Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

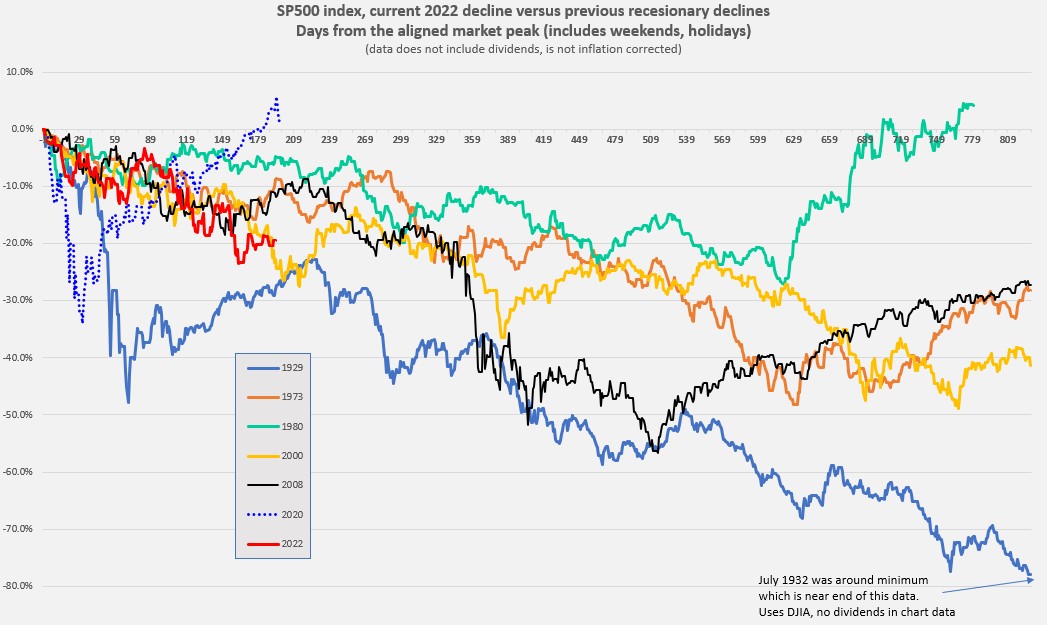

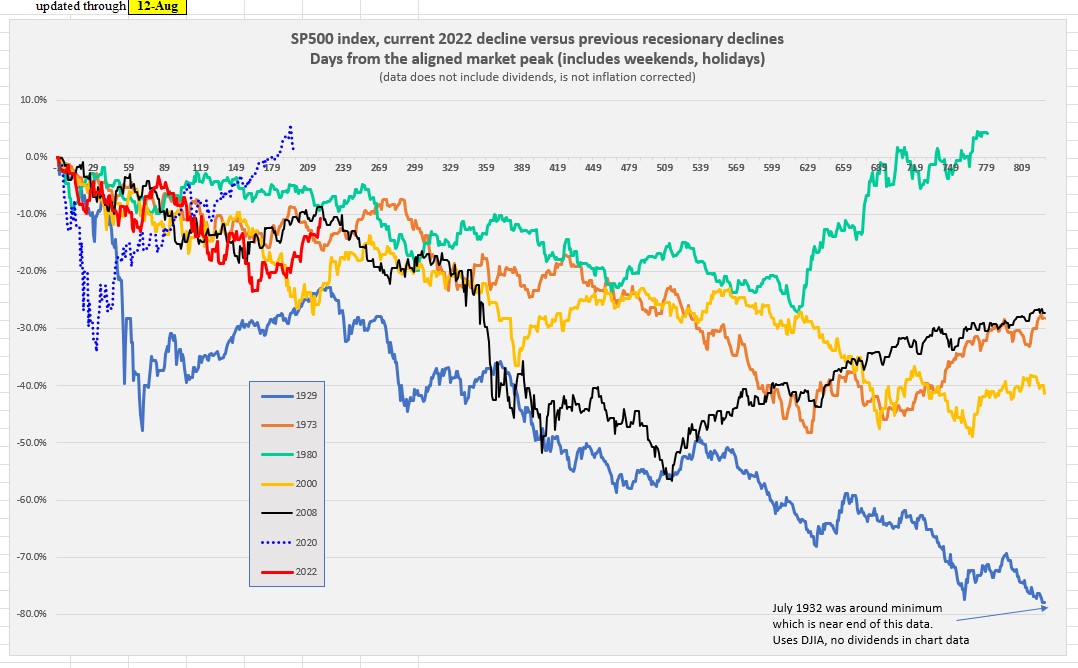

Heh, heh. Hope I have a decade. Yes, I'm hanging on! Hoped I would never have to go through the '70s again.Our current situation reminds me of the late 70's and early 80's where we had a Bear market, high inflation, and rising oil prices. We also had interest rate increases that more closely matched the inflation rates, something we don't have today. The Fed may change the interest rate situation. We'll see.

In real terms 70's-80's market took over a decade to break even in real terms. Hang on.