You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

wow what happen?

- Thread starter steve88

- Start date

Bimmerbill

Thinks s/he gets paid by the post

- Joined

- Jan 26, 2006

- Messages

- 1,645

Don't these high earners save any money? The guy spent the entire $750K per year?

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Don't these high earners save any money?

According to this, many of them don't.

"...50% of Americans said they have only a one-month cushion -- roughly two paychecks -- or less before they would be unable to fully meet their financial obligations if they were to lose their jobs. More disturbing is that 28% said they could not make ends meet for longer than two weeks without their jobs.

And it's not just low-income earners who would find themselves financially challenged. Twenty-nine percent of those making $100,000 or more a year said they would have trouble paying the bills after more than a month of unemployment."

Purron

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 23, 2007

- Messages

- 5,596

Twenty-nine percent of those making $100,000 or more a year said they would have trouble paying the bills after more than a month of unemployment."

This blows me away. Makes me think I'm not so stupid after all.

ziggy29

Moderator Emeritus

These media scare-tactic articles are designed to make people think "wow, things really ARE horrible," I think (which is a separate issue; I think they are designed to create fear which I think is reprehensible in a crisis of confidence). But when I read these articles I think, "wow. How ridiculously irresponsible and short-sighted to have that kind of income and not put some of it away to secure your future."

Somewhere in the article the guy was quoted "... this is a lesson in humility". That did not sound quite right to me. Shouldn't it be "... this is a lesson in stupidity"?

Anyway, take a look at the other extreme. I can't decide which guy is worse.

ABC News: Vermont Man: Cheap and Proud of It

Sam

Anyway, take a look at the other extreme. I can't decide which guy is worse.

ABC News: Vermont Man: Cheap and Proud of It

Sam

Moemg

Gone but not forgotten

He did put some away . He had $500,000 in savings which he used when he started his hedge fund . It probably would have lasted a lot longer if he had lowered his standard of living . Now he's had it lowered for him !

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Once upon a time you dressed so fine

You threw the bums a dime in your prime, didn't you ?

People'd call, say, "Beware doll, you're bound to fall"

You thought they were all kiddin' you

You used to laugh about

Everybody that was hangin' out

Now you don't talk so loud

Now you don't seem so proud

About having to be scrounging for your next meal.

How does it feel

How does it feel

To be without a home

Like a complete unknown

Like a rolling stone ?

Your daughter's gone to the finest school all right, Miss Lonely

But you know you only used to get juiced in it

And nobody has ever taught you how to live on the street

And now you find out you're gonna have to get used to it

You said you'd never compromise

With the mystery tramp, but know you realize

He's not selling any alibis

As you stare into the vacuum of his eyes

And say do you want to make a deal?

How does it feel

How does it feel

To be on your own

With no direction home

Like a complete unknown

Like a rolling stone ?

You threw the bums a dime in your prime, didn't you ?

People'd call, say, "Beware doll, you're bound to fall"

You thought they were all kiddin' you

You used to laugh about

Everybody that was hangin' out

Now you don't talk so loud

Now you don't seem so proud

About having to be scrounging for your next meal.

How does it feel

How does it feel

To be without a home

Like a complete unknown

Like a rolling stone ?

Your daughter's gone to the finest school all right, Miss Lonely

But you know you only used to get juiced in it

And nobody has ever taught you how to live on the street

And now you find out you're gonna have to get used to it

You said you'd never compromise

With the mystery tramp, but know you realize

He's not selling any alibis

As you stare into the vacuum of his eyes

And say do you want to make a deal?

How does it feel

How does it feel

To be on your own

With no direction home

Like a complete unknown

Like a rolling stone ?

I have a nephew like that. He was having a ball selling vacation real estate in Ocean City, MD. Sold five million worth of property in six months, bought the Lincoln Navigator.

Now he's bagging groceries.

Now he's bagging groceries.

dex

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Oct 28, 2003

- Messages

- 5,105

I have a nephew like that. He was having a ball selling vacation real estate in Ocean City, MD. Sold five million worth of property in six months, bought the Lincoln Navigator.

Now he's bagging groceries.

I worked 4 years in a supermarket - high school and college. I'd hate to ever have to go to it.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I want to reach out to the guy....

Someone already has...........

The Karpmans are now on food stamps and a tight budget that doesn't nearly cover their children's $30,000 private school tuition. But thanks to an anonymous donor, the Karpmans children's tuition has been covered through next year and they are deeply appreciative

- Joined

- Apr 14, 2006

- Messages

- 23,112

Where I live, you can send your kids to school for free.Someone already has...........

The Karpmans are now on food stamps and a tight budget that doesn't nearly cover their children's $30,000 private school tuition. But thanks to an anonymous donor, the Karpmans children's tuition has been covered through next year and they are deeply appreciative

Bimmerbill

Thinks s/he gets paid by the post

- Joined

- Jan 26, 2006

- Messages

- 1,645

Yeah, I guess I think its easier to save and invest for the future when you make that kind of money. Maybe it isn't? Do you think your standard of living slowly creeps up with you? Sort of like slowly getting fat, and then realizing "Geez, I'm really fat and have to do something about it!"

OAG

Thinks s/he gets paid by the post

Some of these idiots need to have the plug pulled! They are very sick IMO! I hope the kids plan to support them after the $30K per year education they get (wonder if that is both of them and it is elementary level).

W2R

Moderator Emeritus

I think that many of us would have had different priorities if making $750K/year. Maybe we would give a higher priority to having a substantial emergency fund than to start-up costs for a new business. Instead, the guy took a huge chance on a new business and it didn't pan out.

Many who make that kind of money also make it a priority to prepare for the worst, just in case - - paying off the house and loans, setting up trust funds, and such. Frankly, some would think it incredibly stupid not to do so.

In some ways this man's plight may be similar to that of a hypothetical lower income person, say someone making $60K/year, who decides to quit his job and put every dollar he had into starting a new business, say a dress shop, despite having a mortgage and a family to support. When the dress shop fails, due to his poor planning he might be without an income as well. One big difference is that when the dress shop fails, the lower income person can hardly expect the national media to whip up sympathy and for others to pay for the children's education. And, the lower income person doesn't have as valuable a resume as an asset to help in finding future opportunities.

Easy come, easy go...

Many who make that kind of money also make it a priority to prepare for the worst, just in case - - paying off the house and loans, setting up trust funds, and such. Frankly, some would think it incredibly stupid not to do so.

In some ways this man's plight may be similar to that of a hypothetical lower income person, say someone making $60K/year, who decides to quit his job and put every dollar he had into starting a new business, say a dress shop, despite having a mortgage and a family to support. When the dress shop fails, due to his poor planning he might be without an income as well. One big difference is that when the dress shop fails, the lower income person can hardly expect the national media to whip up sympathy and for others to pay for the children's education. And, the lower income person doesn't have as valuable a resume as an asset to help in finding future opportunities.

Easy come, easy go...

UncleHoney

Full time employment: Posting here.

According to this, many of them don't.

"...50% of Americans said they have only a one-month cushion -- roughly two paychecks -- or less before they would be unable to fully meet their financial obligations if they were to lose their jobs. More disturbing is that 28% said they could not make ends meet for longer than two weeks without their jobs.

And it's not just low-income earners who would find themselves financially challenged. Twenty-nine percent of those making $100,000 or more a year said they would have trouble paying the bills after more than a month of unemployment."

If this isn't a crash and burn scenario I've never seen one.

The people in Washington need to study the numbers and get in touch with reality. Is the American consumer really in need of more money to borrow, are they really wanting to take on more debt?

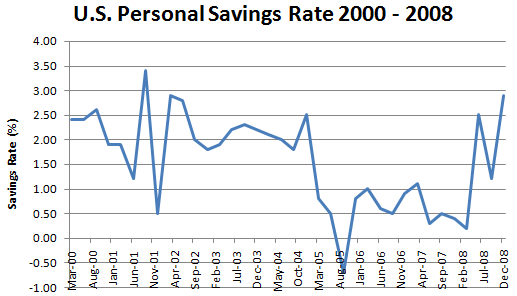

With 50% living on the edge of disaster it sure looks to me like the old American consumer is maxed out. And I think we are in the process of breeding another generation of depression era savers. The longer this pain goes on people will get tired of being stressed out each month. Very slowly the bills and loans will get paid off and saving will start.

The longer people are hunkered down the less likely they may go back to the old ways. Even if people don't sink in a pool of red ink they will maybe learn something by having their whits scared out of them.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If this isn't a crash and burn scenario I've never seen one.

And I think we are in the process of breeding another generation of depression era savers. The longer this pain goes on people will get tired of being stressed out each month. Very slowly the bills and loans will get paid off and saving will start.

Hopefully it's already started and it will take hold. The mainstream has lived beyond their means for far too long, it's at the root of our current economic problems. My fear is that memories will fade and the mainstream will go back to their (way) over-leveraged tendencies...but I hope I am completely wrong.

Savings rate rises to 14-year high in January - MarketWatch

U.S. households socked away most of the extra income they got in January from annual cost-of-living raises, boosting the personal savings rate to a 14-year high, the Commerce Department said Monday.

ohfrugalone

Recycles dryer sheets

- Joined

- Aug 2, 2008

- Messages

- 71

I feel sorry for the guy and at the same time, think - wow don't you have any common sense. The story ran on 20/20 or whatever the name of the show is last night and they have been living in that house for 2 years without paying the mortgage. Most normal people would have been evicted way before that. ....and they have run up $100,000 in credit card debt. The wife hasn't attempted to get a job from what I can tell - other than working the snack bar at the Little League games so the kids don't have to pay the fees. I can't help but think with the $100,000 in credit card debt that they haven't really adjusted their life style other than not getting the pool repaired or the hot water heater in their master bath.

And when they are foreclosed on - they will have to move to a small apartment which won't hold all the wife's clothes - well among other things - less face it their house is huge. Then they will sell things on Craig's List. What are they waiting for?

And when they are foreclosed on - they will have to move to a small apartment which won't hold all the wife's clothes - well among other things - less face it their house is huge. Then they will sell things on Craig's List. What are they waiting for?

ziggy29

Moderator Emeritus

Well, now that we've watched history unfold, if you're not wrong and the markets start roaring back fueled with zero to negative savings rates again and expanding credit, GET OUT!Hopefully it's already started and it will take hold. The mainstream has lived beyond their means for far too long, it's at the root of our current economic problems. My fear is that memories will fade and the mainstream will go back to their (way) over-leveraged tendencies...but I hope I am completely wrong.

Once upon a time you dressed so fine

You threw the bums a dime in your prime, didn't you ?

People'd call, say, "Beware doll, you're bound to fall"

You thought they were all kiddin' you

You used to laugh about

Everybody that was hangin' out

Now you don't talk so loud

Now you don't seem so proud

About having to be scrounging for your next meal.

How does it feel

How does it feel

To be without a home

Like a complete unknown

Like a rolling stone ?

Your daughter's gone to the finest school all right, Miss Lonely

But you know you only used to get juiced in it

And nobody has ever taught you how to live on the street

And now you find out you're gonna have to get used to it

You said you'd never compromise

With the mystery tramp, but know you realize

He's not selling any alibis

As you stare into the vacuum of his eyes

And say do you want to make a deal?

How does it feel

How does it feel

To be on your own

With no direction home

Like a complete unknown

Like a rolling stone ?

I always liked Dylan's music, but looking deeply at the words makes one realize that at a young age this guy was old. By playing the enigma, he never put all his cards on the table, sort of kept you guessing. He apparently knew the game before the average person even started to play it.

Amazing, wonder how much money he lost in the Ponzi scheme (Wall street)

jug

I had a senior position at a global mega corp. I was surprised - and unprepared - for the pressure to spend. Intense peer pressure from all around - including HR. House, cars, toys, kids colleges - indescribable. And unbelievable.I think that many of us would have had different priorities if making $750K/year. Maybe we would give a higher priority to having a substantial emergency fund than to start-up costs for a new business. Instead, the guy took a huge chance on a new business and it didn't pan out.

My experience showed this to be a sign that the person was not "part of the team". The corporate world looks for people that depend on continued employment and need every penny of the variable income (aka bonus). If not, they really can't be counted on. This is only more so at senior levels.Many who make that kind of money also make it a priority to prepare for the worst, just in case - - paying off the house and loans, setting up trust funds, and such. Frankly, some would think it incredibly stupid not to do so.

stephenandrew

Recycles dryer sheets

- Joined

- May 5, 2007

- Messages

- 148

Amazing

I can't even imagine making $750,000 per year and being in debt. I mean how much stuff do you really need? I don't begrudge anyone who wants to work hard the right to make a lot of money and spend it anyway they want, but my god, 95% of the people on this Board could have probably been comfortably retired at his age (45 I think) had they had his income stream since he graduated from Business School. I am not sure that I would say I feel sorry for this guy---he made years and years of foolish choices, and it was clear based on how he spoke, his educational background, and his profession, he was no dummy. Poor, poor judgement.

I can't even imagine making $750,000 per year and being in debt. I mean how much stuff do you really need? I don't begrudge anyone who wants to work hard the right to make a lot of money and spend it anyway they want, but my god, 95% of the people on this Board could have probably been comfortably retired at his age (45 I think) had they had his income stream since he graduated from Business School. I am not sure that I would say I feel sorry for this guy---he made years and years of foolish choices, and it was clear based on how he spoke, his educational background, and his profession, he was no dummy. Poor, poor judgement.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

I can't even imagine making $750,000 per year and being in debt.

It's more common than you'd ever believe. I've heard a rumor that Goldman Sachs is making low cost loans available to employees to bridge them over last year's cut in bonuses.

Naturally a lot of this is driven by overconfident, self-important, blow hards who think they are worth the money they make and always will be. The good times will never end. And besides, everyone in their circle spends the way they do, so it all seems normal . . . and to a certain extent, necessary.

But at the same time, "Wall Street" employees typically work in areas where the cost of living is so high as to be unimaginable to ordinary Americans. To say that "I would be set for life on $x00,000 per year" is not at all certain. Especially when you're required to work 80+ hours per week to pull down that paycheck. The idea of adding a 2-4hr round-trip commute to the lower cost x-urbs on top of your normal 12 hour day is simply unworkable. So you get a place in the city (NY), where the MEDIAN price for a condo is $1MM ($500K for a studio!!!!). But then you have kids, and the public schools here all blow. So you send them to private school for ~$30K per year a piece. Etc, etc, etc. The money goes fast.

Similar threads

- Replies

- 7

- Views

- 541

- Replies

- 16

- Views

- 823