Truckinalong

Recycles dryer sheets

- Joined

- Sep 27, 2018

- Messages

- 64

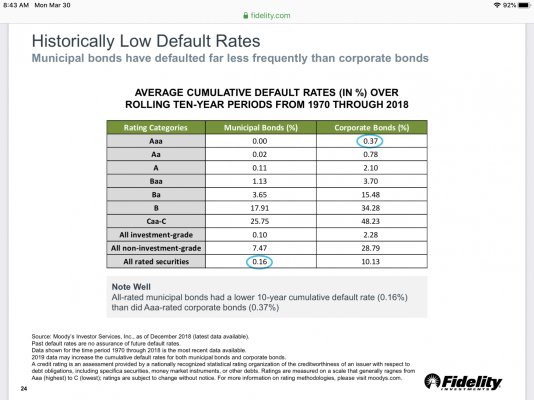

What I can't wrap my head around, municipalities of all sizes are taking in significantly lower sales tax, conventions tax, toll roads, airport fees and on and on. Combined with significant additional expense in fighting covid it's a bad combination. The press tends to focus on the weaker credits, but even the best fiscally run municipality does not have an extra 6 months of year of liquidity just laying around. I also think we will see very much people unable to pay their property taxes. Then what, tax levy and foreclose on the town?

In other words it seems the idea of these muni's defaulting looks higher than ever. Given many of their debt payments are semi annual or annual we may not know yet.

I hope the experts here can tell me why I should not worry with respect to investing in muni bonds / funds specifically.

In other words it seems the idea of these muni's defaulting looks higher than ever. Given many of their debt payments are semi annual or annual we may not know yet.

I hope the experts here can tell me why I should not worry with respect to investing in muni bonds / funds specifically.