UnrealizedPotential

Thinks s/he gets paid by the post

- Joined

- May 21, 2014

- Messages

- 1,390

It's me, as a teenager living in Hawaii, back in the 1960's. And thank you for the compliment.

When I look at it, I can almost hear my late mother say "Get that hair out of your eyes!!! "Neither parent was a fan of those bangs.

We were about to go for a ride in my uncle's Jeepster, which was open to the air and that is why my aunt lent me her scarf to cover my long hair.

The hair reminds me of Mary Ann on Gilligans Island. You did say the picture was in Hawaii and so it just reminds me of the show. But it's a good picture and it's kind of fun to see a snapshot in time.

Last edited:

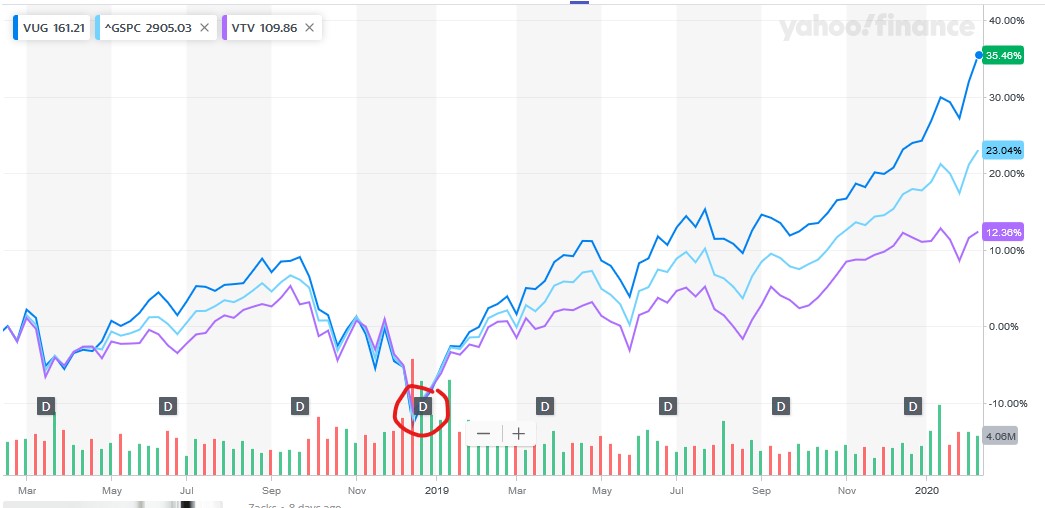

Seems like so far in 2020 I have hit a new high almost every day the market is open. And it's not my investing acumen; it's the market. I just have broad index mutual funds for the most part.

Seems like so far in 2020 I have hit a new high almost every day the market is open. And it's not my investing acumen; it's the market. I just have broad index mutual funds for the most part.