Kwirk

Full time employment: Posting here.

- Joined

- Mar 11, 2006

- Messages

- 524

I love my kids so I'd go with obese.

So how does one accumulate $$$ sufficient to jump from base to comfy to fire in 1 year each?

What the underlying % success rate would be important to me, didn’t see that. A 95% success rate wouldn’t be the same answer as something higher.

I’d work as long as you can stand it regardless. You’ll be retired for a LONG time whether you go at 54 or 57. Retired for 30 years or 34 years isn’t a huge difference.

And I’d call obese FIRE 100% BTD, and adjust the others accordingly. But we each decide for ourselves.

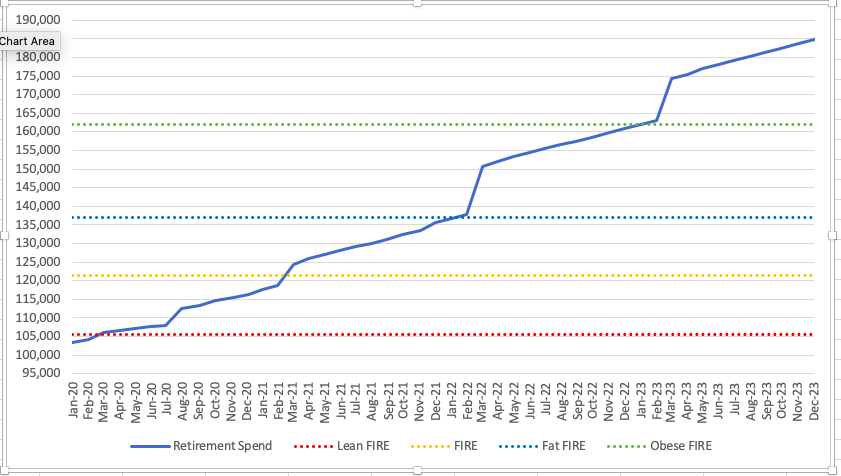

What are your savings withdrawal rates for each of these?

I’m just under your age and pulled the trigger last year.

Are you confident you have your expenses right including buying health insurance? Also a recent thread found many of us spend on average $15k per year on repairs and home improvements you may have dismissed as “not happening again”.

After leaving my fin advisor, I am down to 2.5% SWR until SS and a nonCOLA pension kick in.

Are you defining FAT fire as over $100k spend (location dependent if that’s fat) or like $50k over your current spend rate after meeting insurance?