marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

There is no single right answer.

That should be the subtitle to this forum! Seems to be the answer to just about everything here.

There is no single right answer.

Keep in mind that according bro social security statistics, the percentage of people that apply for ss at 70 is in the single digits. Less than 1 in 10. Very few do.....

That should be the subtitle to this forum! Seems to be the answer to just about everything here.

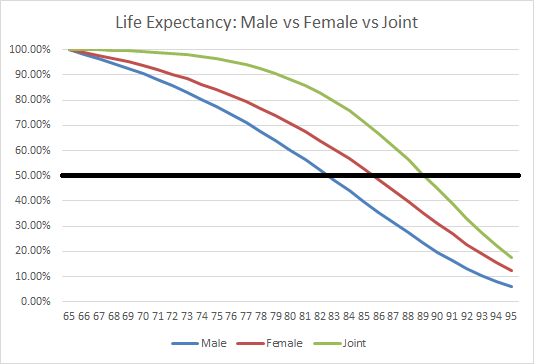

The black horizontal line represents the 50th percentile for survival (or what we commonly call "life expectancy"), which is approximately age 89 for the starting-age-65 couple (based on the Social Security Administration's 2007 Period Life Table). Notably, though, it's only age 85 for a 65-year-old female, and age 82 for a 65-year-old single male.

it seems very straight forward to me that the best time to take it is whenever the market drops and you other wise would be taking a suboptimal withdraw amount. SS is the perfect tool to avoid a market bottom.

That's what I did in late 2008.I like that approach.

Since I am married, I need to take into account the greater future payments which spouse will receive.

Keep in mind that according bro social security statistics, the percentage of people that apply for ss at 70 is in the single digits. Less than 1 in 10. Very few do.

Sent from my iPhone using Early Retirement Forum

I will probably never the the math on SS, it seems very straight forward to me that the best time to take it is whenever the market drops and you other wise would be taking a suboptimal withdraw amount. SS is the perfect tool to avoid a market bottom.

For singles, in theory it doesn't matter. If it were me and I was single and had enough for 100% success, I would still wait as it is cheap longevity insurance to protect me if I did live long or if the financial markets were unkind.

However, if you add in unfavorable genetic history or existing health issues that impact long term mortality then taking early is a better option.

That's where I am too, and why I'm waiting until 66 or perhaps a bit later. The difference for DW is significant.

I've made it clear though that I fully expect her to wear black and behave for a year before she starts fooling around with the pool boy on the life insurance. That gets me an eye roll.

I'll wait until Medicare age (65) before claiming mine. Taking it early would eliminate my PPACA subsidy, so I'd be giving over $5k of my ss to some insurance company -no thanks.

I am surprised there are not early retirement articles on financial planning to minimize taxes and maximize PPACA subsidies, lots of boomers leaving the workforce early!

Interesting point. I don't recall any of the analyses of break even discussing the savings effect of early SS. If you hold spending the same, take it or leave it, then taking is saving for the early years. When you reach the actuarial break even point you still have the saved funds that otherwise would have come out of your portfolio between 62 and 66 or 70. A useful factor if you want to leave an inheritance. Still seems like the primary benefit is the longevity insurance effect of increased COLA protected cash flow in old age if the markets go south and eat up your portfolio.Most of the analysis I see shows the difference in benefits at taking them early vs. at FRA as if they were fully spent. Usually I see it suggested that the break even point for when you would collect more money is around 78-80.

But these seem to assume it's all about how much money is received in benefits for the analysis.

What if the person who claimed at 62 didn't spend the money but instead put the money into their asset allocation to save? Wouldn't that make the break even point much later? Of course this assumes positive market returns but it just seems like this would argue for taking it earlier in many cases. Spending the social security money and allowing you to take less out of your portfolio is the same as saving the social security right?

Maybe that analysis has already been done but I don't recall seeing it.

And obviously, there are things like subsidies, income limits and taxes that make each decision different.

so what you are doing is 8 years of roth conversions pre 70-1/2 .