cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

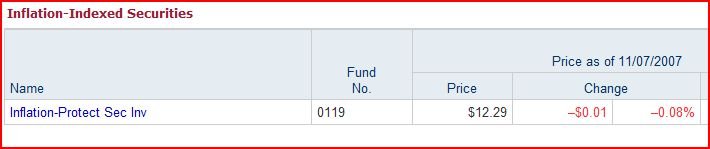

Incorrect my trollish friend...down .09%.

Never said I dont believe in tips. I dont believe they produce a 'real' rate of return, and at the current yields they're a lousy investment.

Oh thats right, you're the guy that bought 'a truckload' at a yield much lower than it is today!

Never said I dont believe in tips. I dont believe they produce a 'real' rate of return, and at the current yields they're a lousy investment.

Oh thats right, you're the guy that bought 'a truckload' at a yield much lower than it is today!