What? You have not talked about strategies like Strangle, Straddle, Iron Condor, Butterfly, etc...

Just kidding. One can read about these here,

10 Options Strategies To Know | Investopedia, but I found the simple calls and puts tough enough to execute right to make money.

I like to add that what Fermion described above is buying calls when you expect the stock to go up. But if you already have the stock but do not think it will go up to a certain level, you can sell somebody the call option to buy it from you at a higher-than-current price in the future and pocket some premium. The latter is call "writing covered calls", and it can bring you extra "dividends", although at the cost of losing out if your stock turns out to be a winner and shoots up high (it limits your gain).

Also Fermion talked about selling cash-secured puts when you don't mind owning a certain stock at a price even lower than the current. But if you own the stock and want to protect yourself if the stock drops, you buy the put option to sell it at a certain price. It is the same as buying fire insurance for your home, and people do this with their stock when they are afraid that it will drop, but cannot sell it yet due to a certain restriction.

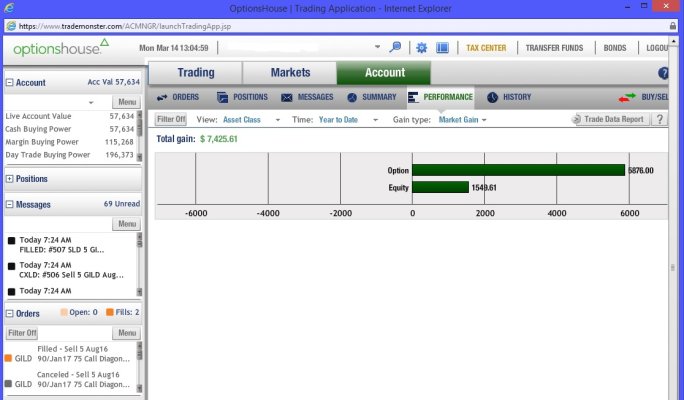

The selling cash-secured put was what I used to make about 4% in 3 months (as talked about on post #1005), on some cash that I keep on hand but do not yet want to commit to market. This is the cash I would drop into the market if pandemonium hits the market, but so far that has not happened.