- Joined

- Oct 13, 2010

- Messages

- 10,780

In my neck of the woods we had 2 companies on the exchange last year, and 3 this year, the new one being UnitedHealthcare.

Last year I noticed that BlueCross BlueShield of NC had the same network for policies sold on the exchange as for those sold directly. I think that also holds true for offerings in 2015.

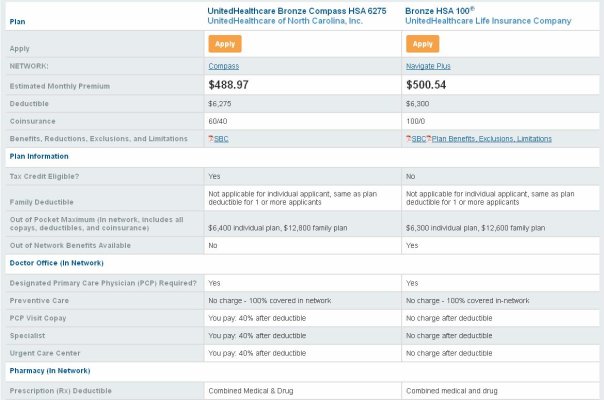

But when I check UnitedHealthcare, if you buy a policy from the exchange, it is called United Healthcare Compass, and has a much smaller network. There are two competing healthcare chains in my area, Carolinas Healthcare and Novant. When I checked the exchange-based policy from UnitedHealthcare, I saw that the only Novant stuff in there were imaging centers....there were no doctors. But if I check the non-exchange policy, all the Novant docs are in there.

Has anyone else noticed this trend? I'm thinking if this trend continues, we, who buy on the exchange, could end-up second-class citizens when it comes to medical services.

Last year I noticed that BlueCross BlueShield of NC had the same network for policies sold on the exchange as for those sold directly. I think that also holds true for offerings in 2015.

But when I check UnitedHealthcare, if you buy a policy from the exchange, it is called United Healthcare Compass, and has a much smaller network. There are two competing healthcare chains in my area, Carolinas Healthcare and Novant. When I checked the exchange-based policy from UnitedHealthcare, I saw that the only Novant stuff in there were imaging centers....there were no doctors. But if I check the non-exchange policy, all the Novant docs are in there.

Has anyone else noticed this trend? I'm thinking if this trend continues, we, who buy on the exchange, could end-up second-class citizens when it comes to medical services.

It's actually $11 more to get the big network, but the big network is not offered on the exchange.

It's actually $11 more to get the big network, but the big network is not offered on the exchange.