Monterey298sc

Recycles dryer sheets

- Joined

- Aug 3, 2018

- Messages

- 133

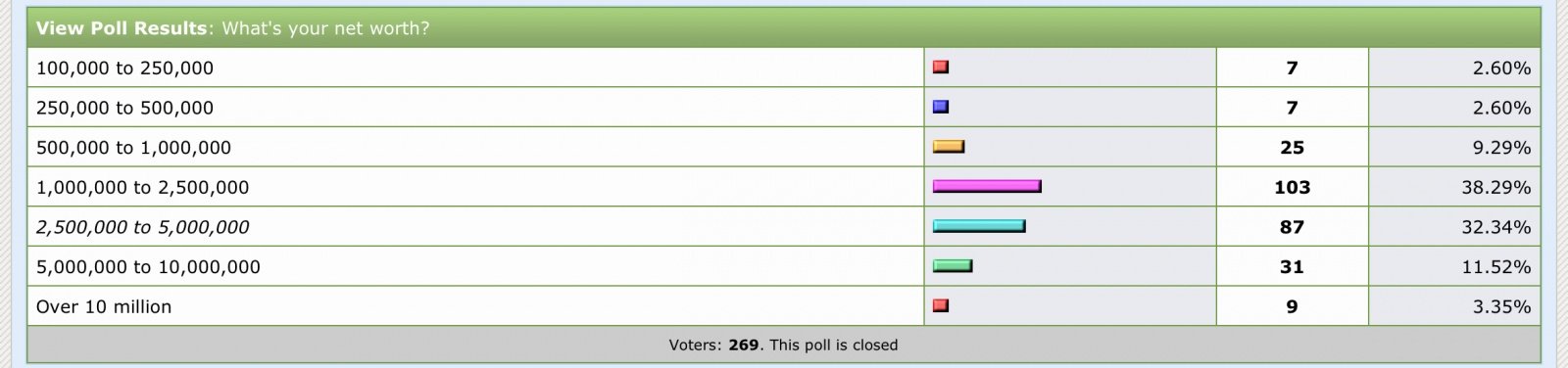

What is the average portfolio here on ER. Just looking to see if I am average or not. I will start.

3.8m cash , not including homes. Primary, rental and lake vacation would add up to about 900,000.

3.8m cash , not including homes. Primary, rental and lake vacation would add up to about 900,000.