(Apologies for another mega-post...seems to happen on weekends!)

I also think short term market moves are super unpredictable, but I do think there is a strong case that the market is reacting more-or-less rationally by taking in new, substantive information as its available.

The pace with which this has all developed is breathtaking. Being locked in our houses and 24x7 coverage on every media outlet is compressing time. As I write this 13 of the 30 threads on the ER.org portal page are from the Covid containment area. This is all we're talking about so it feels like its been going on forever.

But let's remember that on Feb 11, just 60-odd days ago, there were only 45k cases diagnosed GLOBALLY. On March 11, it was still only 126k globally. Setting aside the finance porn issue, the pace at which legitimate, substantive information has been entering the investing market is staggering. We're talking about news cycles measured in hours, not days.

I think we've seen the market digest this in pretty recognizable chunks of info...

Phase 0, January 1: Assume that the market was "priced right". (Let's keep whether that's actually true in other threads please.

)

Phase 1, early January: the world saw China's actions but it was wrapped in a lot of information that this could be contained. The market just motored along.

Phase 2, late January: it cropped up in Italy. No one was terribly surprised that it had spread at some level and it continued to look like contract tracing could potentially chase it down. Market motored along as the "armageddon" scenario still looked very unlikely.

Phase 3, end of February: this was getting serious. Italy was looking more like chaos. It was clear aggressive measures had to be taken. Other countries were involved, but it still might be regionally controlled. Market started to price in global downturn but didn't consider it the central scenario.

Phase 4, early March: they locked down all of Italy. Spain, Germany, etc were now on the board. We started seeing "go home" alerts to travelers in certain countries. Diamond Princess was an incubator. US/UK were foot dragging but enough of a pattern had been built up to know there were going to get sucked in as well. The prospect of the entire western world being closed was now firmly on the table with no clear path out or insight on government support. Russia and Saudi Arabia lost their minds. Panic set in.

Phase 5, late March: Every modern country on the planet is in or heading towards shutdown...its all there for everyone to see...but governments are starting to take action. On March 26 the Senate passed the $2T stimulus. Steady, global drumbeat of bad news on the disease front but supportive news on the stimulus front.

Phase 6, now: the tide shows signs of turning. Most western economies show signs of the disease peaking. Governments continue to throw money and promises into the economies. Everyone is starting to make noises about turning the economies back on but no one knows what will happen. Russia and Saudi Arabia might make up. Scenarios do range from global depression to full "V" but the center of the probability curve is likely somewhere in the middle.

And the market?

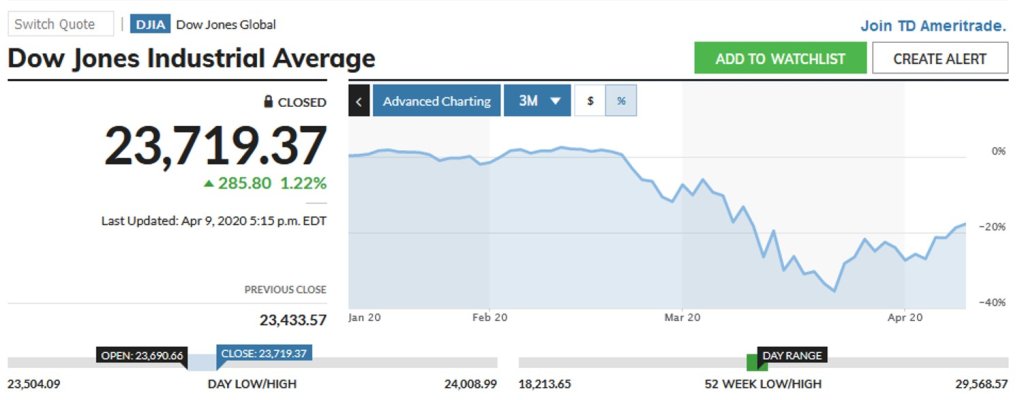

Its priced almost exactly in the middle of January and the peak panic.

I think its been digesting actual information in order to price future probabilities. Its felt super crazy to all of us because the pace has been shocking, and moves amplified by trading/short covering/etc, but its not irrational in light of the known situations.

The real question is what are the big information points yet to come?

The ones on my mind...

1) Does China regress? They have a new city on lockdown. If China is the leading-leading-leading indicator, then some type of spiral there will rightly put depression back into the more likely bucket because there's again no known path out.

2) Does Europe finish peaking? If so, then we have a path to TRYING to turn on Western economies again.

3) What happens when they turn Europe back on? Espressos at coffee shops in Milan in June...or masks and you can walk to work if you have a disease passport?

4) Rolling US disease management. Can CA really finish its amazing job of largely keeping a lid on it? What does this look like in the world's largest economy.

5) The 2nd/3rd world. India, Africa, Central America...these countries are by and large just getting warmed up and in most cases have almost no chance of replicating the Asian/western response approach.

6) Science. The global pharm community is in motion like never before. Its very likely we will start to see substantive progress on treatment approaches. A vaccine is at least a year away, but if they can find therapies/approaches that make this less deadly, that's changes everything.

7) Antibody testing & Herd Immunity. The most hopeful scenario, ironically, is that all of this shutting down the economies was for naught. Loads of people had it and were very mildly affected. When antibody testing ramps up we discover we're closer to herd immunity that we know, the disease is less deadly than we think, and we can all get back to life.

And the combination of all those probabilities...is why I'm an AA fan and an indexer. I have no freaking clue how all of this will turn out.

)

)