Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

I figured I'd post this FWIW. The only significant bonds I have are from the international bond fund PFORX so I'm thinking of adding a domestic bond fund. Maybe something else will stand out to you as being missing. I haven't even worked out the percentages in each fund yet though.

ONEQ was the first I added just because I wanted to move away from the old securities quickly. It's possible I'll sell it eventually and just balance the others to make up for it, if possible. I don't even recall the exact justification for adding each one, but they made sense at the time. As I said, FWIW:

ONEQ - Fidelity NASDAQ Comp. Index Trk Stk(ETF)

NUMV - NuShares ESG Mid-Cap Value ETF

PRBLX - Parnassus Core Equity Fund - Investor Shares

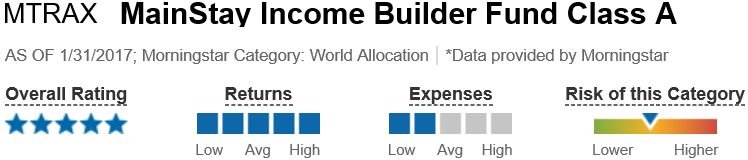

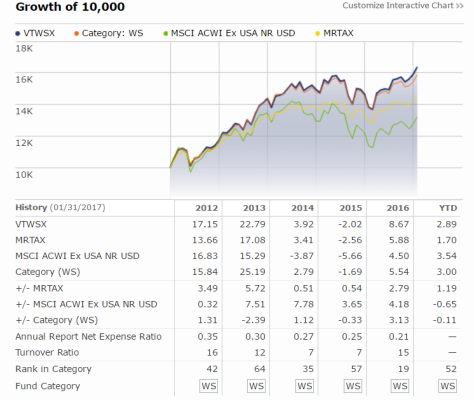

MTRAX - MainStay Income Builder Fund Class A

PFORX - Foreign Bond (U.S. Dollar-Hedged) Fund Institutional Class

ONEQ was the first I added just because I wanted to move away from the old securities quickly. It's possible I'll sell it eventually and just balance the others to make up for it, if possible. I don't even recall the exact justification for adding each one, but they made sense at the time. As I said, FWIW:

ONEQ - Fidelity NASDAQ Comp. Index Trk Stk(ETF)

NUMV - NuShares ESG Mid-Cap Value ETF

PRBLX - Parnassus Core Equity Fund - Investor Shares

MTRAX - MainStay Income Builder Fund Class A

PFORX - Foreign Bond (U.S. Dollar-Hedged) Fund Institutional Class