Sorry for the delay as we are having fires near here in Northern California and I'm a little distracted.

Well I was thinking of doing the histogram too. So I started into this and

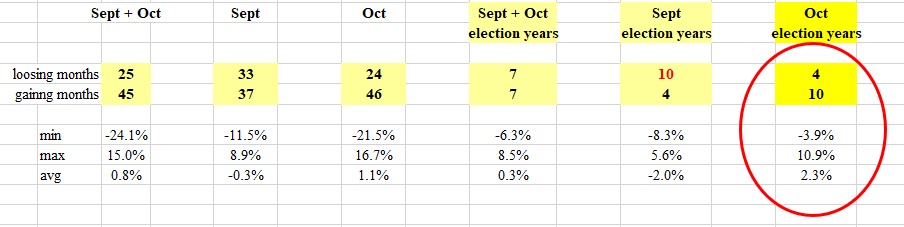

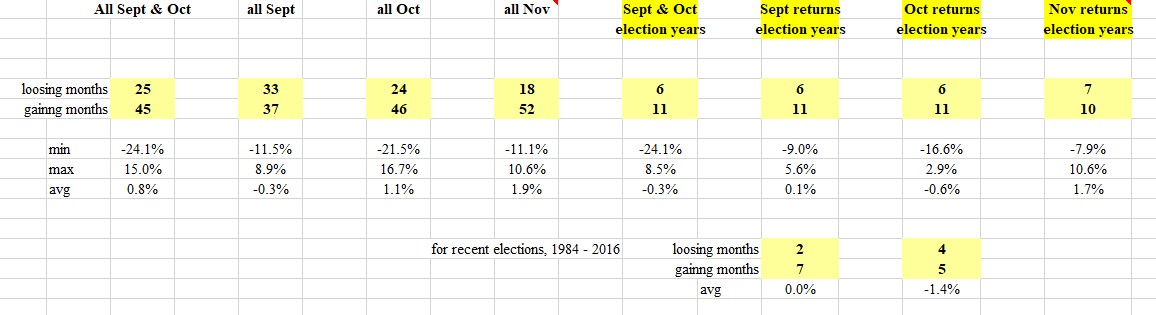

discovered an error which greatly changed my election year results. So here is the revised data which includes the month of November too. Please ignore the OP data, sorry.

You can see that for election years the months of September, October, and November have similar winning and loosing number of months! Interesting that in election years since 1984 (last half of election year data) the September returns have a lot more gaining months then loosing months. Note the 2008 September and October results can affect the data as these months were a -24% loss.

The averages look like nothing special. No "signals" in this data to make a bet one way or the other, I think. This now is not really all that surprising to me but I just think the exercise is interesting anyway.