You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

We are entering a "Golden Period" for fixed income investing

- Thread starter Freedom56

- Start date

- Status

- Not open for further replies.

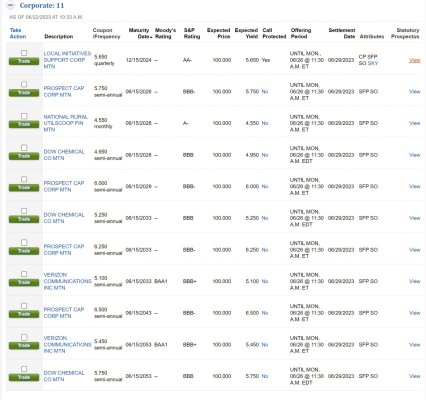

New corporate notes at Fidelity. Nothing worth buying.

It's such a Catch 22. I want to diversify my corp bonds away from just the banking sector however it seems like the banks offer the best yield to risk notes...

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's such a Catch 22. I want to diversify my corp bonds away from just the banking sector however it seems like the banks offer the best yield to risk notes...

Look at the secondary market.

Freedom56

Thinks s/he gets paid by the post

It's such a Catch 22. I want to diversify my corp bonds away from just the banking sector however it seems like the banks offer the best yield to risk notes...

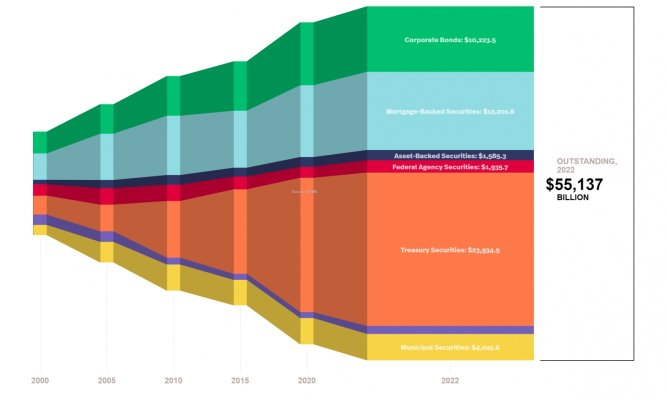

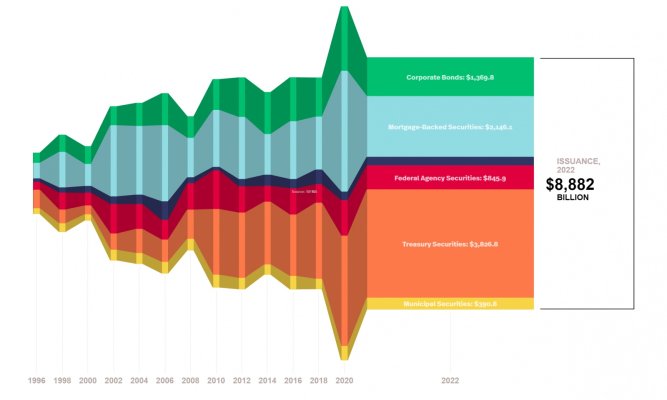

With corporate bonds/notes, financials are the biggest issuers of high grade notes. You can stay out of trouble by staying with the strongest banks in North America. Look at the secondary market for corporate bonds from other sectors such as e-commerce, semi-conductors, computer hardware, communications, healthcare, pharma, and other sectors. These sectors do not issue notes every other week like banks do. The other issue is that the strongest companies often have yields less than treasuries or CDs for the same duration which begs the question, why bother with them. Just buy CDs or treasury's instead for diversification. Per the attached charts, corporate bonds are a small slice of the bond market.

Attachments

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have 99% higher quality bonds in my ladders, but every once in a while I go slumming. Bought some BBB- 69121KAC8 7.6% yield. 2 year duration, small position this morning.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have 99% higher quality bonds in my ladders, but every once in a while I go slumming. Bought some BBB- 69121KAC8 7.6% yield. 2 year duration, small position this morning.

It’s Owl Rock Capital in case anyone is curious like me.

Accidental Retiree

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2012

- Messages

- 1,500

Thanks to this thread, we have recently started purchasing TIPS and CDs at Vanguard since that’s where funds are currently available.

I looked up the TD Bank bond that’s been under discussion here, CUSIP #89114XAJ2.

I can find this bond and buy it at Schwab, but the Buy link for this same bond is inactive at Vanguard.

Does this mean the bonds are sold out at VG but not Schwab?

I looked up the TD Bank bond that’s been under discussion here, CUSIP #89114XAJ2.

I can find this bond and buy it at Schwab, but the Buy link for this same bond is inactive at Vanguard.

Does this mean the bonds are sold out at VG but not Schwab?

Freedom56

Thinks s/he gets paid by the post

Thanks to this thread, we have recently started purchasing TIPS and CDs at Vanguard since that’s where funds are currently available.

I looked up the TD Bank bond that’s been under discussion here, CUSIP #89114XAJ2.

I can find this bond and buy it at Schwab, but the Buy link for this same bond is inactive at Vanguard.

Does this mean the bonds are sold out at VG but not Schwab?

It means that Vanguard is not offering the new notes. TDA always had the best access to new corporate notes. Now that the merger has been completed, Schwab has that title.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

well I still have a TDA account. Till September. My HSA.

PhotoAviation61

Dryer sheet wannabe

- Joined

- Jun 15, 2023

- Messages

- 22

Thanks to this thread, we have recently started purchasing TIPS and CDs at Vanguard since that’s where funds are currently available.

I looked up the TD Bank bond that’s been under discussion here, CUSIP #89114XAJ2.

I can find this bond and buy it at Schwab, but the Buy link for this same bond is inactive at Vanguard.

Does this mean the bonds are sold out at VG but not Schwab?

Just an FYI. The TD 6% bond (89114XAJ2) is now available on secondary market on my Fidelity Fixed income page and can be bought for 99.875 (does not include Fidelity markup).

There was a discussion about how much in treasury bonds to hold vs corporate bonds. The context was that treasury bonds are highly resilient in a stock market downtown while corporate bonds drop much more. Any thoughts on this?

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

well I still have a TDA account. Till September. My HSA.

I have a TD HSA account via HSA Bank. And both it and my regular TD accounts are also not being merged until Labor Day.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Are you planning to stick with Schwab and see how it goes?I have a TD HSA account via HSA Bank. And both it and my regular TD accounts are also not being merged until Labor Day.

It means that Vanguard is not offering the new notes. TDA always had the best access to new corporate notes. Now that the merger has been completed, Schwab has that title.

well I still have a TDA account. Till September. My HSA.

I have a TD HSA account via HSA Bank. And both it and my regular TD accounts are also not being merged until Labor Day.

Are you planning to stick with Schwab and see how it goes?

Half of my pretax (IRA) holdings are in TDA. Other half (401k and tIRA) are at Fidelity.

I'm gonna let it ride unless Schwab ticks me off.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have Schwab, getting 5.09% in MM I am staying.

Freedom56

Thinks s/he gets paid by the post

As a TD Bank bond holder, I want to see Schwab succeed. TD Bank still owns 10% of Schwab.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There was a discussion about how much in treasury bonds to hold vs corporate bonds. The context was that treasury bonds are highly resilient in a stock market downtown while corporate bonds drop much more. Any thoughts on this?

I presume they mean resilient to mark-to-market volatility. I think having a ladder, holding to maturity, and limiting low quality corporates mitigates that risk for me.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Are you planning to stick with Schwab and see how it goes?

Yes, that is the plan. Hopefully Schwab is basically the same as TD. I only have 2 accounts; it and Vanguard. They pair well for me. Vanguard bond desk is very good at hunting down obscure bonds like my South Jersey Industries 2076 bond that is paying 11% straight up (no YTM ), while TD allows me to buy Canadian utility preferreds on OTC such as Fortis. Vanguard doesnt allow OTC trading. If Schwab doesnt plug the holes TD does, then I would have to move on as I dont need 3 brokerage accounts.

GravitySucks

Thinks s/he gets paid by the post

There was a discussion about how much in treasury bonds to hold vs corporate bonds. The context was that treasury bonds are highly resilient in a stock market downtown while corporate bonds drop much more. Any thoughts on this?

I keep about 5 years of essential spending in treasuries and FUAMX and am moving to holding more as the shorter term corporates mature. There are a few times since I retired that it was reassuring to see that one class go up while everything else went down.

Luckily didn’t have to withdraw anything March 2020 but it was nice to see I had something go up when everything else was down.

And the five+ years in case we get another 1929 situation.

Yes, that is the plan. Hopefully Schwab is basically the same as TD. I only have 2 accounts; it and Vanguard. They pair well for me. Vanguard bond desk is very good at hunting down obscure bonds like my South Jersey Industries 2076 bond that is paying 11% straight up (no YTM ), while TD allows me to buy Canadian utility preferreds on OTC such as Fortis. Vanguard doesnt allow OTC trading. If Schwab doesnt plug the holes TD does, then I would have to move on as I dont need 3 brokerage accounts.

11%? Damn.

Lakedog

Full time employment: Posting here.

- Joined

- May 23, 2007

- Messages

- 984

I have a TD HSA account via HSA Bank. And both it and my regular TD accounts are also not being merged until Labor Day.

Same here, looks like anyone with a TD HSA (via HSA Bank) is the last to be merged - my three accounts (regular, Roth, HSA) are also scheduled for Labor Day weekend. I plan to see how it goes with Schwab before deciding about moving any accounts.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

11%? Damn.

Everything is a trade off. But not always with risk of getting paid from poor credit quality. South Jersey Industries was the former regulated gas utility ( SJI ticker) that went private by the Infrastructure Investments Fund of JP Morgan buying them out with regulatory approval. The South Jersey has a same sister 2031 5.02% subordinated note that is about 7% YTM. So there is no stress on the holding company its just that the 2079 subordinated note was actually a $25 baby bond ticker SJIJ that got delisted from the NYSE and wound up on the $1000 par bond desk. The $25 5.625% note trades about $12.50 or so because of being delisted and illiquidity. I consider it an 11% “annuity like” modest purchase yield spicer to the stash. So in this case its the liquidity risk from delistment that brings out the increased yield.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Corporate defaults and bankruptcies are surging.

https://www.cnbc.com/2023/06/24/hig...mic-uncertainty-boost-corporate-defaults.html

https://www.cnbc.com/2023/06/24/hig...mic-uncertainty-boost-corporate-defaults.html

Last edited:

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's transitory, unless you are one of those that failed! "Maybe" we need a little cleansing from time to time.

Every recession is sort of like a good flush.

- Status

- Not open for further replies.

Similar threads

- Replies

- 35

- Views

- 3K

- Replies

- 3

- Views

- 463

- Replies

- 17

- Views

- 760