Remember the Equifax data breach? Equifax has reached an agreement to settle. Terms of the settlement can be found here https://www.ftc.gov/enforcement/cases-proceedings/refunds/equifax-data-breach-settlement

As this is an FTC webpage it isn’t copyright protected, so it can be reproduced here, so a summary of the settlement follows.

According to the FTC site, the settlement is not yet available. You can sign up for updates and will be advised when it is operative, here https://public.govdelivery.com/accounts/USFTC/subscriber/new?topic_id=USFTC_109

FTC webpage announcing settlement here https://www.ftc.gov/enforcement/cases-proceedings/refunds/equifax-data-breach-settlement

Equifax data breach settlement page here https://www.equifaxbreachsettlement.com

As this is an FTC webpage it isn’t copyright protected, so it can be reproduced here, so a summary of the settlement follows.

Highlights of the benefits Equifax will provideIn September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories. The settlement includes up to $425 million to help people affected by the data breach.

To get the free credit monitoring or cash payments described below, you must file a claim when the claims process begins.

Once the claims process begins, if you were affected by the breach, you can request:

Free Credit Monitoring and Identity Theft Protection Services

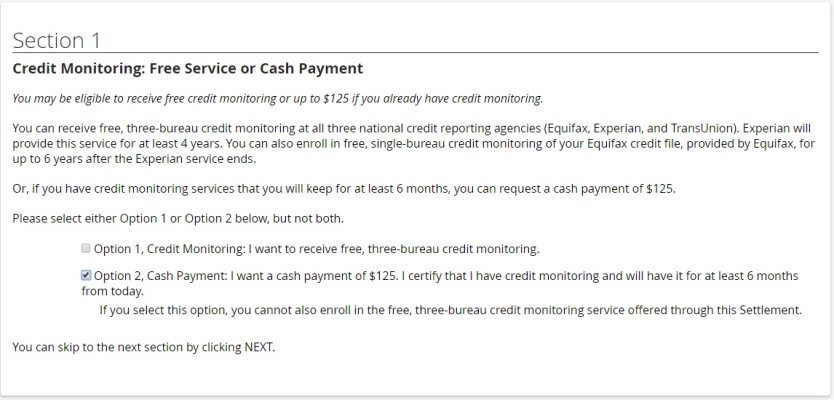

Up to 10 years of free credit monitoring OR $125 if you decide not to enroll because you already have credit monitoring. The free credit monitoring includes:

At least four years of free credit monitoring of your credit report at all three credit bureaus (Equifax, Experian, and TransUnion) and $1,000,000 of identity theft insurance.

Up to six more years of free credit monitoring of your Equifax credit report.

If you were a minor in May 2017, you are eligible for a total of 18 years of free credit monitoring.

Cash Payments (capped at $20,000 per person)

For expenses you paid as a result of the breach, like:

Losses from unauthorized charges to your accounts

The cost of freezing or unfreezing your credit report

The cost of credit monitoring

Fees you paid to professionals like an accountant or attorney

Other expenses like notary fees, document shipping fees and postage, mileage, and phone charges

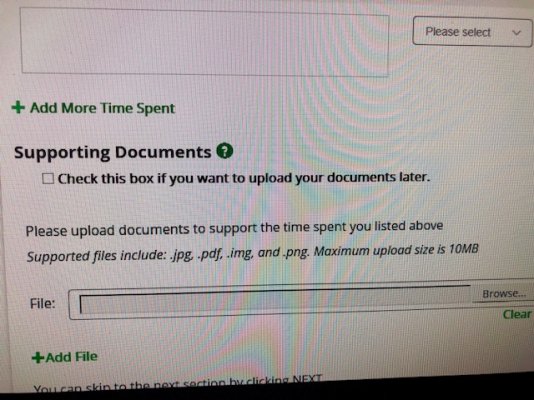

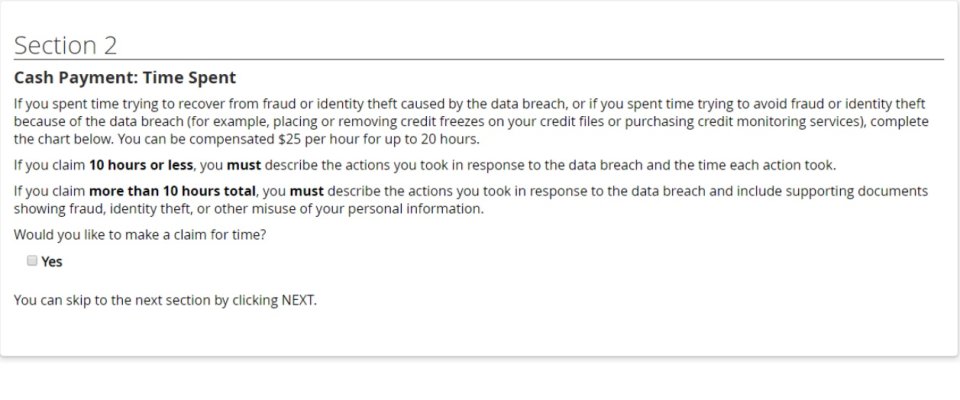

For the time you spent dealing with the breach. You can be compensated $25 per hour up to 20 hours.

For the cost of Equifax credit monitoring and related services you had between September 7, 2016, and September 7, 2017, capped at 25 percent of the total amount you paid.

Free Help Recovering from Identity Theft

For at least seven years, you can get free identity restoration services.

Free Credit Reports for All U.S. Consumers

Starting in 2020, all U.S. consumers can get 6 additional free credit reports per year for 7 years from the Equifax website.

According to the FTC site, the settlement is not yet available. You can sign up for updates and will be advised when it is operative, here https://public.govdelivery.com/accounts/USFTC/subscriber/new?topic_id=USFTC_109

FTC webpage announcing settlement here https://www.ftc.gov/enforcement/cases-proceedings/refunds/equifax-data-breach-settlement

Equifax data breach settlement page here https://www.equifaxbreachsettlement.com