My son and I sold a co-owned home and we'll both come away with about $50k that we need to park somewhere for 18-24 months. He for next home purchase and me earmarked for a car replacement. Given current market what are the suggestions on best place for money that will be needed in 18-24 months.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Where to Park some Money

- Thread starter GATime

- Start date

If you have a brokerage account I would suggest buying T-bills at auction 56 week and 2 yr bills split based upon when you plan on spending it. There is another discussion down below asking about t-bills.

https://www.early-retirement.org/forums/showthread.php?p=2765955

https://www.early-retirement.org/forums/showthread.php?p=2765955

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I’d suggest treasury notes but I’d choose the secondary market instead of auction.

disneysteve

Thinks s/he gets paid by the post

- Joined

- Feb 10, 2021

- Messages

- 2,378

T bills or brokered CDs, whichever are paying more for your desired duration. I think that’s the treasuries under 2 years. .

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

Along with the other good ideas above, of course both of you should get your $10k for self/spouse in to I Bonds. Redeeming at less than 5 years will incur last 3 months interest penalty, but if you're getting 7%+, sacrificing that amount is no big deal in the bigger picture.

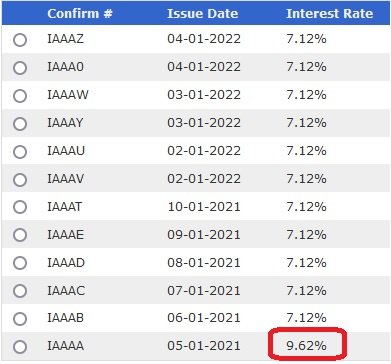

Attachments

Yes, we both have Vanguard brokerage accounts. I recently purchased my I-Bond allotment for 2022. He is single so that would only work for $10k if decides that route. Given the current market downturn, would anyone consider VTI with the accepted volatility.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

Given the current market downturn, would anyone consider VTI with the accepted volatility.

No - not based on requirements in your initial post.

Turbo29

Full time employment: Posting here.

I’d suggest treasury notes but I’d choose the secondary market instead of auction.

Why?

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,188

Yes, we both have Vanguard brokerage accounts. I recently purchased my I-Bond allotment for 2022. He is single so that would only work for $10k if decides that route.

18-24 months puts you into 2024. He could buy $10k now, then you could gift each other 10K to be delivered in 2023, and $10K for delivery in 2024. That would get you the started with the current nice yield. Of course, that is assuming no relationship issues that might cause issues delivering the gifts.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

Why?

You have access to purchase any outstanding treasury issue, so you can pick most any maturity date you like. Because they are so liquid, there is going to be very little spread and so you are going to get the best/going yield based on maturity. Buying at auction, you have to wait until the auction date, whereas buying in the secondary market you can buy any day/time you like. Lastly, since there are no commissions (at least with Fidelity), there is no benefit buying at auction.

There is one particular drawback buying at auction - you will not know the exact price/yield you get until after auction.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Along with the other good ideas above, of course both of you should get your $10k for self/spouse in to I Bonds. Redeeming at less than 5 years will incur last 3 months interest penalty, but if you're getting 7%+, sacrificing that amount is no big deal in the bigger picture.

Yes, we both have Vanguard brokerage accounts. I recently purchased my I-Bond allotment for 2022. He is single so that would only work for $10k if decides that route. Given the current market downturn, would anyone consider VTI with the accepted volatility.

You can also buy $20k as gifts for each other and out them in a gift box as your 2023 allowance and if you deliver them and redeem them as early as 1/1/23 then your minimum yield would be 2.79%

You will very likely do much better than the rates above if the future rates are not 0%, which is highly likely. For example, if the rate for the second six months is 6%, the yields above would 4.79% and 2.79%.

While 2.79% for 20 months isn't stellar, it is still better than 20 month UST at this point and is very likely to be much higher.

That would cover off $20k that you could invest today. The bad part is that to get those juicy rates it requires a little work on your part.

For whatever you can't do via ibonds then I would just go with US Treasuries. I would not go VTI for something like near term savings for a house and a car, especially at this point in time.

Last edited:

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Here's a few ideas from Jason Zweig who writes a column for the WSJ. Since it is behind a paywall I will quote a few of the more interesting parts.

https://www.wsj.com/articles/making-your-cash-work-harder-as-interest-rates-rise-11651245069?page=1

I would get a copy of the 4/29/2022 WSJ if any of the above is of interest. Due diligence is always worthwhile.

https://www.wsj.com/articles/making-your-cash-work-harder-as-interest-rates-rise-11651245069?page=1

Here are a few suggestions, starting with what you shouldn’t do.

Financial advisers often recommend ultra-short-term bond funds and bank-loan (also called floating-rate or senior-loan) funds as if they were substitutes for cash. They’re not.

These funds can hold corporate debt, sometimes below investment grade, and aren’t immune to rising rates. Many charge fees in excess of 0.5%. So far this year, ultra-short-term funds have lost an average of 0.9%, according to Morningstar; the average bank-loan fund is down 0.65%. Cash doesn’t act like tha

Next week, the Treasury will announce its latest rate on inflation-protected savings bonds, or I bonds. The annualized yield for the coming six months will likely be 9.6%.

Yes, that’s 9.6%, nine point six percent.

Mr. Schalk says he is a conservative investor who has about 7% of his portfolio in cash.

For years, he stashed much of that in short-term floating-rate notes issued by a subsidiary of his former employer, Caterpillar Inc., recently yielding 0.35%.

Now, however, Mr. Schalk plans to move into 3-month U.S. Treasury bills, which he will buy on TreasuryDirect in equal increments on May 1, June 1 and July 1. He will sign up to reinvest them automatically in new T-bills as they mature.

That way, he benefits if rates rise over time and avoids the risk of holding long-term debt. Three-month Treasury bills yielded about 0.82% this week.

“It’s not sexy,” says Mr. Schalk, “but it should be very safe and significantly improve my return.”

A couple of exchange-traded funds, iShares Treasury Floating Rate Bond and WisdomTree Floating Rate Treasury, offer a way to hitch a ride on rising short-term rates.

The WisdomTree ETF holds the four most recently issued floating-rate notes from the U.S. Treasury. These instruments mature two years after they’re issued, but they pay variable interest that resets every week with the latest 3-month T-bill auction.

Over time, the ETF’s yield should approximate that of the federal-funds rate, says Kevin Flanagan, head of fixed-income strategy at WisdomTree Investments Inc. That’s the benchmark for overnight bank lending that the Federal Reserve uses to modulate interest rates.

I don't necessarily advocate any of these for you or anybody else. After all, our situations are all different and like they say, YMMV.Finally, you don’t have to take your bank’s lousy interest rates lying down.

MaxMyInterest.com, an online service, automates the process of opening accounts in your name, each with $250,000 in Federal Deposit Insurance Corp. coverage, at banks offering high-yield savings accounts.

Max isn’t a bank and doesn’t have access to your money. Instead, it functions like a switchboard, conveying transfer requests to route your deposits among the eight online banks in its network, ensuring you get the best blend of income and FDIC insurance.

Gary Zimmerman, Max’s founder and chief executive, says its average customer allocates $200,000 to $400,000 in cash, although account sizes range from $20,000 to $10,000,000.

This week, Max offered yields on savings accounts up to 0.82%. That doesn’t count Max’s annual fees of 0.08% (accounts with $60,000 or less pay a flat $48).

I would get a copy of the 4/29/2022 WSJ if any of the above is of interest. Due diligence is always worthwhile.

Last edited:

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why?

What Howie said.

I haven’t bought at auction since well before online orders were available, but I’ll probable place an auction order or two just check it out.

Similar threads

- Replies

- 15

- Views

- 528

- Replies

- 57

- Views

- 3K

- Replies

- 144

- Views

- 9K