TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

DD is a sophomore in college. Last March she took the opportunity to run a small company as part of an internship program (I'll tell more about that in another thread later). She needed money to buy a car, pay for apartment, etc. I made her a $7,000 loan, payable on Oct 15. Part of that was for the remainder of freshman year, since she had gone over her budget.

She worked very very hard, and made about $7,000 (she had expected to make more). She also learned a lot. However, her expenses were high, and she will only be able to pay back about $2,000 of the loan. Her spending was not extravagant.

Other factors: She ignored reminders that the loan would be due soon, and let the due date pass without paying anything. No "Sorry, Dad, I'm not going to be able to repay it." She didn't manage the money well, and had a few hundred dollars in overdraft fees.

So the question is: how do I handle this?

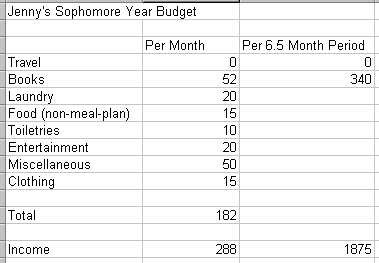

My plan: Explain that I don't fault her for not making money, and I understand how hard she worked. However, she needs to bear the responsibility for the risk she took, and suffer the consequences of not making enough money. Therefore, I'm putting her on a relatively austere month-by-month budget. I will forgive most of the loan. She has a job during the year, and makes about $288 per month, so I will require her to pay me $50 per month, and suggest that she save $50 month for next summer. Note that she has a generous prepaid meal plan.

It's so hard to find the balance between being helpful and giving her the proper understanding of spending. For example, she says "sometimes my roomates all go out to dinner, and how can she say no?" So this budget is meant to make her realize that if you don't have the money, you shouldn't spend it.

Any suggestions? Thanks!

She worked very very hard, and made about $7,000 (she had expected to make more). She also learned a lot. However, her expenses were high, and she will only be able to pay back about $2,000 of the loan. Her spending was not extravagant.

Other factors: She ignored reminders that the loan would be due soon, and let the due date pass without paying anything. No "Sorry, Dad, I'm not going to be able to repay it." She didn't manage the money well, and had a few hundred dollars in overdraft fees.

So the question is: how do I handle this?

My plan: Explain that I don't fault her for not making money, and I understand how hard she worked. However, she needs to bear the responsibility for the risk she took, and suffer the consequences of not making enough money. Therefore, I'm putting her on a relatively austere month-by-month budget. I will forgive most of the loan. She has a job during the year, and makes about $288 per month, so I will require her to pay me $50 per month, and suggest that she save $50 month for next summer. Note that she has a generous prepaid meal plan.

It's so hard to find the balance between being helpful and giving her the proper understanding of spending. For example, she says "sometimes my roomates all go out to dinner, and how can she say no?" So this budget is meant to make her realize that if you don't have the money, you shouldn't spend it.

Any suggestions? Thanks!