marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

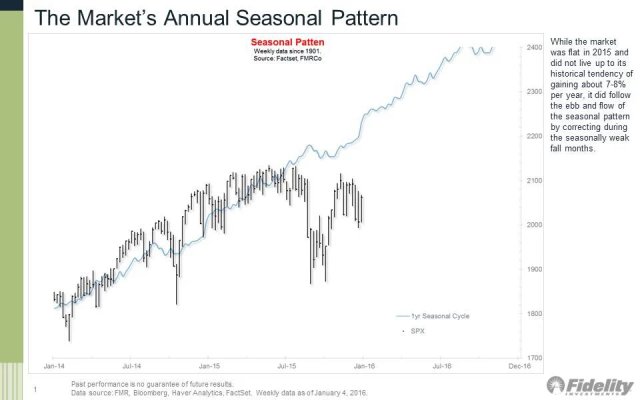

While I'm not a super fan of Fido, every now and then their Jurrien Timmer comes out with a chart like this.

I'm not sure I can explain it accurately but it's a weekly track of S&P's 'seasonal pattern' (average?) over the past 115 years. It takes into account all sort of factors and data including election years and so on.

Against that is last year's performance. If you look at the last six months the average (blue line) did predict the slowdown--just not as severe as actual.

The last chart like this (two years ago?) had a two year look-ahead and was spot on!

If this chart is equally on target, we could/should see a strong market improvement over the next few months.

Not trying to 'say' anything here. It's just a chart that I always look forward to and wanted to share. I'm also not quite sure how meaningful it is and would look to some of our more seasoned investors to provide an assessment.

As always YMMV and, yes, I know, "past performance doesn't guarantee...."

I'm not sure I can explain it accurately but it's a weekly track of S&P's 'seasonal pattern' (average?) over the past 115 years. It takes into account all sort of factors and data including election years and so on.

Against that is last year's performance. If you look at the last six months the average (blue line) did predict the slowdown--just not as severe as actual.

The last chart like this (two years ago?) had a two year look-ahead and was spot on!

If this chart is equally on target, we could/should see a strong market improvement over the next few months.

Not trying to 'say' anything here. It's just a chart that I always look forward to and wanted to share. I'm also not quite sure how meaningful it is and would look to some of our more seasoned investors to provide an assessment.

As always YMMV and, yes, I know, "past performance doesn't guarantee...."