I think we've mis-diagnosed the problem in this thread, and therefore are arguing over the wrong cure.

In my view, the acute illness is too much debt, fueled by easy credit and overconsumption, and other imbalances allowed/enabled to fester by short-sided government and private action. There is too much slack, particularly in the housing sector, not only shrinking the employment pool, but all but eliminating the extra consumer "oomph" from using home equity as amphetimine...

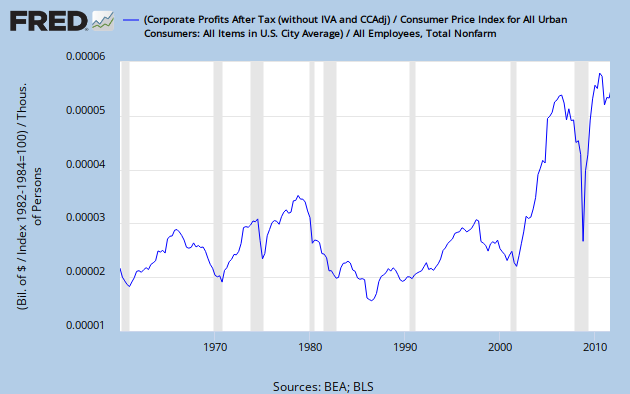

The general line of thinking seems to be that we can simply cut corporate taxes and then businesses will use that extra money to create jobs. The problem is, businesses are already sitting on record amounts of cash. And yet they aren't investing and they aren't creating many jobs.

A "dividend holiday" of one or two years would allow shareholders to decide if they want some of that money in their pockets. If they decide the company can use it productively, then no special dividend. Otherewise, a few billion/trillion returned to the economy...

Clearly corporate cash and profitability are not constraints to recovery.

I believe this is an accurate statement, at least of short-term reality...

What's not clear is why policy designed to loosen a non-constraint will have any beneficial impact.

However, I can envision a longer-term benefit, if, say, lower rates motivate companies to locate/relocate facilities in the USA.

This is a paradox for me. I'm all for smaller government, and a more balanced budget, in the long run. But the answer must be in the center somewhere. I've heard many on the right call for repeal of Sarbanes-Oxley and Dodd-Frank, for example, to reduce "uncertainty", and stimulate the economy. Along with these legislatives actions, one often hears the EPA, USDA, etc. mentioned as well. Not streamline or improve, mind you, but eliminate. I don't think we need to go that far. I'm not sure how we compete with countries with no pollution controls, child labor laws, and such; do we revert back to that? Is that really where we want to go?

Of course, sifting through all that legislation is tough, and expensive, and fraught with special interest conflicts from all sides, and thus does not make for good sloganeering...

Given the weak economy, and the amount of deleveraging still needed, some classic stimulative actions, like the payroll tax cut, or a sales tax holiday, or government infrastructure spending, are likely needed to help speed the deleveraging process, as well as stimulate demand. This would likely make government deficits at all levels worse in the short- to medium-term, a not-so-popular idea at this time...