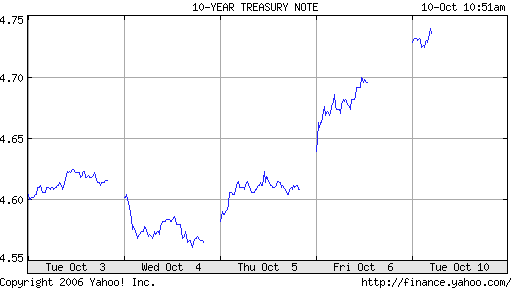

I'm curious what you have against a mutual fund MM account. Given the moderate and rising interest rates, and the recent surge of the stock market, you could do much worse. With only a 5 year timeframe, i'd definitely be an option i'd consider.

It just sounds to me like preservation of principal is important to you for this money. "Medium" volatility could easily involve an investment that could cost you as much as 30% of your principle if we just happened to have a "bad" 5 years with whatever medium volatile investment you end up picking.

Give me relatively high interest rates and the need to use the money in the short term, and i'm all over a good paying money market account like those you get from mutual fund companies (not banks). They're also great for when you're just being defensive, if you're a timer.