Space Mountain

Recycles dryer sheets

- Joined

- Jul 16, 2007

- Messages

- 51

Hey everybody:

I recently met what appears to be the love of my life.

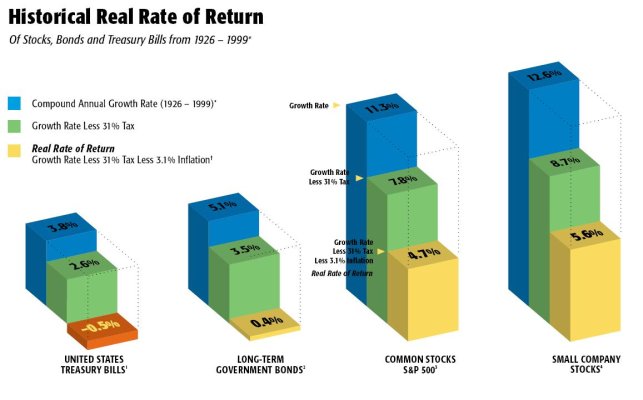

I was hoping folks here can convince my girlfriend, that at 34 years of age, FDIC savings are NOT the way to go.

She is VERY conservative with her investments while I am not afraid of a little risk. I am not suggesting she goes ALL out and invests in ALL stock mutual funds. However, a blend of stocks/bonds would not seem so bad?

I know I can convince her to see things my way but a little nudge from this forum I believe would go a long way.

Heck, even if we end up NOT becoming soul mates, I would like to see her planning for her future and NOT losing out to inflation.

If I need to provide more information, simply ask and I will oblige.

Thanks everybody!!!

Space Mountain

I recently met what appears to be the love of my life.

I was hoping folks here can convince my girlfriend, that at 34 years of age, FDIC savings are NOT the way to go.

She is VERY conservative with her investments while I am not afraid of a little risk. I am not suggesting she goes ALL out and invests in ALL stock mutual funds. However, a blend of stocks/bonds would not seem so bad?

I know I can convince her to see things my way but a little nudge from this forum I believe would go a long way.

Heck, even if we end up NOT becoming soul mates, I would like to see her planning for her future and NOT losing out to inflation.

If I need to provide more information, simply ask and I will oblige.

Thanks everybody!!!

Space Mountain