EvrClrx311

Full time employment: Posting here.

- Joined

- Feb 8, 2012

- Messages

- 648

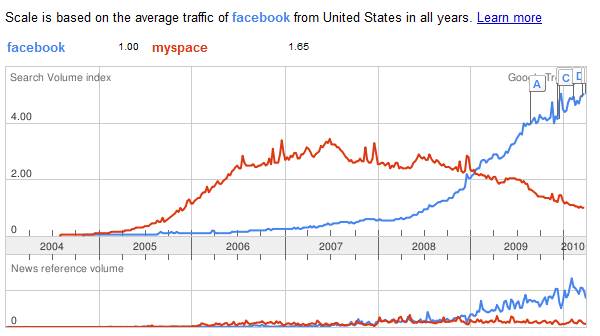

realistically... if it hits about $10 a share I'd invest, hoping that they come up with something new in the future that could send the stock back up. The company does have the exposure to an incredibly large audience... just a boring and outdated product that isn't profitable. If they started making gadgets (like cell phones, teleportation or time machines), and revolutionizing how we access and view the world, then I'd get a little more interested... just being a free digital parking lot for people to post data is not appealing anymore. The advertising market is huge, don't get me wrong... but it is a difficult business to be in... specially if its your only business... since people can block or ignore it.

Last edited: