In the interest of leaving things as simple as possible for DW when I get on the wrong side of the grass I simply have Vanguard Target Retirement, Wellesley and Wellington in my IRA. No rebalancing, timing or looking at the tea leaves required and I figure these 3 funds will manage their bond components far more competently than I ever could on my own. They certainly seem to be doing so thru current events.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bridgewater: “Bonds are a terrible place to be.”

- Thread starter chassis

- Start date

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There's a difference between getting out of fixed income and getting out of long term bond funds.

In the range of possible outcomes, one plausible one, some could argue likely, is the Fed continues to raise short term rates. The market sees longer term growth as tepid. So long term rates remain relatively stable, while short term rates spike, causing the yield curve to invert, in such a scenario likely recessionary, LT bonds providing stability and nice income from the higher coupon, will look sweet.

Not saying it will happen, but it could.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Bond funds, always seemed like a dumb idea to me, because when the flight to cash happens, they get clobbered as fund managers proceed to "sell low" in the panic. If you have individual bonds, you might take it in gut on interest rates, but if you hold to maturity, you'll get what you set out to get.

Agree 100% but I’ve been chastised for thinking bond funds are any different from individual bonds. Bonds are complicated. It’s tough to be diversified with individual bonds but If I have an emergency that forces me to sell, at least I can pick my poison. A fund manager choice of what to sell may not favor the folks that are not redeeming shares.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Agree 100% but I’ve been chastised for thinking bond funds are any different from individual bonds. Bonds are complicated. It’s tough to be diversified with individual bonds but If I have an emergency that forces me to sell, at least I can pick my poison. A fund manager choice of what to sell may not favor the folks that are not redeeming shares.

The biggest difference between a fund and an individual bond is:

An individual bond has a predetermined value on a predetermined date it will return to, short of default - the par value. A fund does not.

If you have them laddered well enough, you should always have fresh cash to reladder, balance into equities, spend or do whatever. If you have to sell from a bond fund, like now, it could be down and you take a loss.

Markola

Thinks s/he gets paid by the post

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

In the range of possible outcomes, one plausible one, some could argue likely, is the Fed continues to raise short term rates. The market sees longer term growth as tepid. So long term rates remain relatively stable, while short term rates spike, causing the yield curve to invert, in such a scenario likely recessionary, LT bonds providing stability and nice income from the higher coupon, will look sweet.

Not saying it will happen, but it could.

But you can always get back into a bond fund at any time. It is not like stocks where there are big moves on certain days where if you are out, you miss out.

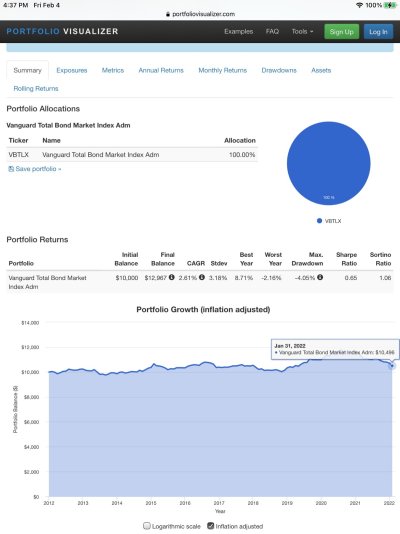

Someone buying and holding $10,000 worth of Vanguard Total Bond Fund ten years ago and reinvesting dividends would, after adjusting for inflation, have made $496.

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

But you can always get back into a bond fund at any time. It is not like stocks where there are big moves on certain days where if you are out, you miss out.

Same problem for both…picking a point to enter. I think the board calls this “timing”

Winemaker

Thinks s/he gets paid by the post

I put $100,000 in various preferred stocks at no more than $5,000 in each issue, all below par, in late 2014/early 2015 when I first retired. It's now worth $145,000 or so. I consider it a convoluted bond fund, of my own convictions. I have been reinvesting divvies in other issues.

Markola

Thinks s/he gets paid by the post

Which is better than cash or short-term bonds over the same time frame. Might be better than a CD ladder also, but I'm not gonna investigate.

I own this fund, not individual bonds, so am not judging. These 10 year returns are difficult to see but I posted in the depths of March 2020 how bonds were outpacing stocks at that moment FOR THE CENTURY. I guess ballast is the only reason for why we own bonds and bond funds. It’s certainly not the returns.

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Same problem for both…picking a point to enter. I think the board calls this “timing”

Per my earlier post, there's a difference between getting out of fixed income altogether and simply getting out of long term bond funds. It is my understanding that switching from bond funds to ladders and other fixed income investments doesn't count as timing.

We have posts in this forum every day on tweaking our investment mix and specific types of investments. I am not sure why you see this thread differently. Not everyone here only has mutual funds or keeps the same investments throughout their retirements.

Related link:

These Are the Worst Income Investments for the New Year - Knowing what to avoid can be as important as what to buy for investing.....here’s my take on the worst income investments for 2022. Hint: They’re all longer-term bond funds.

https://www.barrons.com/articles/worst-income-investments-51641338869

Last edited:

gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

Bonds are for getting out of jail.

Inflation is the great destroyer of wealth in cash and bonds at today’s ridiculously low rates.

Inflation is the great destroyer of wealth in cash and bonds at today’s ridiculously low rates.

Closet_Gamer

Thinks s/he gets paid by the post

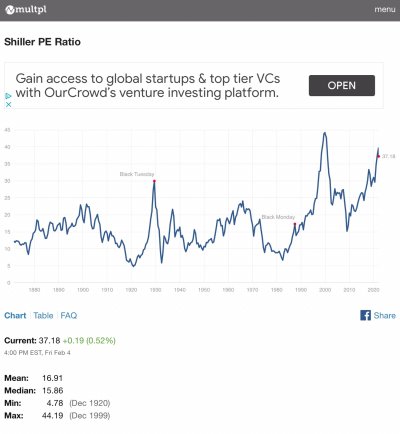

I've posted several times about my concerns over the blast radius around a long-term (even a mid-term) bond bear market. The rising yields would become an anchor on every other asset class as well.

I also think the current negative real yields are a major problem and that rates "have to go up".

But many of us have thought rates "had to go up" since 2008.

I've stuck to my AA, including exposure to longer term/higher duration bonds with the attendant interest rate risk. If I'd only ridden the short end of the curve waiting for interest rates to adjust, my bond yield would have been 1-2% lower than it has been...for over a decade. And I've benefited in rebalancing opportunities when bonds rallied in the face of our various disasters over the last 15 years.

So, all that gets me back to...gritting my teeth and sticking to my AA.

(I do think about getting out of bond funds and building a ladder...but I've watched people smarter than me argue about whether there is really any difference over the long term. And I don't really have time to do the proper ladder research...so bond funds for me.)

I also think the current negative real yields are a major problem and that rates "have to go up".

But many of us have thought rates "had to go up" since 2008.

I've stuck to my AA, including exposure to longer term/higher duration bonds with the attendant interest rate risk. If I'd only ridden the short end of the curve waiting for interest rates to adjust, my bond yield would have been 1-2% lower than it has been...for over a decade. And I've benefited in rebalancing opportunities when bonds rallied in the face of our various disasters over the last 15 years.

So, all that gets me back to...gritting my teeth and sticking to my AA.

(I do think about getting out of bond funds and building a ladder...but I've watched people smarter than me argue about whether there is really any difference over the long term. And I don't really have time to do the proper ladder research...so bond funds for me.)

Bond funds, always seemed like a dumb idea to me, because when the flight to cash happens, they get clobbered as fund managers proceed to "sell low" in the panic. If you have individual bonds, you might take it in gut on interest rates, but if you hold to maturity, you'll get what you set out to get.

100% (assuming no widespread defaults of course)

I've stuck to my AA, including exposure to longer term/higher duration bonds with the attendant interest rate risk. If I'd only ridden the short end of the curve waiting for interest rates to adjust, my bond yield would have been 1-2% lower than it has been...for over a decade. And I've benefited in rebalancing opportunities when bonds rallied in the face of our various disasters over the last 15 years.

In a 1-2% interest rate environment, I think the strategy you did made sense. At 7+% interest rate, you have a much, much higher risk on the long side. Plus, I can put my money into 2 year treasuries at 1.31% or 2.28% for 30 year. Is it worth the 97 bps of extra money if inflation stays higher for longer? Think about a mortgage in reverse. Are you willing to get a 2 year ARM mortgage over a 30 year fixed (taking on debt) in the current environment? If not, you should be in shorter duration (funding) bonds for the same reason.

Which Roger

Thinks s/he gets paid by the post

- Joined

- Jun 5, 2013

- Messages

- 1,019

+1

The recency bias expressed in threads like this is alarming.

Agree 100%. If we were in a bear market for stocks, this conversation would be completely different, with comments like "sure, bonds are flat at best, but at least I'm not losing 50% like stock investors".

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

Is it worth the 97 bps of extra money if inflation stays higher for longer? Think about a mortgage in reverse. Are you willing to get a 2 year ARM mortgage over a 30 year fixed (taking on debt) in the current environment? If not, you should be in shorter duration (funding) bonds for the same reason.

Good analogy.

Closet_Gamer

Thinks s/he gets paid by the post

In a 1-2% interest rate environment, I think the strategy you did made sense. At 7+% interest rate, you have a much, much higher risk on the long side. Plus, I can put my money into 2 year treasuries at 1.31% or 2.28% for 30 year. Is it worth the 97 bps of extra money if inflation stays higher for longer? Think about a mortgage in reverse. Are you willing to get a 2 year ARM mortgage over a 30 year fixed (taking on debt) in the current environment? If not, you should be in shorter duration (funding) bonds for the same reason.

I understand you point -- though I don't carry a mortgage

I actually agree with the premise that inflation is going to stay high, but I've strongly believed a lot of things over the years that turned out not to be so.

Rates had to rise, Google had to tank, TSLA was a fad, AMZN would find meaningful competition, healthcare had to get cheaper, etc.

I'm glad I didn't chase my certainty. My AA has saved me from myself many times. Its no doubt caused drag in parts of my portfolio as well ... international, REITs, TIPs ... but that is the power of hindsight.

None of this changes my concerns about rates moving. If they move in a big way, the damage to equities may make the damage to bonds look trivial.

Freedom56

Thinks s/he gets paid by the post

If you own individual bonds and time your purchases to moments when bond fund managers are in panic selling mode, all you will lose is the premium as rates rise. You will lose this premium in any case as the bond approaches maturity. We are approaching a long overdue moment when yields become attractive as bond fund managers begin their liquidation. CEFs will also sell-off to levels well below asset value. Investor should be focused on two thing when investing in bonds:

1- Fixed coupon payments

2- Return of capital

This is not that different from buying CDs. Investors should then ask themselves whether they would buy a fund that invests in CDs with no guarantee of return of capital or buy individual CDs themselves? Passive bond funds will not shield you from market risk and consistently underperform a portfolio of individual bonds due to their tendency to buy high and sell low. For example, the funds that bought Apple 1.25% coupon 2030 notes at or over par are watching it trade at 90 cents on the dollar and could very well drop to a low of 70 cents on the dollar during moments of panic bond selling as rates rise. Passive bond funds sell their lowest yielding investments first. Active funds and individual bond investors avoid these bonds/notes causing precipitous drops until the yield to maturity becomes attractive again.

https://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C925719&symbol=AAPL5030516

A fund that sells this note today will realize loss whereas an individual bond investor can buy today and hold it to maturity and earn the 1.25% coupon plus the capital gain at maturity and effectively earn 2.5% yield to maturity (YTM). If this Apple note were to trade down to 70 cents on the dollar, the YTM would be 6%. Over the past 18 months, the bond market has been flooded with issues like these so it will get very ugly for bond funds as rates rise but set up one of the best buying opportunities for individual bond investors.

1- Fixed coupon payments

2- Return of capital

This is not that different from buying CDs. Investors should then ask themselves whether they would buy a fund that invests in CDs with no guarantee of return of capital or buy individual CDs themselves? Passive bond funds will not shield you from market risk and consistently underperform a portfolio of individual bonds due to their tendency to buy high and sell low. For example, the funds that bought Apple 1.25% coupon 2030 notes at or over par are watching it trade at 90 cents on the dollar and could very well drop to a low of 70 cents on the dollar during moments of panic bond selling as rates rise. Passive bond funds sell their lowest yielding investments first. Active funds and individual bond investors avoid these bonds/notes causing precipitous drops until the yield to maturity becomes attractive again.

https://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C925719&symbol=AAPL5030516

A fund that sells this note today will realize loss whereas an individual bond investor can buy today and hold it to maturity and earn the 1.25% coupon plus the capital gain at maturity and effectively earn 2.5% yield to maturity (YTM). If this Apple note were to trade down to 70 cents on the dollar, the YTM would be 6%. Over the past 18 months, the bond market has been flooded with issues like these so it will get very ugly for bond funds as rates rise but set up one of the best buying opportunities for individual bond investors.

Markola

Thinks s/he gets paid by the post

Agree 100%. If we were in a bear market for stocks, this conversation would be completely different, with comments like "sure, bonds are flat at best, but at least I'm not losing 50% like stock investors".

This. Unless someone can explain how “this time is different,” perhaps because the Fed will bail us out again, in which case we may have other problems. We’re holding at 50/50.

Attachments

Thank you very much for your interesting comments. It would seem as a logical conclusion that active bond funds should perform better than index ones as they could sell and buy following the guidelines you provided. A cursory Google search (you know how those go) shows that while true for short time periods the difference is vastly reduced for longer time periods (10+ years) just as it tends to be for stock funds. So I guess that unless I go the route of buying individual bonds you mention I'm out of luck. Oh well, being in the wind down portion of this journey so be it.If you own individual bonds and time your purchases to moments when bond fund managers are in panic selling mode, all you will lose is the premium as rates rise. You will lose this premium in any case as the bond approaches maturity. We are approaching a long overdue moment when yields become attractive as bond fund managers begin their liquidation. CEFs will also sell-off to levels well below asset value. Investor should be focused on two thing when investing in bonds:

1- Fixed coupon payments

2- Return of capital

This is not that different from buying CDs. Investors should then ask themselves whether they would buy a fund that invests in CDs with no guarantee of return of capital or buy individual CDs themselves? Passive bond funds will not shield you from market risk and consistently underperform a portfolio of individual bonds due to their tendency to buy high and sell low. For example, the funds that bought Apple 1.25% coupon 2030 notes at or over par are watching it trade at 90 cents on the dollar and could very well drop to a low of 70 cents on the dollar during moments of panic bond selling as rates rise. Passive bond funds sell their lowest yielding investments first. Active funds and individual bond investors avoid these bonds/notes causing precipitous drops until the yield to maturity becomes attractive again.

https://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C925719&symbol=AAPL5030516

A fund that sells this note today will realize loss whereas an individual bond investor can buy today and hold it to maturity and earn the 1.25% coupon plus the capital gain at maturity and effectively earn 2.5% yield to maturity (YTM). If this Apple note were to trade down to 70 cents on the dollar, the YTM would be 6%. Over the past 18 months, the bond market has been flooded with issues like these so it will get very ugly for bond funds as rates rise but set up one of the best buying opportunities for individual bond investors.

Beardog

Dryer sheet aficionado

After 30 years of investing, I plan to keep our portfolio the same. 60/40, with 50% TIPS fund and 50% Total Bond Index fund, both with Vanguard. We are FI, but I still work part-time, 10 days per month. I may retire any day, though. I change my mind about 3 times per month these days! I have looked at the possibilities of bond ladders, Liability Matching Portfolios, and many other possible scenarios. I understand why people do these things, but for us, the "set it and forget it" 4 fund approach has worked extremely well. The strongest lesson that I have learned, and had reinforced many times over the past 30 years, is that nobody knows anything. Therefore, everything is a guess, no matter how thoughtful and well-meaning it may be. We invested for the long-haul, so we (DW and I) aren't going change anything based on shorter-term numbers and trends. Perhaps the greatest enemy of a good plan for us, in our late 50's, is a better plan, based on current thinking (this time, it really is different!!).

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Earlier, I saw an article showing the forecast of interest from all major banks. They all predict higher Fed fund rate by the end of this year. The gloomiest one is from Bank of America, at 2%. Others are lower, but as I recall, most are about 1.5%.

I tried to find the article again to share here, but failed.

Can all these institutions be wrong? I dunno. I have a Stable Value fund, and I bond, both paying reasonably well above inflation, and a treasury fund that pays peanuts right now. I would not own long bonds now, and short bonds pay nothing so I ask myself why bother.

PS. Still could not find the article I mentioned, but here's another one from Reuters dated Jan 28, 2022.

I tried to find the article again to share here, but failed.

Can all these institutions be wrong? I dunno. I have a Stable Value fund, and I bond, both paying reasonably well above inflation, and a treasury fund that pays peanuts right now. I would not own long bonds now, and short bonds pay nothing so I ask myself why bother.

PS. Still could not find the article I mentioned, but here's another one from Reuters dated Jan 28, 2022.

Bank of America raised its 2022 fourth quarter forecast on the core personal consumption expenditures (PCE) index to 3.0%, from 2.6%, saying that "an even faster-than-expected drop in unemployment and longer-than-expected supply disruptions mean more inflation."

It also cut its 2022 U.S. economic growth forecast to 3.6%, from 4.0%, noting that "a combination of supply and demand factors points to weaker growth this year."

Bank of America said it now expects a peak fed funds rate of 2.75% to 3.0%.

Last edited:

Similar threads

- Replies

- 34

- Views

- 5K

- Locked

- Replies

- 57

- Views

- 7K