stephenson

Thinks s/he gets paid by the post

- Joined

- Jul 3, 2009

- Messages

- 1,610

Hi All,

My day to ask questions ...

So, I had not looked at opensocialsecurity in a while, and it seems to be telling me something different ... or, maybe not?

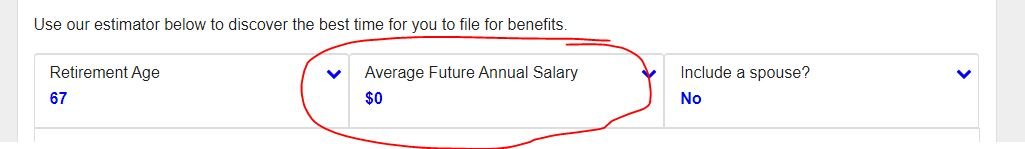

I am 69 yo ... OSS asks for PIA amount at full retirement age, but I am past this. So what number goes in the PIA box? Current amount?

My current amount is $4147, my 70 yo amount is $4462 (spouse did not have sufficient earnings for SS):

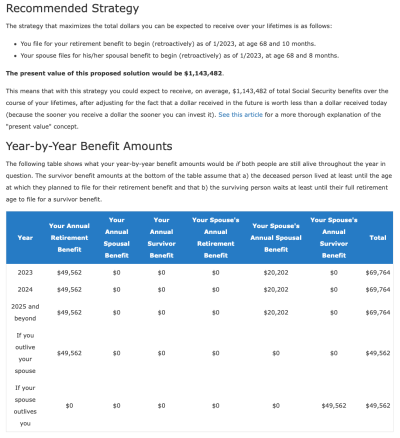

- 4147 - computes to $85,926 with spousal with PV of $1,408,382

- 4462 - computes to $92,453 with spousal with PV of $1,515,360

Both calcs say - "You file for your retirement benefit to begin (retroactively) as of 1/2023, at age 68 and 10 months.

Your spouse files for his/her spousal benefit to begin (retroactively) as of 1/2023, at age 68 and 8 months."

Is this inaccurate in that I did not use the FRA number (don't have it)?

My day to ask questions ...

So, I had not looked at opensocialsecurity in a while, and it seems to be telling me something different ... or, maybe not?

I am 69 yo ... OSS asks for PIA amount at full retirement age, but I am past this. So what number goes in the PIA box? Current amount?

My current amount is $4147, my 70 yo amount is $4462 (spouse did not have sufficient earnings for SS):

- 4147 - computes to $85,926 with spousal with PV of $1,408,382

- 4462 - computes to $92,453 with spousal with PV of $1,515,360

Both calcs say - "You file for your retirement benefit to begin (retroactively) as of 1/2023, at age 68 and 10 months.

Your spouse files for his/her spousal benefit to begin (retroactively) as of 1/2023, at age 68 and 8 months."

Is this inaccurate in that I did not use the FRA number (don't have it)?