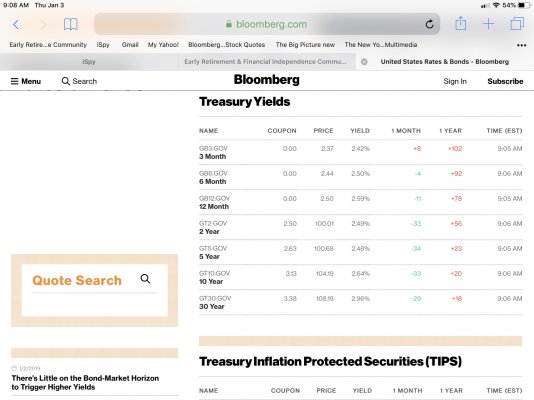

I was just looking at US Treasury rates at Bloomberg and saw the 5 year rate is less than the 6mo, 12 mo and 2 year. Ever so slight, but still it’s an inversion, and I don’t recall it being that wide over the past 2 quarters. Dark clouds on the horizon?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inverted yield curve

- Thread starter MichaelB

- Start date

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

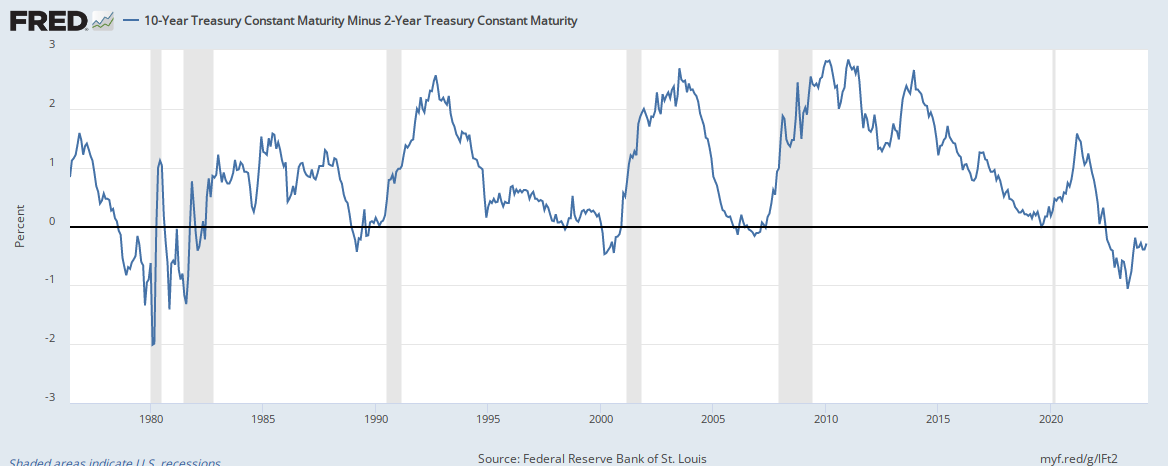

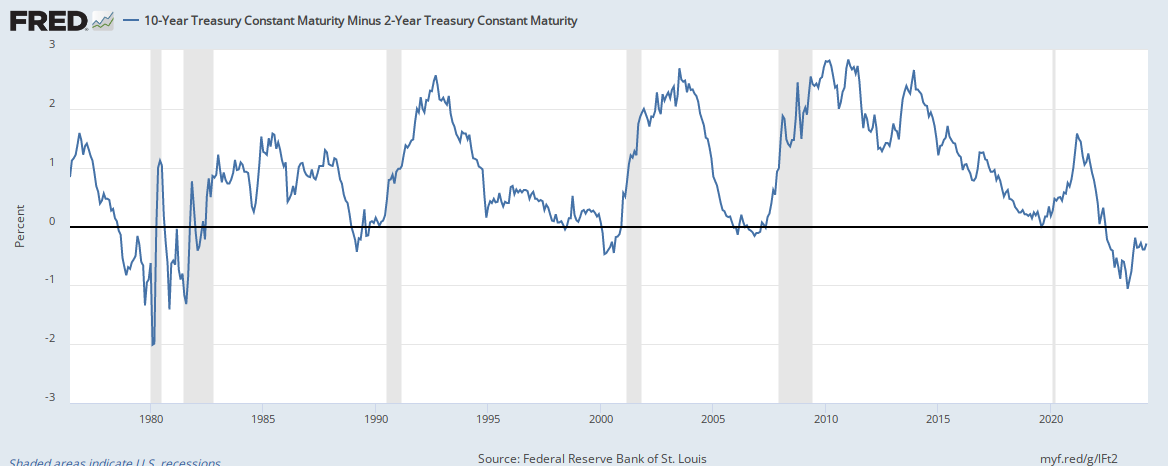

I prefer the 2-10 split which is dancing around inversion. It means nothing other than it might mean something. We'll know in a few years.

Freedom56

Thinks s/he gets paid by the post

The 1 year note is higher than 2 and 5 year notes. The 10 year note is about to invert versus the 1 year note. Last February I predicted that a rate inversion was going to happen. We are most likely headed to new all time lows for the 10 year note and possible the 30 year bond yields. As I stated many times, beware of cheerleaders in government talking up the stock market. Most sectors are in a deep bear market. Energy is continuing in a secular bear market with oil drilling stocks getting completely wiped out. The retail wipe-out is just getting started. The few places to hide for equity investors are utilities, telecom, and pharma. Individual bonds of companies with good cash flow will do fine. CDs and treasuries will be okay. Bond funds on the other hand will continue to under-perform due to their low yields and exposure to industrial, energy, and retail.

Last edited:

Similar threads

- Replies

- 48

- Views

- 6K

- Poll

- Replies

- 141

- Views

- 12K