Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Bookmarked!very similar things were said in 1873, 1896, 1913, 1929, 1954, 1973, 2000

"this time its different..." is nothing new. It's human nature to think what we're experiencing today won't fit the models of yesterday... that somehow we'll never get back to the prosperity we saw before. It's the very thing that by nature makes humans horrible investors.

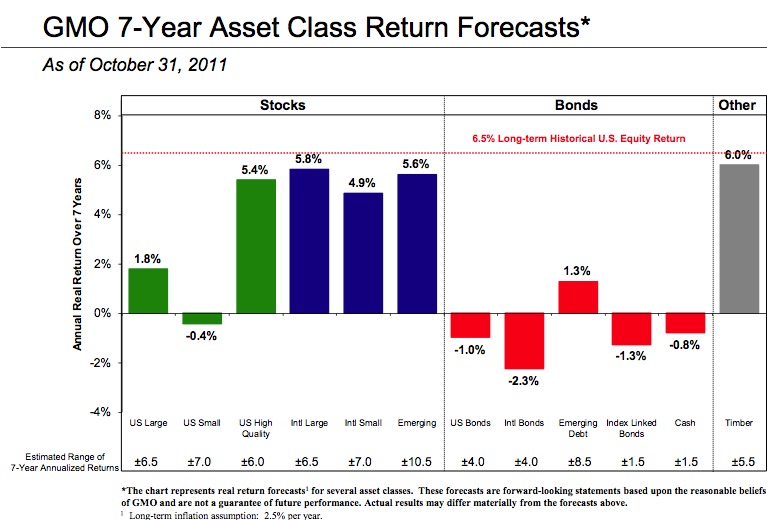

I challenge you to bookmark this comment and come back to look at it in 20 years (10 years might even be enough to show it). I can all but guarantee you that we'll see 5%+ real market returns (8.5%+ actual) between now and then for the S&P500.

If somehow you are correct that the next 20 years fall outside the rules the last 250+ have followed, then I'll call you a genius... or lucky. Either way you can have a good laugh at my expense.

All true enough and I hope you're right! I hope for average or better real returns and it's certainly possible, but I'm prepared for lower real returns and have contingency plans just in case.