You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

So much bullish sentiment

- Thread starter monte1022

- Start date

This thread is full of lots of hope and lots of pessimism. What's missing is that the leaders we pick and the initiatives we support and promote will have a lot to do with our future at all levels, even for retirees.

We've been living off the spoils of the past for much of my life. One example - when I was a younger man the country got behind building an interstate highway system, and it transformed our economy. The deterioration of such infrastructure is not only sad to watch but dangerous. New initiatives around infrastructure, properly managed, would transform our economy, and change our future.

Cynicism is a popular habit, but not productive and not supportive of economic well-being at any level.

We've been living off the spoils of the past for much of my life. One example - when I was a younger man the country got behind building an interstate highway system, and it transformed our economy. The deterioration of such infrastructure is not only sad to watch but dangerous. New initiatives around infrastructure, properly managed, would transform our economy, and change our future.

Cynicism is a popular habit, but not productive and not supportive of economic well-being at any level.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

In 2020 the SP500 was up 18.4%. Very nice in a tumultuous year. But the markets have not gone into an exponential ascent like in early 2000.

I think most of us are having trouble dealing with this in an unemotional way.

My guess is the market broadens out if the vaccines quell the Covid cases. So not so much a sell off in growth stocks but perhaps slower growth with value stocks moving up too. Actually in the last quarter value stocks have done about the same as growth stocks. And even international stocks have done similarly.

I think most of us are having trouble dealing with this in an unemotional way.

My guess is the market broadens out if the vaccines quell the Covid cases. So not so much a sell off in growth stocks but perhaps slower growth with value stocks moving up too. Actually in the last quarter value stocks have done about the same as growth stocks. And even international stocks have done similarly.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I concur with what seems to be the consensus that low interest rates and a supportive fed will continue to provide support for the market, until it doesn't (meteor strike, China invades Taiwan or someplace else, Nancy Pelosi announces she is carrying Mitch's love child)...

Pelosi getting pregnant at her age of 80? That would be a true miracle.

No professional investors that I read say the market is too hot, too expensive or not broad enough. On the contrary.

Does everyone agree the economy is not producing at its full potential?

What happens to equity markets when the economy is producing at full potential, whenever that may be? Will the market be higher, or lower?

Does everyone agree the economy is not producing at its full potential?

What happens to equity markets when the economy is producing at full potential, whenever that may be? Will the market be higher, or lower?

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No professional investors that I read say the market is too hot, too expensive or not broad enough. ...

You obviously are not looking very hard.

https://www.google.com/search?q=sto...3j0i433j0l5.7719j0j7&sourceid=chrome&ie=UTF-8

Markola

Thinks s/he gets paid by the post

To me, the economy and the markets always feel on the precipice of doing.......something different than right now, either going up, down, all around or sideways. My solution is to ask myself if I think my portfolio will be better off in 20 years? So far, the answer is always a confident “yes” and my larger fear then becomes not screwing up that likelihood by attempting to get fancy, fiddling around with my AA and making short term, proven rookie mistakes.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

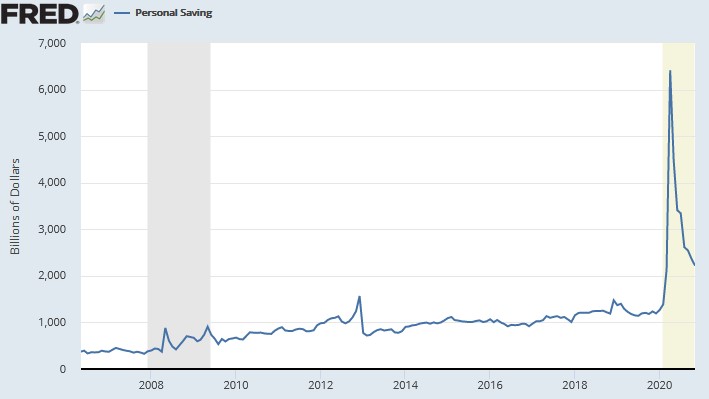

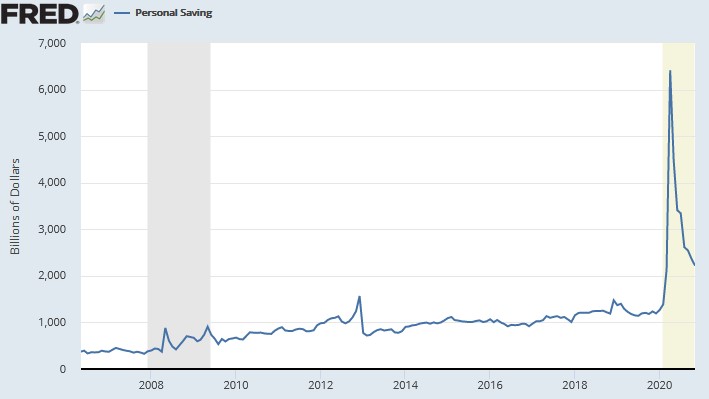

Where is this money going next?

From Fed data, USA personal savings:

From Fed data, USA personal savings:

G8tr

Recycles dryer sheets

- Joined

- Apr 20, 2014

- Messages

- 197

The question "where is the market going from here?" smacks of a desire to time the market. However, trimming a position that you believe, based on individual company or sector metrics has reached full value, isn't market timing to me. The same goes for a position that has exceeded its assigned percentage in your AA. In either case, you might lose out on some potential additional gains, but you'll be able to sleep at night and never feel the need to ask the aforementioned question.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

The question "where is the market going from here?" smacks of a desire to time the market. However, trimming a position that you believe, based on individual company or sector metrics has reached full value, isn't market timing to me...

Many stocks way overpass their full value by several times, and face higher risk than the market.

However, selling them is also anathema to EMH proponents who say that it is the same as stock picking, and you cannot do it reliably.

It's the main reason that I do not believe in EMH. Timing the decline of a bubblicious stock to short it is indeed hard. It is not as hard to recognize that the stock is overpriced to avoid it.

Last edited:

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Really it is kind of silly that "market timing" has such a negative rap around here. Every buy or sell decision is market timing to some degree. We buy when we expect an investment to go up and we sell when we expect it to go down. On the other side of every trade is someone who believes the opposite.The question "where is the market going from here?" smacks of a desire to time the market. However, trimming a position that you believe, based on individual company or sector metrics has reached full value, isn't market timing to me. The same goes for a position that has exceeded its assigned percentage in your AA. In either case, you might lose out on some potential additional gains, but you'll be able to sleep at night and never feel the need to ask the aforementioned question.

I smile when I see someone who considers themselves to be a long term investor anguish over the fact that with a conventional mutual fund it’s typically a few hours of small random movements before we know our trade price. DW and I made a low 7-figure trade on Thursday or Friday and I haven't even gone to look at the price. Our last trade with that asset was a couple of years ago.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Gee OldShooter, are you turning over a new leaf in the new year?

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not sure what you are asking. My point is simply that we cannot avoid market timing unless we don't trade. I am certainly not advocating the sort of large trades/large market timing that has historically gotten people into trouble. In a nutshell, my trading strategy remains like this:Gee OldShooter, are you turning over a new leaf in the new year?

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This thread is full of lots of hope and lots of pessimism. What's missing is that the leaders we pick and the initiatives we support and promote will have a lot to do with our future at all levels, even for retirees.

We've been living off the spoils of the past for much of my life. One example - when I was a younger man the country got behind building an interstate highway system, and it transformed our economy. The deterioration of such infrastructure is not only sad to watch but dangerous. New initiatives around infrastructure, properly managed, would transform our economy, and change our future.

Cynicism is a popular habit, but not productive and not supportive of economic well-being at any level.

Maybe folks will notice when the bridges start collapsing weekly.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No professional investors that I read say the market is too hot, too expensive or not broad enough. On the contrary.

Does everyone agree the economy is not producing at its full potential?

What happens to equity markets when the economy is producing at full potential, whenever that may be? Will the market be higher, or lower?

The market has already anticipated the economy producing at full potential and then some.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

I smile when I see someone who considers themselves to be a long term investor anguish over the fact that with a conventional mutual fund it’s typically a few hours of small random movements before we know our trade price.

I smile at the anguish over the $30 "free" Turbotax or not.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I smile at the anguish over the $30 "free" Turbotax or not.

Its more like $55 free or not.

G8tr

Recycles dryer sheets

- Joined

- Apr 20, 2014

- Messages

- 197

Indeed it has. But that's in regard to the domestic economy. What we don't know is whether the incoming administration will bleed off some of the recently created wealth based on that anticipation.The market has already anticipated the economy producing at full potential and then some.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The market has already anticipated the economy producing at full potential and then some.

If only we could reliably measure this anticipation. I guess that is what earnings estimates are about. The SP500 estimated forward PE is currently 25.5.

corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

Really it is kind of silly that "market timing" has such a negative rap around here. Every buy or sell decision is market timing to some degree. We buy when we expect an investment to go up and we sell when we expect it to go down. On the other side of every trade is someone who believes the opposite.

I smile when I see someone who considers themselves to be a long term investor anguish over the fact that with a conventional mutual fund it’s typically a few hours of small random movements before we know our trade price. DW and I made a low 7-figure trade on Thursday or Friday and I haven't even gone to look at the price. Our last trade with that asset was a couple of years ago.

I buy when I have money and sell when I need it. Sometimes I rebalance, but I have only done that once in the past 5 years. Price does not play a role at all.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

From Liz Ann Sonders (Schwab):

So, I get the question all the time: What about inflation? Why haven’t we had inflation in light of all of this massive stimulus? And the answer is, well, we've had plenty of it, it's just been in asset prices, not in the real economy.

As I pointed out in a couple of other threads, the price of industrial metals, i.e. copper, tin, zinc, iron ore, has been rising. Same with rock phosphate and urea for fertilizer. These are still far from their all-time high, but are higher than 1 year ago, even pre-Covid.

The world economy is still recovering, so I don't think the rise of commodity prices is due to higher demand, but rather due to lack of supply. Will supply improve soon?

Just yesterday, I read of Toyota not being able to produce pickup trucks due to lack of some semiconductor chips.

When will higher commodity prices get reflected in the PPI? How high will the Fed let it go until it raises interest rates?

I don't know the answer to any of that, so can only keep an eye on new developments. No need to sell anything at this point.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think it is clear that the Fed and the incoming administration will let the economy run hot for quite awhile. People were surprised that in the pre-Covid economy the unemployment rate could drop so low without inflation. That lesson will not be soon forgotten.

Will we see a wage spiral eventually leading to less controlled inflation? Could be a few years in coming but that might cause equities to hiccup. Anyway we are no where near that yet.

Will we see a wage spiral eventually leading to less controlled inflation? Could be a few years in coming but that might cause equities to hiccup. Anyway we are no where near that yet.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Me neither.... I don't know the answer to any of that ...

"The Latin maxim ignoramus et ignorabimus, meaning "we do not know and will not know", stood for a position on the limits of scientific knowledge, in the thought of the nineteenth century." And, I would say,it also applies to predictions of almost any sort, like investing.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,702

Except on Amazon only on Dec 26.Its more like $55 free or not.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

OFF TOPIC: Amazon has TT Delux for $40 now. Being a gun slinging trader I bought it.

https://smile.amazon.com/gp/product/B08HSKNTCM/ref=ox_sc_saved_title_1?smid=A3ODHND3J0WMC8&psc=1

https://smile.amazon.com/gp/product/B08HSKNTCM/ref=ox_sc_saved_title_1?smid=A3ODHND3J0WMC8&psc=1

Similar threads

- Replies

- 17

- Views

- 737

- Replies

- 57

- Views

- 3K