And risk the other direction too. If rates drop, you get called and have to reinvest at lower rates.

Last edited: