gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

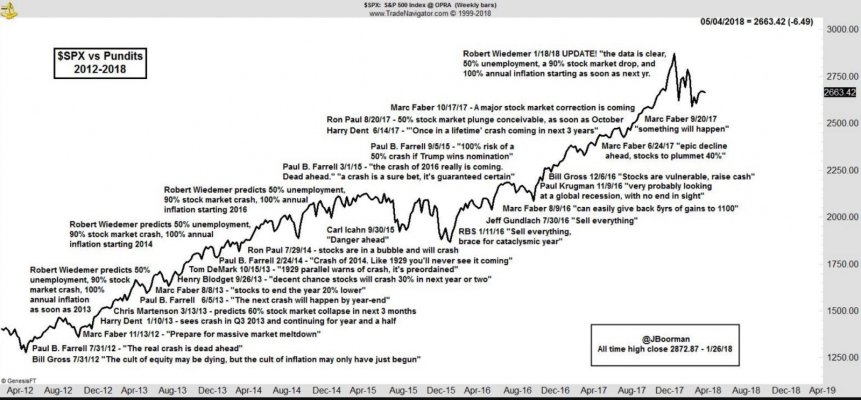

https://www.cnbc.com/2018/12/17/wor...-the-stock-market-since-great-depression.html

Dow and S&P only down about 8%, hard to believe it's one of the worst.

But at this point, I'd settle for a lump of coal for Christmas.

Humbug!

Dow and S&P only down about 8%, hard to believe it's one of the worst.

But at this point, I'd settle for a lump of coal for Christmas.

Humbug!