You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Permanent Portfolio- PRPFX

- Thread starter FDCaptain

- Start date

jIMOh

Thinks s/he gets paid by the post

YES- I own it in a taxable account.

I like it's risk profile. We use the fund to put mid term expenses (new car, kids education, extra mortgage payments).

My expectation is a yearly return of around 6-7% after taxes.

I like it's risk profile. We use the fund to put mid term expenses (new car, kids education, extra mortgage payments).

My expectation is a yearly return of around 6-7% after taxes.

YES- I own it in a taxable account.

I like it's risk profile. We use the fund to put mid term expenses (new car, kids education, extra mortgage payments).

My expectation is a yearly return of around 6-7% after taxes.

You described our exact intent with this fund!

Thanks.

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think I adequately described my feelings very well in this thread:

http://www.early-retirement.org/forums/f28/anyone-familiar-permanent-portfolio-prpfx-fund-29121.html

http://www.early-retirement.org/forums/f28/anyone-familiar-permanent-portfolio-prpfx-fund-29121.html

I think I adequately described my feelings very well in this thread:

http://www.early-retirement.org/forums/f28/anyone-familiar-permanent-portfolio-prpfx-fund-29121.html

Thank you.

jIMOh

Thinks s/he gets paid by the post

I think I adequately described my feelings very well in this thread:

http://www.early-retirement.org/forums/f28/anyone-familiar-permanent-portfolio-prpfx-fund-29121.html

Granted many discussions of managed funds on this board will be "one sided" against said managed funds. I will not try to sway anyone to be for or against this fund or managed funds in general.

What I will ask is could someone show me a portfolio of funds or ETFs which would own:

1) Gold bullion

2) Silver coins

3) swiss francs

4) US bonds

5) energy stocks

6) growth stocks

which I believe are the 6 assets this fund holds.

I opened my first position in this fund in mid feb. I am up around 4% ytd for this fund ( I will need to check a statement to verify this, but that is what my yahoo tracking portfolio is telling me).

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Gee, and I could have sworn that I owned a bunch of managed fund. Oh look, I do!

Nothing to do with managed funds being bad. Any fund that charges a lot and underperforms is a bad fund.

Right now the vast majority of this funds holdings are in gold, silver, US treasury bonds and swiss government bonds denominated in swiss currency.

As I mentioned in the thread referenced, this fund went absolutely nowhere until precious metals went bazonkas and the dollar dropped.

Since there isnt much reason to expect gold to go a lot higher or the dollar much lower, and it being unlikely that US treasury bonds will leap in value to cover the gap, I'd expect this fund to give up a fair portion of its recent gains when gold trickles back down and the dollar gains strength.

The funds holdings in stocks and other items of interest are extremely small.

So on one hand you have a fund that nobody really wanted to buy when it went sideways for decades, but after its shot its wad everyone wants to get into the action.

Remember that thing about buy low, sell high?

Nothing to do with managed funds being bad. Any fund that charges a lot and underperforms is a bad fund.

Right now the vast majority of this funds holdings are in gold, silver, US treasury bonds and swiss government bonds denominated in swiss currency.

As I mentioned in the thread referenced, this fund went absolutely nowhere until precious metals went bazonkas and the dollar dropped.

Since there isnt much reason to expect gold to go a lot higher or the dollar much lower, and it being unlikely that US treasury bonds will leap in value to cover the gap, I'd expect this fund to give up a fair portion of its recent gains when gold trickles back down and the dollar gains strength.

The funds holdings in stocks and other items of interest are extremely small.

So on one hand you have a fund that nobody really wanted to buy when it went sideways for decades, but after its shot its wad everyone wants to get into the action.

Remember that thing about buy low, sell high?

Since there isnt much reason to expect gold to go a lot higher or the dollar much lower

Could have fooled me...

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If they do, owning the 'permanent portfolio' wont help you much.

Gee, and I could have sworn that I owned a bunch of managed fund. Oh look, I do!

Nothing to do with managed funds being bad. Any fund that charges a lot and underperforms is a bad fund.

Right now the vast majority of this funds holdings are in gold, silver, US treasury bonds and swiss government bonds denominated in swiss currency.

As I mentioned in the thread referenced, this fund went absolutely nowhere until precious metals went bazonkas and the dollar dropped.

Since there isnt much reason to expect gold to go a lot higher or the dollar much lower, and it being unlikely that US treasury bonds will leap in value to cover the gap, I'd expect this fund to give up a fair portion of its recent gains when gold trickles back down and the dollar gains strength.

The funds holdings in stocks and other items of interest are extremely small.

So on one hand you have a fund that nobody really wanted to buy when it went sideways for decades, but after its shot its wad everyone wants to get into the action.

Remember that thing about buy low, sell high?

Looks to me like PRPFX has done pretty good for the last 7 years.

What else has had this kind of steady, non-volatile return during the same period?

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Its really only been in the last 5 years that the fund did well. The nasdaq did pretty good for about 5 years back in the 90's. Hope you didnt grab that tiger by the tail in 2001...

What else would have worked? You could have bought equal amounts of vanguards energy, reit, health care, precious metals and emerging markets and seen a far better return, not a lot of net volatility, and actually owned asset classes that move for reasons people can explain. And the expenses would have been less than a third of what you'd have to pay for prpfx.

I'm far less concerned with what this fund has done in the last 7 years than with what it didnt do for 20 years before that, which is make money. Sat there and lost ground to inflation is what it did.

Should gold and the dollar revert to the mean...and they will...you could easily lose 30% in this fund and then go sideways for another 20 years with it.

I know, this fund pushes all the "GOLD!" and "Wow, these are funny asset classes I dont own!" buttons. Theres no way to deal with those sorts of rationalizations.

A fund like this would have made good sense were we still on a gold backed monetary system, coupled with good old switzerlands tendency to never get involved in wars, and with US treasury debt being what everyone in the world wanted to own as the standard in safety.

But its not the early to mid 1900's anymore.

What else would have worked? You could have bought equal amounts of vanguards energy, reit, health care, precious metals and emerging markets and seen a far better return, not a lot of net volatility, and actually owned asset classes that move for reasons people can explain. And the expenses would have been less than a third of what you'd have to pay for prpfx.

I'm far less concerned with what this fund has done in the last 7 years than with what it didnt do for 20 years before that, which is make money. Sat there and lost ground to inflation is what it did.

Should gold and the dollar revert to the mean...and they will...you could easily lose 30% in this fund and then go sideways for another 20 years with it.

I know, this fund pushes all the "GOLD!" and "Wow, these are funny asset classes I dont own!" buttons. Theres no way to deal with those sorts of rationalizations.

A fund like this would have made good sense were we still on a gold backed monetary system, coupled with good old switzerlands tendency to never get involved in wars, and with US treasury debt being what everyone in the world wanted to own as the standard in safety.

But its not the early to mid 1900's anymore.

Its really only been in the last 5 years that the fund did well. The nasdaq did pretty good for about 5 years back in the 90's. Hope you didnt grab that tiger by the tail in 2001...

What else would have worked? You could have bought equal amounts of vanguards energy, reit, health care, precious metals and emerging markets and seen a far better return, not a lot of net volatility, and actually owned asset classes that move for reasons people can explain. And the expenses would have been less than a third of what you'd have to pay for prpfx.

I'm far less concerned with what this fund has done in the last 7 years than with what it didnt do for 20 years before that, which is make money. Sat there and lost ground to inflation is what it did.

Should gold and the dollar revert to the mean...and they will...you could easily lose 30% in this fund and then go sideways for another 20 years with it.

I know, this fund pushes all the "GOLD!" and "Wow, these are funny asset classes I dont own!" buttons. Theres no way to deal with those sorts of rationalizations.

A fund like this would have made good sense were we still on a gold backed monetary system, coupled with good old switzerlands tendency to never get involved in wars, and with US treasury debt being what everyone in the world wanted to own as the standard in safety.

But its not the early to mid 1900's anymore.

Okay! Okay! So don't invest in PRPFX already! Mr. millenium investor.

Go and invest in CD's then. They brought in 15%+ back in the days you seem to base your investment opinion on. Or, maybe penny stocks. They were big in the 80's too.

PRPFX is up 4.33% YTD, has a 5 year annual return of 12.91% and has had only 3 negative quarters since 2002. That is not too bad at all by anyones standards.

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Its never fun to tell someone that their dog's ugly.

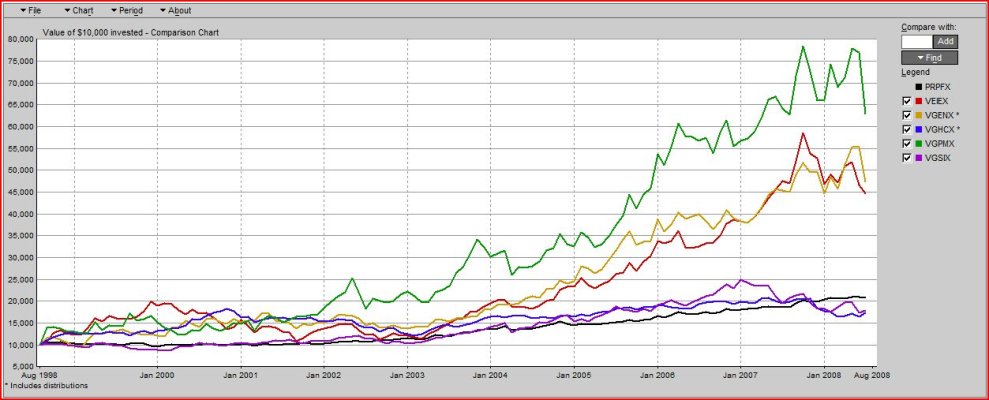

Lets look at a pretty picture of the five funds I mentioned, and remember that the average expense ratio you'd pay for this is ~.25% instead of .95%+

Couple of steady performers, couple of rockets. One or two showing a little volatility at any given time but bought and viewed as a package, very little volatility. Far better returns, weighing in at about 16.5% annualized. The permanent portfolio is that black line down near the bottom that seems to be doing nothing very interesting.

And as a package they've always been good performers. Not just for the last 5 years.

Oh, and once again "buy low, sell high"...

Perhaps it'd be more constructive if you described why you'd expect the fund to do as well over the next 5 years as it has over the last 5, or maybe even explained why its done well over the last 5?

I'm also guessing that with 37% turnover per year, PRPFX isnt a lot of fun to hold in a taxable account.

Lets look at a pretty picture of the five funds I mentioned, and remember that the average expense ratio you'd pay for this is ~.25% instead of .95%+

Couple of steady performers, couple of rockets. One or two showing a little volatility at any given time but bought and viewed as a package, very little volatility. Far better returns, weighing in at about 16.5% annualized. The permanent portfolio is that black line down near the bottom that seems to be doing nothing very interesting.

And as a package they've always been good performers. Not just for the last 5 years.

Oh, and once again "buy low, sell high"...

Perhaps it'd be more constructive if you described why you'd expect the fund to do as well over the next 5 years as it has over the last 5, or maybe even explained why its done well over the last 5?

I'm also guessing that with 37% turnover per year, PRPFX isnt a lot of fun to hold in a taxable account.

Attachments

Its never fun to tell someone that their dog's ugly.

Now I see why you are so grumpy and why you feel the need to go waaaaaaay back.

VEIEX -15.37 YTD

VGENX - 2.45% YTD and they are in energy!

VGHCX -4.76% YTD

VGPMX -1.09% YTD

VGSIX -0.33% YTD This has the best YTD performance. Was -16.5% in 2007.

Good luck to you sir.

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I see the issue. Performance of one fund only within a 5 year period is the most important thing. Performance of a different set of funds is only interesting for the last six months. Any term comparisons or observation of the funds performance outside of the range that gives the answer you want is not desirable.

Good luck to YOU, sir.

And for what its worth, I dont currently own any of these funds.

However if I did, in the last ten years every 10k I had invested in this fund set would have turned into about 47k. So I dont think I'd be too pissed about being down an average of under 5% ytd.

Still waiting on the explanation as to why you think PRPFX performed the way it did over the last 5 years or why you think it'll repeat the same performance over the next 5.

Good luck to YOU, sir.

And for what its worth, I dont currently own any of these funds.

However if I did, in the last ten years every 10k I had invested in this fund set would have turned into about 47k. So I dont think I'd be too pissed about being down an average of under 5% ytd.

Still waiting on the explanation as to why you think PRPFX performed the way it did over the last 5 years or why you think it'll repeat the same performance over the next 5.

And for what its worth, I dont currently own any of these funds.

Still waiting on the explanation as to why you think PRPFX performed the way it did over the last 5 years or why you think it'll repeat the same performance over the next 5.

Why are you promoting funds you don't even own? Any arm-chair expert can go back and pick a set of funds that have HAD good performance. Put your money where your mouth is.

And as for PRPFX's next 5 years - I will leave that up to the expert fund managers that have steered PRPFX to flawless performance for many years.

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Why are you promoting funds you don't even own?

Two reasons. One is that I have owned them, and two is BECAUSE YOU ASKED ME TO!

What else has had this kind of steady, non-volatile return during the same period?

Not really "promoting" anything. Seems one of the reasons why someone might become interested in this fund is for diversification purposes...at least thats what several supporters have made note of. The five fund selection I mentioned are very typical diversifiers that actually have good long term records and in combination with traditional domestic and foreign equities and bonds make for a pretty good portfolio.

Any arm-chair expert can go back and pick a set of funds that have HAD good performance.

Indeed. Seems you've picked one fund thats HAD good performance and cant explain why its performed well or should perform well going forward.

And as for PRPFX's next 5 years - I will leave that up to the expert fund managers that have steered PRPFX to flawless performance for many years.

Uh oh, you just opened that "many years" can of worms again.

The fund managers havent done anything new or special or unique. In fact the idea of the permanent portfolio is to hold principally four asset classes in roughly equal amounts because historically at least one always did well when the others didnt.

All thats happened is that several of those asset classes all went up at the same time, unfortunately nobody can adequately explain or could have predicted those rises. Within the constraints of the whole idea of the permanent portfolio, I think that the creator might agree that if a bunch went up at once (breaking the historic correlative factors) that it is quite reasonable to expect that they'd all go down at once.

The point I was making is that the rationale for choosing the four primary asset classes doesnt really apply anymore. Gold is not a "store of value", an offset to inflation, or any of the things it was a hundred years ago. Switzerlands neutrality doesnt really mean anything anymore. Yada yada yada.

By the way, a fund that goes up sharply over a 5 year period is demonstrating extreme volatility...just the kind that people like...until the oscillator turns the other way.

At least understand your investments, why you own them, and ideally make sure that your investment choices actually are what you think they are. Oh and its nice if they regularly make money.

Yeah, I know. Its got GOLD! in it. GOLD!

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This thing is going to the moon.

Indeed.

So FDCaptain...did you get your moneys worth?

Cute Fuzzy Bunny,

Wake me up when PRPFX starts trending down would ya.

You obviously have your opinion and you should let others have theirs. Why are you so negative and mean? That's not behaving like a Cute Fuzzy Bunny.

You will no doubt respond to this with some other "holier that thou" comments. For me, this conversation is over as it is not providing any benefit other than for you to puff your ego.

Good day!

Wake me up when PRPFX starts trending down would ya.

You obviously have your opinion and you should let others have theirs. Why are you so negative and mean? That's not behaving like a Cute Fuzzy Bunny.

You will no doubt respond to this with some other "holier that thou" comments. For me, this conversation is over as it is not providing any benefit other than for you to puff your ego.

Good day!

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Its negative and mean to point out that a particular fund may not be a good investment choice or that you should at least understand it fully and then make sure it does what its supposed to do before putting down your hard earned money?

I'm not expressing an opinion as much as stating facts. The fund says it exists to maintain the value of principal and grow it reasonably without taking on too much risk.

The fund didnt maintain the value of its principal nor grow it from 1987 through 2004. Inflation adjusted it lost money, while charging 1% expenses and creating a lot of taxable events.

From 2004 to current, it demonstrated extreme volatility upwards.

In short, about as far from its stated intention as you could get.

One could have invested in vanguards wellesley fund during the same period and actually gotten low volatility, principal stability and reasonable growth without a lot of risk. A $10k investment in 1987 would be worth $60,000. Invested in PRPFX you'd have $35000.

But if you really want some comment thats aside from good advice and readily available fact, how about that I put you on my ignore list after your third post about six months ago?

I'm not expressing an opinion as much as stating facts. The fund says it exists to maintain the value of principal and grow it reasonably without taking on too much risk.

The fund didnt maintain the value of its principal nor grow it from 1987 through 2004. Inflation adjusted it lost money, while charging 1% expenses and creating a lot of taxable events.

From 2004 to current, it demonstrated extreme volatility upwards.

In short, about as far from its stated intention as you could get.

One could have invested in vanguards wellesley fund during the same period and actually gotten low volatility, principal stability and reasonable growth without a lot of risk. A $10k investment in 1987 would be worth $60,000. Invested in PRPFX you'd have $35000.

But if you really want some comment thats aside from good advice and readily available fact, how about that I put you on my ignore list after your third post about six months ago?

ziggy29

Moderator Emeritus

Psst....One could have invested in vanguards wellesley fund during the same period and actually gotten low volatility, principal stability and reasonable growth without a lot of risk. A $10k investment in 1987 would be worth $60,000. Invested in PRPFX you'd have $35000.

W2R

Moderator Emeritus

Psst....

Love my Wellesley!!

Psst....Wellesley!

Similar threads

- Replies

- 8

- Views

- 447

- Replies

- 51

- Views

- 5K

- Replies

- 16

- Views

- 2K

- Replies

- 26

- Views

- 1K