You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

asset allocation

- Thread starter ripper1

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Two schools of thought.

One is that since your living expenses are covered there is no need to take any risk - you have "won the game" - and can go totally safe fixed income. particularly true if your pension is COLA.

Other school of thought is that since you don't need that money that you can take risk so you can go all equities.

Judgement call. So essentially, anything in between would be ok.

Is your pension COLAed?

One is that since your living expenses are covered there is no need to take any risk - you have "won the game" - and can go totally safe fixed income. particularly true if your pension is COLA.

Other school of thought is that since you don't need that money that you can take risk so you can go all equities.

Judgement call. So essentially, anything in between would be ok.

Is your pension COLAed?

ripper1

Thinks s/he gets paid by the post

Pension will probably lose the COLA component in 2015 and wifes ss to start in 2016 should pretty much cover expenses. We may still draw 1 to 2% for travel expenses.Two schools of thought.

One is that since your living expenses are covered there is no need to take any risk - you have "won the game" - and can go totally safe fixed income. particularly true if your pension is COLA.

Other school of thought is that since you don't need that money that you can take risk so you can go all equities.

Judgement call. So essentially, anything in between would be ok.

Is your pension COLAed?

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1. The academics will probably say invest the portion needed to completely fill out your "floor income" needs, whatever pension and Soc Sec don't cover (the OP said "most"), very conservatively (some would even recommend a SPIA, Pfau seemingly among many others).Two schools of thought.

One is that since your living expenses are covered there is no need to take any risk - you have "won the game" - and can go totally safe fixed income. particularly true if your pension is COLA.

Other school of thought is that since you don't need that money that you can take risk so you can go all equities.

Judgement call. So essentially, anything in between would be ok.

But you can go either way or anything in between with the rest. Without knowing you, I'd look at how you were invested during your work/accumulation years. Of you were aggressive, I'd guess you'd go equity heavy with your "excess." If you were conservative, light on equities. Just a guess. Might also depend on whether you want to leave a residual estate or not. Good problem to have though, congrats!

Last edited:

ripper1

Thinks s/he gets paid by the post

I have always been a 50/50 investor. I tolerated the 2007-09 debacle quite well. I have now melt up to 55/45 and have decided to make that my new investment contract with myself. Thanks, Midpack.+1. The academics will probably say invest the portion needed to completely fill out your "floor income" needs, whatever pension and Soc Sec don't cover (the OP said "most"), very conservatively (some would even recommend a SPIA, Pfau seemingly among many others).

But you can go either way or anything in between with the rest. Without knowing you, I'd look at how you were invested during your work/accumulation years. Of you were aggressive, I'd guess you'd go equity heavy with your "excess." If you were conservative, light on equities. Just a guess. Might also depend on whether you want to leave a residual estate or not. Good problem to have though, congrats!

50/50 here, with non COLA pensions currently covering 70% of spending. I was at 40/60 prior to ER but it has drifted up to 50/50 and have decided to leave it there as we have another 2 small pensions starting in 3 years.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have always been a 50/50 investor. I tolerated the 2007-09 debacle quite well. I have now melt up to 55/45 and have decided to make that my new investment contract with myself. Thanks, Midpack.

Since anything is appropriate, why not just let it ride?

ripper1

Thinks s/he gets paid by the post

I have a public employee pension so until I get more clarity as to where I stand I'm a little caustios at this point.Since anything is appropriate, why not just let it ride?

ripper1

Thinks s/he gets paid by the post

cautious......sorry.I have a public employee pension so until I get more clarity as to where I stand I'm a little caustios at this point.

Hermit

Thinks s/he gets paid by the post

55/35/10 here. I thought I would be covered entirely including non-cola'd pension, but I may be a little light after 6 months of RE. The 10 in cash and additional cash outside of portfolio should cover until my SS in 6 years. I'm comfortable with this.

Danmar

Thinks s/he gets paid by the post

I have a large non cola pension. Big risk in my opinion is inflation for a long retirement. Thus my entire portfolio is in conservative div stocks. If I capitalize the value of the pension my AA is about 58/42 (equity/FI) I am 63 with a very high tolerance to equity risk. Do what you feel comfortable with.

F4mandolin

Full time employment: Posting here.

Afraid I have kind of gone a little berserk....I was going to stay around 60-40. But......taking a bit of a risk and am likely around 70-30 now.

galeno

Recycles dryer sheets

If we had all our expenses covered by COLA'd pensions, we'd have a 80/20 port and withdraw a gross 2% per year and spend it on pure fun.

You'd still die very rich.

You'd still die very rich.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Based on what I see in in-laws accounts, 20%, 35%, or 50% equities would work. I say this because they went through the recession with 20% and were fine with temporary 10-15% decline in account value.If one had a pension and social security that covered most of ones living expenses what would be a reasonable asset allocation for equities/fixed income? Just asking.

Now that we are a number of years past the recession, I believe a 35% equity allocation makes more sense. If you really don't mind risk, then an equal split would be fine.

Look at the max drawdown for the allocation, and think of how you would feel with an account value that declines 25% or more. If that would cause a lot of worry, you have to dial back the stock.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

+1Two schools of thought.

One is that since your living expenses are covered there is no need to take any risk - you have "won the game" - and can go totally safe fixed income. particularly true if your pension is COLA.

Other school of thought is that since you don't need that money that you can take risk so you can go all equities.

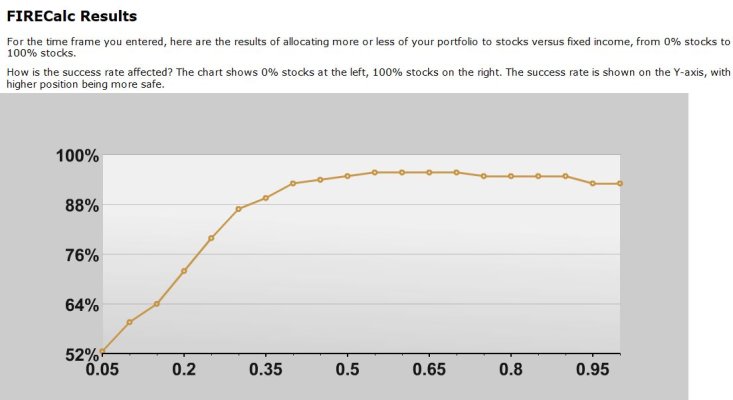

I think it boils down to your risk tolerance. If you can sleep soundly when the market takes a huge dive, then a very high allocation to equities may be the way to go. If not, then the less the better, within reason. (The 30 year FIRECalc chart below shows your odds of success drop off substantially with an equity allocation below 35-40%.)

Attachments

galeno

Recycles dryer sheets

I Don't look at it that way. Our retirement portfolio faces two types of risk:

1. Volatility risk also called "shallow risk". Highwe CAGR + highwe GSD = lower initial AWR. Investor cannot sleep well because of the sharp ups and downs of his portfolio. Solution = hold more FI assets.

2. Inflation risk also called "deep risk". Low CAGR + low GSD = higher initial AWR. Investor cannot eat well because inflation is depleting the portfolio's principal faster than his needed term. Solution = hold more equities.

E.g. In Jan we will go from 65/35 to 60/40. We are simply swapping 5% of shallow risk for 5% more of deep risk.

I worry about deep risk far more than I do about shallow risk.

1. Volatility risk also called "shallow risk". Highwe CAGR + highwe GSD = lower initial AWR. Investor cannot sleep well because of the sharp ups and downs of his portfolio. Solution = hold more FI assets.

2. Inflation risk also called "deep risk". Low CAGR + low GSD = higher initial AWR. Investor cannot eat well because inflation is depleting the portfolio's principal faster than his needed term. Solution = hold more equities.

E.g. In Jan we will go from 65/35 to 60/40. We are simply swapping 5% of shallow risk for 5% more of deep risk.

I worry about deep risk far more than I do about shallow risk.

+1

I think it boils down to your risk tolerance. If you can sleep soundly when the market takes a huge dive, then a very high allocation to equities may be the way to go. If not, then the less the better, within reason. (The 30 year FIRECalc chart below shows your odds of success drop off substantially with an equity allocation below 35-40%.)

galeno

Recycles dryer sheets

I'm more worried about asteroids vs stagflation. Deflation? Yes. Be worried. Stagflation? No way.

What about stagflation? You can drown in the middle of the pool too right?

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My current equity exposure is 65%, almost all in taxable accounts. If I had more money is retirement accounts, my equity exposure would be lower. Next year I will look at some more sales of appreciated equity, depending on how the tax position looks. People often say to ignore taxes in buy/ sell decisions, and I think this would be smart if I were 90% correct about what is coming, but I am not that correct, so I prefer to let tax considerations play a large part in deciding where or if to pare.

I am bearish on equities overall, fence sitting on medium term bonds.

Ha

I am bearish on equities overall, fence sitting on medium term bonds.

Ha