wmc1000

Thinks s/he gets paid by the post

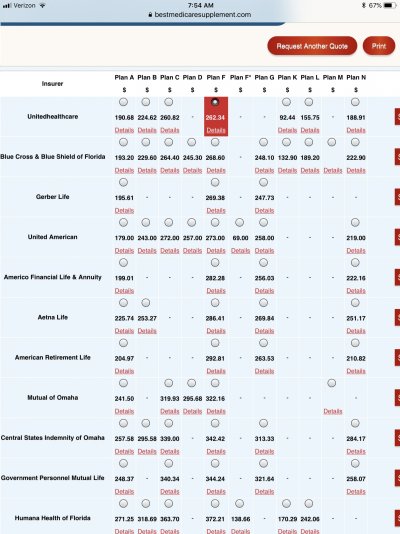

I have found that one of the best websites to see a comparison of companies plans and pricing for supplements is https://www.bestmedicaresupplement.com/ - you don't have to give then any info to except zipcode, age sex and whether you smoke to see the price quotes from a large group of companies.

As far as Plan F vs Plan G the cost savings for Plan G was greater than the $183 deductible we each have to cover. In our case with just an annual doctor visit we don't come close to paying the deductible of $183 so our savings are even greater than they would be if we maxed out the deductible.

Additionally DW and I have had a great comfort level using the folks at https://www.boomerbenfits.com to sign up for both our Medicare supplement plan and Part D prescription coverages. They reviewed all of the Part D plans available to us and walked us through the differences and limits ie, quantity limits step therapy, etc. They will also do an annual review of the Part D plans as part of their customer service!

As far as Plan F vs Plan G the cost savings for Plan G was greater than the $183 deductible we each have to cover. In our case with just an annual doctor visit we don't come close to paying the deductible of $183 so our savings are even greater than they would be if we maxed out the deductible.

Additionally DW and I have had a great comfort level using the folks at https://www.boomerbenfits.com to sign up for both our Medicare supplement plan and Part D prescription coverages. They reviewed all of the Part D plans available to us and walked us through the differences and limits ie, quantity limits step therapy, etc. They will also do an annual review of the Part D plans as part of their customer service!

Last edited: