I didn't see anything about why the deflation that has plagued Japan for 15 years can't happen here.

Principally because socially, economically, financially and culturally the two countries have practically nothing in common. To experience Japans deflationary economic situation, most americans would have to sharply reduce spending and begin massive savings programs, companies would have to stop capital expansion and begin shifting profits to paying off debt, and government supported corporate zombieism would have to spread far past the "big three".

I suppose one could argue that freddie and fannie and a couple of the financial institutions that have had to be bailed out are functional zombies, but I dont think that problem is going to continue on and be as widespread and tolerated as long term as Japan has. Most of this smells more like criminal endeavor that will end up being punished in some manner than broad based, widespread government sponsored corporate stupidity.

So I guess the thesis that strong deflation could happen here is possible, just highly implausible. And should it become prevalent, eh...stocks and bonds have traditionally produced fabulous returns in deflationary economies presuming that they werent accompanied by a depression.

You could say "But japans stock market has gone nowhere!"...the stocks of the well regarded non-zombie companies have done just fine. So I suppose the key learning from that would be to avoid index funds full of zombie companies.

I have to say that its sort of a boring topic to talk about, principally because it is so unbelievably unlikely to happen, and secondarily because its one of the first quick-draw responses often seen in goldbug conversations. As soon as someone points out that gold went nowhere for 30 years despite inflationary pressure, the "what about deflation just like japan!?!" comes out, only the person throwing that out usually has absolutely no idea about the implications that would have to be fulfilled for such a comparison to be fully drawn.

I know you keep saying we're not having "the goldbug conversation", but when you're pumping up a fund that holds significant amounts of gold, and proposing an alternative thats 20-25% in gold...well...yes we are!

It's the chart on HB's website. Starting value was 100 in 1970 and 2000 in 2003. That's not an almost flat line.

It is when you factor in inflation and then compare the results to other investments that arent full of lead weight. When the vanguard wellesley fund kicks your ass over a 30 year period using only two mundane asset classes with equally low volatility, very good inflation response, better dividend payouts and no threats of mailing out bags of securities if the fund should liquidate...you've got a stinky fund!

Plus the Y axis WAS manipulated to make the trend line look stronger.

What was the source of your millions, if you don't mind sharing?

So many questions about ME! :

Stock options given for job outperformance, real estate, and general investing...in roughly equal proportions. I didnt make any of it by buying underperforming, overpriced assets that I didnt understand and then watching them drop like a rock.

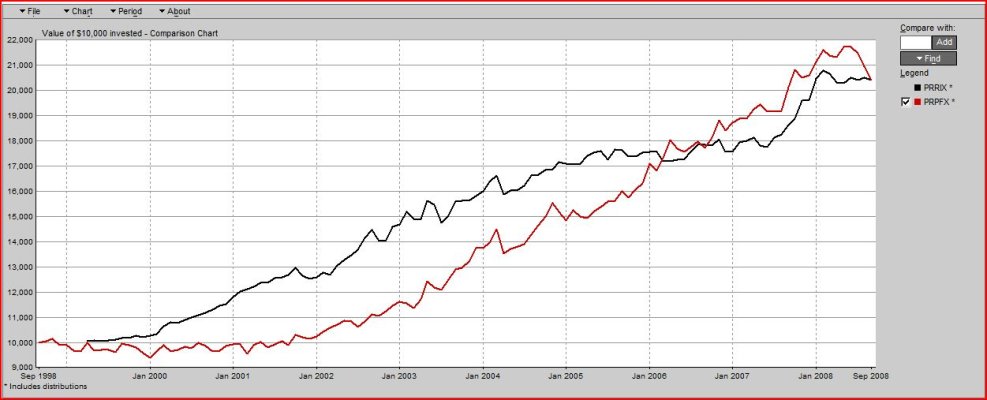

Wouldn't you be up 90% over the last five years if you'd been in PRPFX?

I guess I'd have to go look and see. Only problem is that I dont think that 5 years ago I'd have been very interested in a fund that had extremely weak appreciation over its entire existence and was full of obscure investments largely designed to overcome problems that I dont think we're going to see and for which available data shows an inadequate correlation.

Standing here now as its 'shot its wad' on substantial coincidental speculative appreciation that is already reversing itself, I think I'm still not interested. One last time..."buy low, sell high!"

Irrationality is a relative term. You're the one who is down for the year, right?

Hey, nice jab! I usually define irrationality as someone who looks at the available data and then makes a decision that is contrary to all of that data. Buying this fund would qualify. Anyone who looks at an investment and says "Oh my, its gone up a lot over the last 5 years, its full of stuff that is supposed to act in a certain manner but thirty years of available data shows otherwise, and its got GOLD! in it...where do I sign up?" is not a very good investor and is showing signs of irrationality. A rational investor buys underpriced products with good prospects for future returns, or steady return products that produce a reasonable real return equal to or in excess of the assumed risk.

And isnt practically everyone down this year? If you're invested in a manner to have avoided all paper losses, you probably missed out badly on all the upside in the past and the future. If you changed allocations just in time to avoid the downturns in almost every asset class, then you were nothing short of lucky.

Why...even PRPFX is down for the year!

Anyone that bought this fund 5 years ago and lucked out into a nice speculative return...you might seriously consider divesting yourself of it promptly. You may thank me profusely in a year or two...

This has been a fascinating conversation to have had for the third or fourth time, thanks for all the memories...