Healthy Lifestyle

Recycles dryer sheets

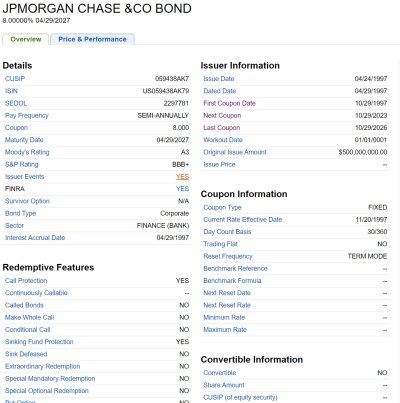

Corporate defaults and bankruptcies are surging.

https://www.cnbc.com/2023/06/24/hig...mic-uncertainty-boost-corporate-defaults.html

These defaults and bankruptcies are surging for

small and some medium size companies that have high debt that need to borrow at higher rates.